- US dollar strengthens on rising yields.

- GBPUSD pulls back from six-week highs.

- USDJPY powers to five-week highs.

The US dollar started the year on a high note, rising against the basket of major currencies. The dollar index appears to have found support above the 96.00 handle after coming under pressure late last year. The rally remains well supported by a surge in Treasury yields, with the 10-year yield powering to highs of 1.63%.

Treasury yields that continue to support dollar strength remain well supported by growing optimism that the Federal Reserve will move to stem runaway inflation this year with rate hikes. Easing concerns that the Omicron variant will affect economic growth has continued to build expectations that the central bank will tighten monetary policy, something that should work in favor of greenback strength.

GBPUSD technical analysis

The dollar strength across the board is the catalyst fuelling a pullback in GBPUSD from 6-week highs. After powering to highs of 1.3550, the pair has come under immense pressure pulling back as the dollar continues to hold steady.

After the recent pullback, 1.3453 has emerged as the short-term support level above which the cable remains well supported to bounce back to 6-week highs. A breach of the support level could leave the pair exposed to further sell-off with a pullback to lows of 1.3400 on the cards. On the flip side, a rally followed by a close above the 1.3500 should pave the way for the pair to edge higher back to highs of 1.3560.

GBPUSD price action drivers

The cable remains on the back foot for the second day running as rising US treasury yields continue to drag it lower. In addition to dollar strength, the pound sentiments have been weighed heavily by persistent Omicron concerns and its potential impact on economic recovery.

The UK is fresh from reporting 158,000 new cases, which Prime Minister Boris Johnson has warned could put the National Health Services under substantial strain. The number of cases in the UK has more than doubled in the last seven days averaging 418,000 a day.

In addition to Omicron concerns, GBP sentiments have also taken a hit amid the unending Brexit concerns. Some of the Brexit rules are poised to come into effect this year, which could challenge the free movement of goods to and from the UK.

Looking forward, focus is on the release of UK Manufacturing PMI for December and the US ISM Manufacturing PMI for December, likely to influence pound and dollar strength consequently sway GBPUSD price action.

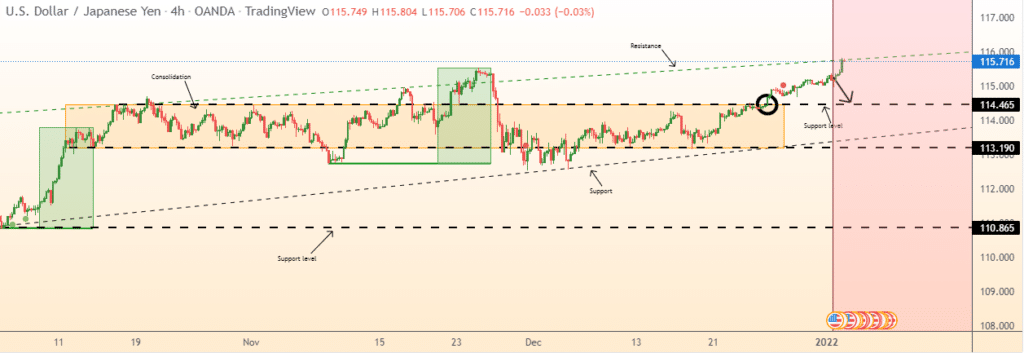

USDJPY rally

Meanwhile, the USDJPY pair powered to five-year highs near the 116.00 level as the Japanese yen remained under pressure against the USD. The pair touched highs of 115.88 levels as the dollar attracted bids amid rising treasury yields.

The pair has registered five consecutive weeks of gains, the yen having lost some ground on the Bank of Japan holding firm on accommodative monetary policies. The FED moving to tighten monetary policy has continued to fuel USD strength against the yen.

After the recent surge, the 114.59 has emerged as the immediate support level, above which USDJPY remains well supported for further upside action. Looking ahead FED driven sentiment will impact yields consequently the pair.

In addition, the Omicron situation will influence sentiments, given that the Japanese yen tends to attract bids during uncertainties. A daily close above 115.81 should pave the way for the USDJPY to make a run for the 116.00 handle.

Leave a Reply