- The Office for National Statistics (ONS) reported on Wednesday that housing price inflation in the UK rose 8.6% year-over-year for February 2021 compared to January 2021. This is a sign of recovery in the UK economy, and now upward pressure on the cable is building up.

- Australia’s retail sales for March are up 1.4%, hence flooring the expected 1%. The Australian dollar looks to be capitalizing on the boost to notch higher against the US dollar.

UK investors are breathing easily for various reasons. First, the consensus seems to be building concerning Brexit after years of squabbling with the European Union. Though there remain a few issues that need ironing, the UK is finding meaningful direction. Secondly, the government is doing a great job managing the economy in the face of the coronavirus pandemic.

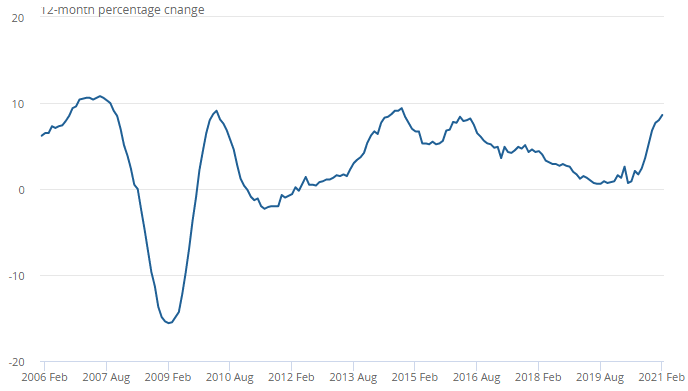

The positive figures that the ONS announced on Wednesday are, therefore, unsurprising. According to the ONS, the growth in February’s average house prices is the highest rate of growth annually in the country since October 2014. The rate of change of annual house prices in the country is also inching closer to the pre-Great Recession era (as the figure below shows).

Figure 1: Annual house price rates of change for all dwellings, UK: January 2006 to February 2021

Investors are adopting an optimistic stance on the GBP/USD (the cable) in light of these developments. Remarkably, the volatility levels in the cable market are subsiding. In the figure below, the resistance level has declined from 1.42282 on April 6 to 1.40748 on April 21, while the support level is higher at 1.35930 on April 21 compared to 1.35659 on April 11.

Figure 2: GBP/USD 4-hour price chart

The reduced volatility, in a sense, signifies the return of confidence in the UK economy, and by extension, the GBP. If the pair breaks out of the current ranging market, the possibility of the pair touching 1.5 in the next few months will get stronger.

The Australian dollar is also under the impact of the greenback

According to the Australian Bureau of Statistics (ABS), in Australia, retail trade (seasonally adjusted) in March rose 1.4%, according to the Australian Bureau of Statistics (ABS). Meanwhile, the turnover climbed 2.3% in March 2021 relative to March 2020. Although the figures for the quarter ended March 2021 are not significantly different from those of the quarter ended December 2020, the market is picking this up as a signal for better times ahead.

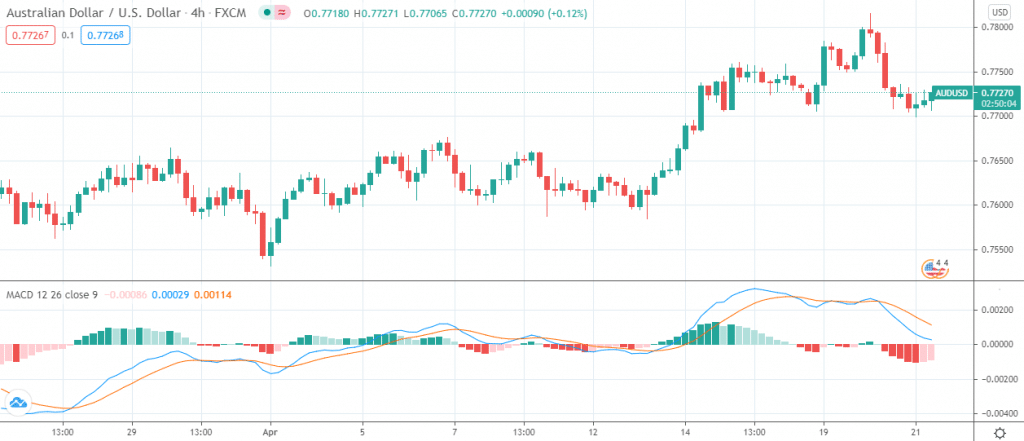

Ahead of the data release, the Australian dollar was edging up against the USD – it reached the month’s high of 0.78158 at 01:00 UTC. However, the pair quickly pared the gains after sinking to 0.76995 just 12 hours later. Despite the sudden reversal, the AUD/USD pair has the potential to edge upwards. In the figure below, the MACD shows the selling pressure on the pair is subsiding.

Figure 3: AUD/USD 4-hour price chart

Gold approaching the $1,800 level

Reflation trading in 2021 has diminished gold’s place in the investors’ minds as more traders chase better returns. Developments such as stimulus spending in the US and increased vaccination progress in the EU and the UK are bringing back risk-on sentiments in the market. However, the market seems to be shifting its attention back to gold amid the extended weakness of the greenback.

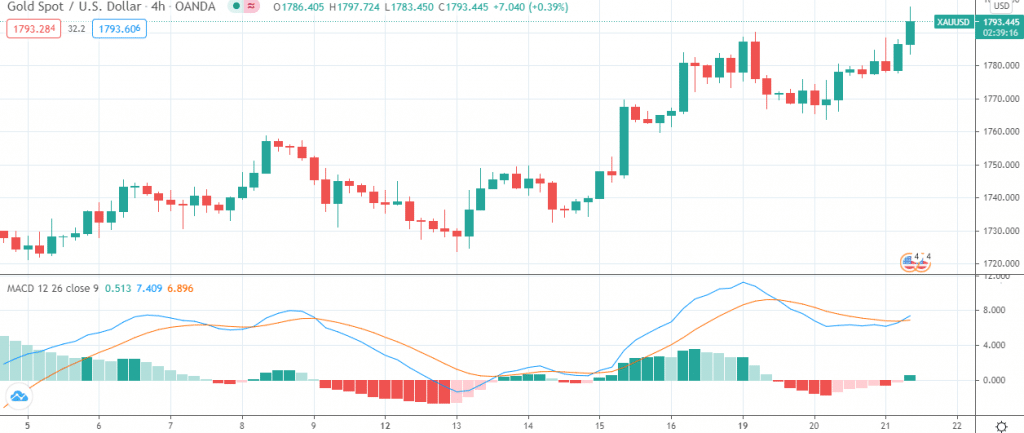

Substantial capital has been flowing into the gold market since early March 2021. The uptrend that began then is still going strong. The MACD in the figure below shows the bulls are winning. At the time of writing, the XAU/USD price was at 1,793, and by the look of things, the price could surpass 1,800 before the end of Wednesday.

Figure 4: XAU/USD 4-hour chart

Leave a Reply