What on earth is the risk of ruin in forex? This statistic is one of the most crucial to understand for any money management strategy.

No one in their right mind would want to ruin their trading account through sudden margin calls. Yet, unbeknownst to most traders, this occurs a lot more frequently due to miscalculating certain statistics.

What if you knew a straightforward metric that quickly tells you the likelihood? Enter the risk of ruin, a statistic providing you a chance (represented as a percentage) of how likely you would blow your account based on your risk per trade, average win percentage, and average risk-to-reward (RR) ratio.

Understanding your risk of ruin is the pinnacle of mastering risk management in forex. All too often, traders who lose money trading think of risk too narrowly by only focusing on one or two things.

It may seem illogical to accept, yet it’s possible to lose money in the long run with an average win percentage of 50% and a risk-to-reward ratio of 1:2. Although the possibility is technically low, it remains ever-present nonetheless.

Still, even if your risk of ruin is minute, you’d probably be interested in ways of bringing it to as close to zero as possible. In this article, we’ll cover this concept in more detail, how to calculate it, and methods of improving it.

So, what is the risk of ruin?

The risk of ruin is exemplified as a percentage reflecting the probability of a trader blowing their account or losing substantial quantities of it. If your risk of ruin is higher than the recommended figure, you may reach a level where the possibility of recovering your losses is slim to none (known as the point of ruin).

You need to incorporate this concept with the drawdown to get the most accurate calculation that we’ll explore. The drawdown measures how much your account (as a percentage) has dipped from its current point after a series of losses.

It’s also another critical metric to grasp along with the risk of ruin. According to most literature, an optimal drawdown is typically not above 20%. It allows you as little time as possible to recover back to your account’s previous peak and beyond.

How to best calculate your risk of ruin?

Several methods to calculate your risk of ruin are available at your disposal and range considerably in complexity. Of course, you want to utilize only the simplest options without getting bogged down on complicated mathematical equations.

In this article, we’ll go over two options, one simple and the other needing a bit more work. Regardless of the channel you employ, you need to own substantial numerical data over your strategy as a preface.

This information should be available from your testing and journaling results.

Forex risk of ruin calculator

The first calculation choice is utilizing the numerous online calculators. Here, you input a few statistics. In most cases, these include your win percentage, risk-to-reward, and risk per trade.

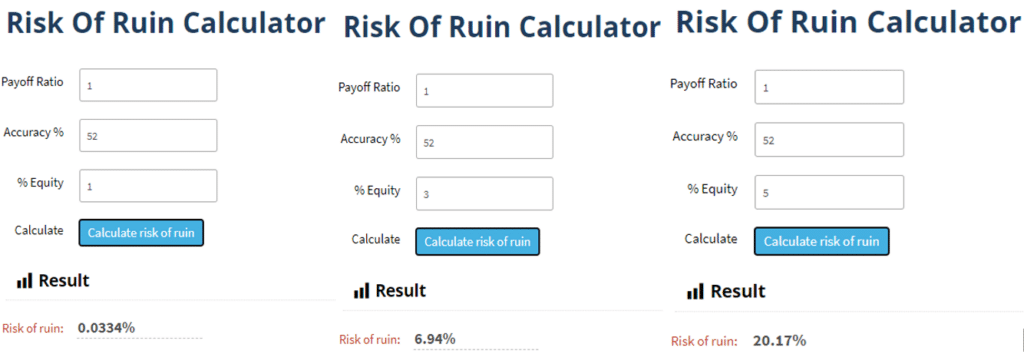

In the image above, let’s imagine three scenarios where a trader had a RR of 1:1 (payoff ratio) and a 52% win accuracy. One can see how the risk of ruin percentages drastically changes as you increase the percentage of equity risked per position.

Build risk of ruin table for forex trading

Generally, consensus on the recommended risk of ruin rate sits between 0% and 0.5%; this is what you should aim for. Anything remotely or tremendously higher is a cause for concern and impetus for traders to improve their overall money management. You can apply formulas, presented below, to create your personal advanced trading journal spreadsheet with risk of ruin calculation:

~ Using the ‘[1 – (B – P)) / (1 + (B – P)] ^U’ formula

The alternative of online calculation is to use the following formula:

[1 – (B – P)) / (1 + (B – P)] ^ U

B represents your average win percentage, P reflects your average losing percentage); ^U represents your drawdown percentage.

Let’s consider an example to grasp this method fully. Imagine ‘Sam’ has decided a drawdown level of 15%. He also has an average winning percentage of 65% (B), meaning their loss rate is 35% (P). We can now replace the calculation with the figures:

[1 – (0.35)] divided by (1 + (0.35) = 0.48

Note: 0.35 is 100 times less than 35 (the difference between B and P) to get a decimal representation of the whole figure.

Using the 0.48, we simply find out the power of 15, resulting in 0.000017 or 0% rounded up. Theoretically, such statistics present the ideal risk of ruin, assuming nothing changes with the strategy.

Final word

At its core, the risk of ruin percentage reinforces the importance of allocating a conservative portion of your equity to all positions. Your long-term survival in the markets boils down to this one concept.

The 0-0.5% threshold exhibits the minutest likelihood of blowing your account over a trading lifetime, and this is what’s important. As a trader, you aim to have a lifelong, consistent strategy that will never make you lose a substantial portion of your account and allow you to overcome the inevitable losing streaks in the least amount of time.

No matter your level of conviction in picking the best trading opportunities, losses are still a reality. The most profitable traders realize they will lose at some point but possess superior confidence to never deviate from their trading plan and strategy.

Risking ‘small’ or not more than 2% of your equity on any given trade is one of the primary methods for ensuring your risk of ruin is healthy. In this article, you’ll hopefully have understood the importance of improving the reward of your trades as much as possible to maximize profits.

Overall, knowing your point of ruin is the foundation of money management in forex and is a statistic every serious trader should calculate beforehand.

Leave a Reply