While turning in to the financial news, you might have heard the terms “hawkish” and “dovish” being mentioned in regards to central banks. These two terms are used to describe the monetary policies of financial institutions.

When the financial institution authorities modify the interest rates, it has far-reaching consequences for the foreign exchange market. Interest rates are normally enhanced in order to counteract rising inflation rates, and they are decreased to invigorate a country’s economy, thus slowing down the recession process.

In order to assist the public, central banking institutions keep them updated regarding the course in which the financial policy is likely to advance. This phenomenon is popularly known as “forward guidance.”

Here, we shall discuss dovish and hawkish policies in detail and what they mean for a Forex trader.

What is the meaning of hawkish?

Hawkish is a term used to designate a macroeconomic tool. Central banking authorities are described as hawkish when they aim to tighten their financial program through the enhancement of interest rates and the sale of assets. So, if a financial policy predicts a rise in interest rates, it can be termed hawkish. This term is also used for financial decision-makers if there is a prevalent optimism about the future of financial growth.

When financial policies are modified by central banking institutions, the price of pairs tends to oscillate. Thus, if a dovish statement was delivered by a financial institution stating the need for impetus in a particular economy, and if the tone was changed at a later date stating the growing inflation as a basis, you can expect the currency to increase in worth with respect to others.

A hawkish financial plan can be described by the following terms:

- Steady improvement of the economy

- Rising inflation rates

- Balance sheet reduction

- Securing of financial blueprints

- Hiking interest rates

Normally, the terms that describe growing inflation, increased interest rates, and solid financial improvement tend to advocate a hawkish financial stratagem.

What is the meaning of dovish?

Whenever financial institutes mention bringing down interest rates or enhancing computable moderation to revitalize the economic condition, the term dovish is used to describe the strategy. In case they are not too hopeful of the economy improving, anticipate inflation rates to fall, and make the information public, the policymakers are described as dovish.

These are some terms you may come across in regards to a dovish financial plan:

- Feeble financial improvement

- Inflation rates falling

- Enhancing the balance sheet

- Slackening financial policies

- Cutting down interest rates

A comparison between hawkish and dovish

The principal distinctions between hawkish and dovish policies are highlighted below:

However, we need to delve deeper if we wish to compare the two kinds of financial policies and how currencies are impacted by them.

| Hawkish policies | Dovish policies |

| The financial institutions are enhancing interest rates for controlling inflation. -> Currency may rise in value. | They are reducing interest rates to revitalize the economic situation. -> The value of a currency may go down. |

| There is a reduction of the balance sheet through the sale of assets. -> Currency may rise in value since the bank rates might go up due to the sale of assets. | They are enhancing the balance sheet by buying assets that lead to the invigoration of the economy. -> The value of the currency might be diminished due to decreasing market size for the currency. |

| Financial institutions issue forward guidance, including optimistic announcements regarding the economy and inflation. -> Value of currencies may rise due to the predicted rise in bank rates. | Financial institutions issue forward guidance, including pessimistic announcements about the economic condition and deflation. -> Value of currencies may fall due to the predicted reduction in bank rates. |

Trading a hawkish or dovish central financial institute

Even the slightest change in a financial institution’s policy can impact a currency heavily. Forex players like to keep an eye on FOMC gatherings and proceedings to detect subtle amendments in speeches that indicate additional bank rate growth and fall in order to make the most of the situation.

The present financial policy position of central financial institutions is shown in the picture above. When a central institution’s financial plan advances to the left (dovish), the respective currency may decrease in worth compared to others. If it advances in the opposite direction, you can expect the currency value to rise.

This isn’t a simpler matter of purchasing the currency with a hawkish financial bearing and getting rid of the one with a dovish bearing. It’s more about how you expect the bank rates to change. Looking at a couple of different situations can help you understand this better.

Situation 1

If presently a financial institution is hiking its rates, the prediction for further advancement for bank rates will have been predicted by the market. Every serious forex trader must remain up to date with economic information leading to a change in the position of the central financial institution. When the financial strategy changes, large shifts in a currency’s value may occur.

Situation 2

Similarly, when the bank rates are being reduced and the economy is slumping, the present dovish bearing would have been factored in by the market. Forex dealers can consult the economic calendar and stay updated with the latest financial news to determine the nature of the future policies of the institution.

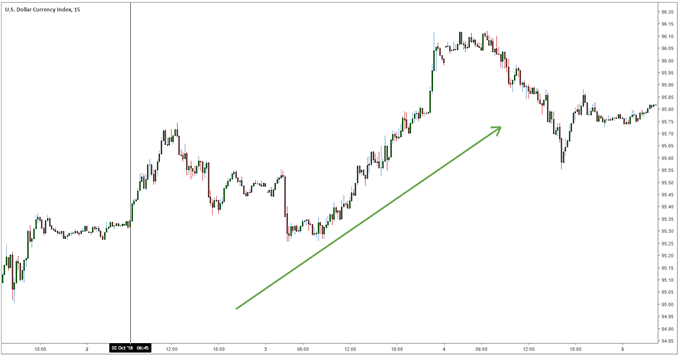

Towards the end of 2018, a hawkish bearing was adopted by the Federal Reserve, and the Chairman even stated on 2nd October that the neutral rate was still quite far off. This statement was widely regarded as hawkish, and it indicated that the bank rates needed to be hiked at multiple instances before the neutral rate could be reached.

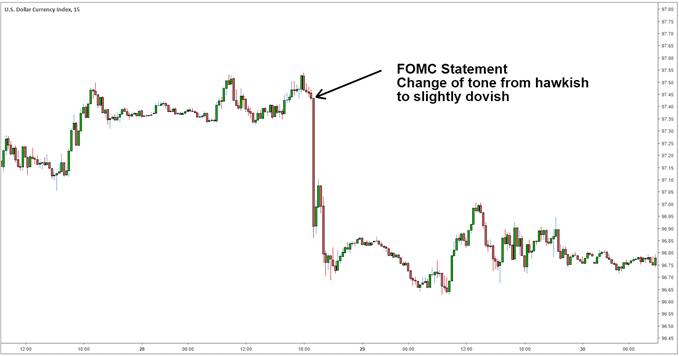

Towards the end of November, a different statement was given by the FOMC, where the Chairman stated that the bank rates were situated slightly beneath the neutral rate. This is similar to the 1st situation we described earlier, where a hawkish bearing was shifted to a dovish one. Below, you can see how the Dollar Index (DXY) behaved during these two key dates:

- 2nd Oct 2018 – Dollar increases in worth due to the statement made by the Chairman of the Federal Reserve, which then considered a hawkish posture.

- 15 min US Dollar index chart, vertical line denoting the date on which the statement was made.

- 28th Nov 2018 Second statement delivered by the Chairman, depicting a departure from the hawkish posture mentioned earlier. The value of the dollar falls as a result (see 15min USD Dollar index chart below).

Final word

If you want to augment your trading odds and make it profitable, then you should regularly monitor the policies of financial institutions. This is because they control the currencies in which you trade. The financial policy can drive trends in the long term, particularly in rare and lucrative scenarios such as a chief policy change.

Leave a Reply