The trillion-dollar forex market attracts traders of all walks of life trying to profit from price swings. While some opt to play the long-term game, others focus on short-term gains, as is the case with investing. Scalping is one such strategy widely deployed in the $6 trillion marketplaces.

How scalping works

This is a short-term trading strategy whereby people look to profit from the smallest of price movements that take place in either direction. The idea is to make as many trades as possible and accumulate as many small winnings as possible.

Timing on entry and exit points is done on minute charts. In this case, traders carry out technical analysis on one minute, five minute, or ten-minute charts trying to capture the slightest of price movements. Trades are usually opened in the direction of the short-term trend and left to run as long as the trade is moving in favor. The trade is closed as soon as the trend reverses and trade starts going against

The trading process entails

- Choosing pairs with low spreads

- Settling on more volatile pairs

- Using moving averages

- Identifying support and resistance levels

- Executing trades manually

Tips

To succeed with this short-term strategy, it is important to focus on pairs with tight margins. Small spreads make it possible to generate optimum profits on small price movements. With small spreads, 1 or 2 pip changes could result in a significant payout.

In addition to focusing on tight spreads, it is essential only to trade volatile currency pairs. Volatility is what causes price swings. The higher the volatility, the more swings that come into play, increasing the chances of making many small profits. Higher volatility amounts to more trading opportunities.

Top scalping strategies

Let us now look into each of the four most popular strategies based on the time frames and indicators used.

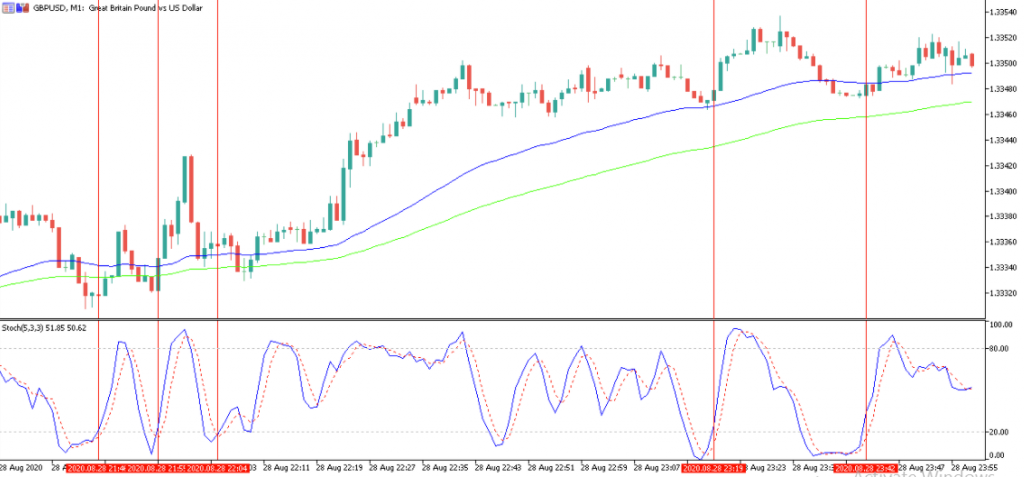

The 1-minute strategy

With this strategy, the idea is to open a position, gain a few pips, and close. Likewise, it requires a lot of time and concentration as one must open dozens of trades to be profitable.

The requirements for utilizing the strategy include:

- Volatile currency pair

- Time frame 1-minute

- Stochastic and Exponential moving average

- Trading during London and New York trading sessions

The strategy execution includes the following steps:

- In one minute chart of a major currency pair, say EUR/USD or GBP/USD, apply a 50 and 100 Exponential moving average.

- Likewise, apply the stochastic Oscillator with periods 5, 3, 3.

- Long position. A long position is opened only when the 50 EMA crosses the 100 EMA and is positioned above. When this occurs, wait for the price to come back to the EMA. The stochastic indicator must also cross over the 20 levels from below.

A stop-loss can be placed 2 to 3 pips below the low point of a given swing with a long position in play. The take profit should be 8 to 12 pips from the entry price.

- Sell short. A sell or short position is opened only when the 50 EMA crosses the 100 EMA from above and is positioned below. The sell signal is confirmed on the stochastic indicator crossing below the 80 levels and moving lower. Similarly, the sell position can be opened as soon as the price pulls back and touches the moving average.

A stop-loss order is placed two to three pips below the entry point, while the profit target is placed 8 to 12 pips from the entry price.

Stochastic and trend line strategy

This strategy leverages the stochastic indicator and trend line to identify ideal entry points. Whenever the stochastic indicator reading is above 80, then the same implies overbought, requiring traders to prepare for short positions.

Likewise, whenever the reading is less than 20, the same implies an oversold condition ideal for opening short positions.

To implement this strategy, you will need a volatile currency pair and a trend line to know whether the market is in an uptrend or downtrend. Using the trend line tool, try to connect the highest or lowest points in the chart depending on how the price is moving. In case of an uptrend, the trend line should touch as many points as possible, as shown below.

After this, you need to pay close watch to your stochastic indicator. Whenever the reading is above 80, it would be wise to prepare for short portions and long positions whenever the reading is below 20.

The Bollinger Band Strategy

Bollinger Bands are effective when looking to make as many trades as possible. The indicator measures the highest and lowest points of a currency pair. Besides, they are effective for knowing when to avoid the market.

With this strategy, you only need to enter a short position as soon as the price touches the Bollinger Band indicator’s upper band indicator as to the same signals overbought. Likewise, a long position can be triggered as soon as the price touches the lower band.

The profit target, in this case, will be price retreating to the middle band of the indicator.

The range-bound strategy

This strategy works best when dealing with range-bound markets whereby price oscillates between support and resistance levels. In this case, it is important first to identify the high and low price points and draw the support and resistance levels.

Likewise, a short position would be opened at the resistance level as the price would often pull back and edge lower to the support level, which would be the profit target. A long position is entered on price bouncing off the support level. The price target, in this case, will be the resistance level.

Scalping pros

- Profitable when executed using precise entry and exit strategies.

- It does not require fundamental analysis as the focus is on price swings.

- With effective risk management, a strategy can offer little risk exposure.

- Offers many trading opportunities conversely compound profits.

Drawbacks

- The placing of so many traders can result in high transaction costs.

- It is time-consuming given hours spent placing trades.

- Requires leverage to make a substantial profit.

Bottom line

In the Forex market, the idea is to find an edge to be able to generate significant profits. Some traders find their edge on opening trades and closing within seconds or minutes, in what is commonly referred to as scalping. The strategy offers an opportunity to generate small profits over a prolonged period. The strategy works well for people with sufficient time and able to spend hours on the screen opening and closing trades.

Leave a Reply