Source: Bloomberg

Analysts project that the Federal Reserve will scale back asset purchases next year, starting with mortgage-backed securities.

SPY is down -0.31% on premarket, DXY is down -0.21%.

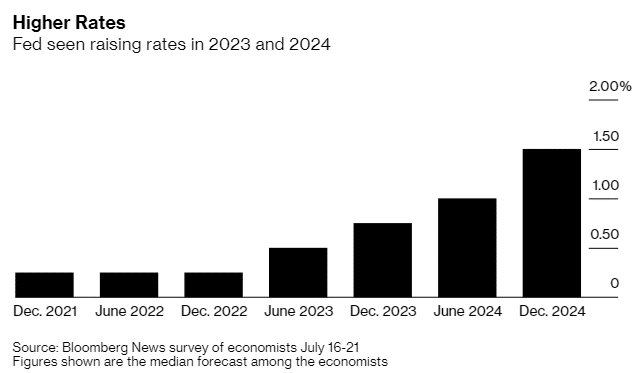

- The analysts see the Fed raising rates quicker through 2024, with two quarter-point hikes by the end of 2023.

- More analysts expect the Fed to announce tapering in December, with actual reductions beginning the first quarter of 2022.

- Economist Thomas Costerg projects “a mechanical reduction each month,” with $10 billion per month on the table.

- At least half of economists see the Fed tapering to last 10 to 12 months up to the end of 2022 from the first quarter.

- Analysts also expect the Fed to announce that the uptick in inflation is transitional, with more than 78% of economists agreeing with the stance.

- The analysts also project Fed’s Chair Jerome Powell to retain the position of the Fed chair.

- The projections by analysts come as the Fed is set to end its two-day policy meeting on Wednesday in which rates are expected to be held at new zero and $120 billion bond purchases maintained.

Leave a Reply