Whether consciously or not, every technical analyst incorporates some form of support and resistance. This concept is the bread-and-butter of trading in any financial market. Any newbie can observe a chart and realize that price constantly bounces around similar levels over time.

Ultimately, you want to buy as low as possible or sell as high as possible. However, don’t be fooled; understanding this theory is more challenging than it seems, owing to its high subjectivity and various interpretations.

Nonetheless, it’s a fundamental principle of how the forex markets move. We’ll explore this concept in more detail and give some tips at the end on becoming better acquainted with it.

What are support and resistance?

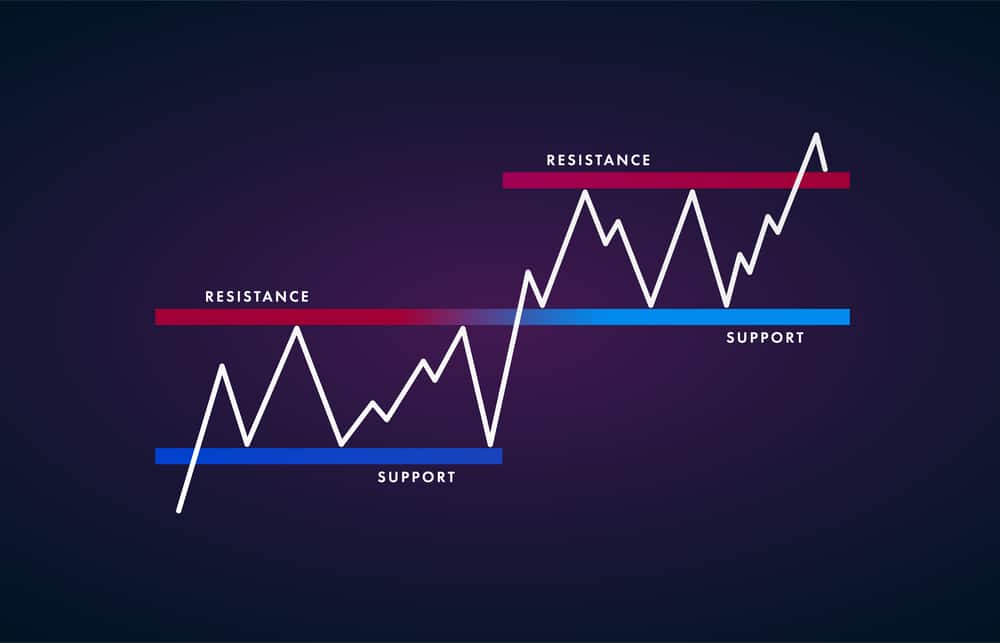

Support and resistance refer to areas on a chart the price fails to break below (support) or above (resistance). When markets are trending down, they will eventually reach a ‘floor’ before retracing to the other side.

Conversely, when the price moves up, it will reach a ‘ceiling’ before bouncing back down. When the market gets to a perceived support level, there’s a belief that the buying power will overwhelm the bears.

On the other hand, when the price comes to an anticipated resistance level, there’s a probability that the selling pressure will be strong enough to prevent the market from moving higher. The other key component of this whole concept is support and resistance ‘flips.’

This simply means that a support level can act as a resistance level in the future (and vice versa) as price constantly breaks and retests these areas. Lastly, such places are characterized by being tested multiple times, particularly before a reversal.

The different types of support and resistance

Let’s explore the main types you’ll encounter in forex.

Basic key levels

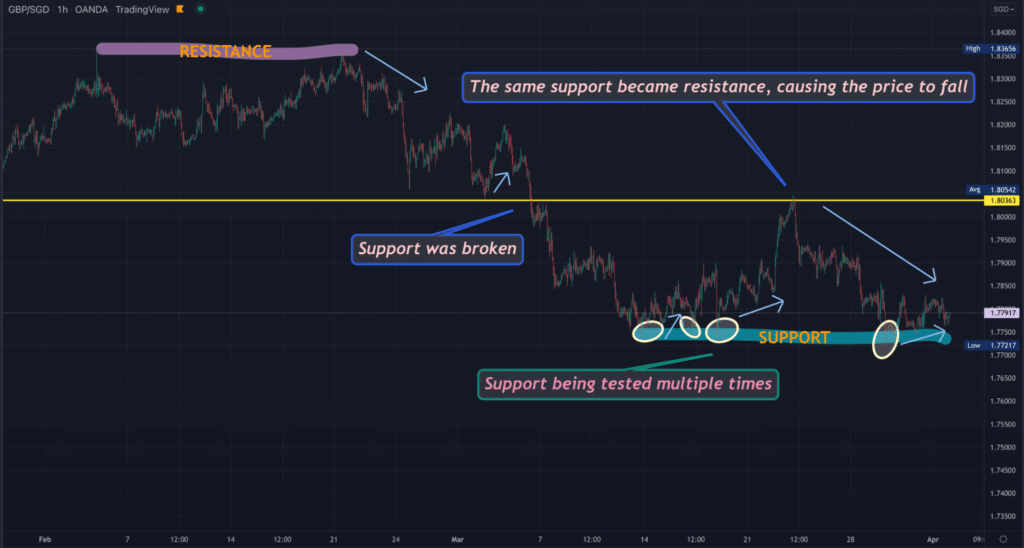

These are levels that traders plot horizontally and are the most basic form of SnR. The chart below is on the 1HR time frame for GBPSGD.

Here, we have highlighted a key resistance (in purple) and support (in blue) level. In the latter case, we have shown one of the many examples of such areas being tested a few times before a reasonably substantial move in the other direction.

Lastly, the yellow line in the middle represents the support and resistance ‘flip’ where the roles are reversed.

Trendlines

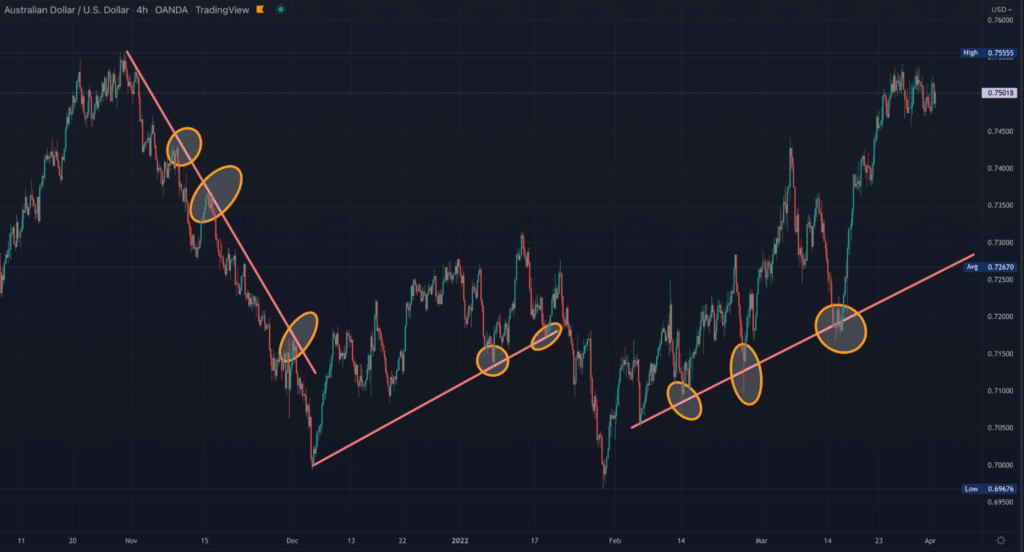

You can identify key levels using simple trendlines by observing whether the price respects the points on the line. This method isn’t so easy as the market needs to be in a well-defined trend.

Plus, there is no universally accepted way of accurately drawing a trendline. Regardless, we have illustrated below how SnR appears in this manner.

Moving Averages

This is sometimes referred to as ‘dynamic’ support and resistance. In this regard, traders plot Moving Averages of various periods, most commonly the 5, 10, 25, 50, 100, and 200-day depending on personal preference and time frame.

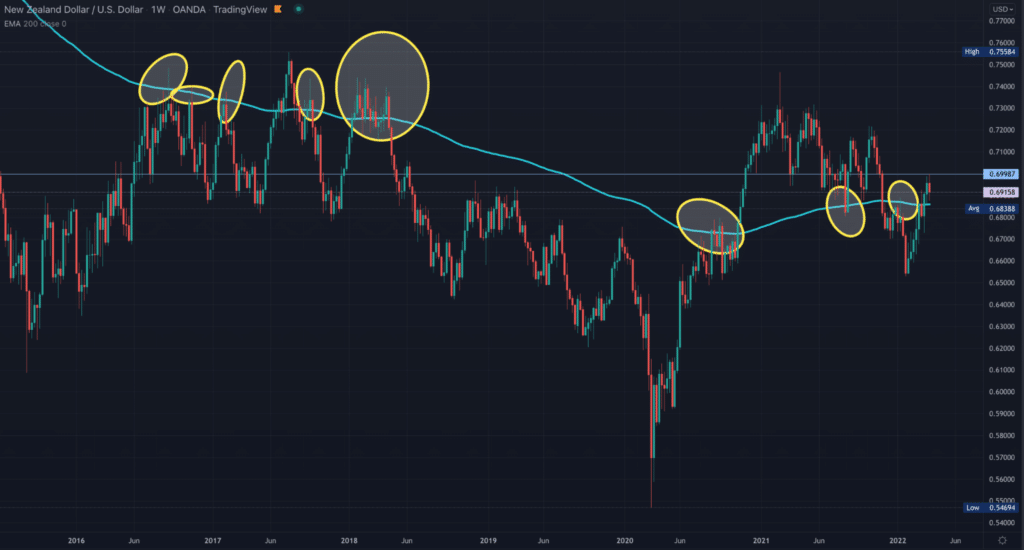

For the most part, using Moving Averages is quite similar to trendlines. The chart below consists of the 200-day MA on the weekly chart of NZDUSD.

Such a period on this indicator, along with the time frame, is deemed significant for long-term trends. We’ve highlighted (with ellipses) moments where the price has stalled around the Moving Average before moving in the other direction.

Round/psychological numbers

These denote the tendency for markets to find support/resistance at prices with whole numbers, e.g., 1.15000. Essentially, the more zeros (at least three), the better.

There’s a perception that most traders take their positions in these areas because of how we are psychologically wired to round off prices to the nearest zero. The chart above shows examples of these levels (note how the market reacts to them each time).

Are support and resistance even real?

This question continuously gets debated, often controversially, on numerous forex-related forums such as those from Forex Factory and Reddit.

Ultimately, SnR is trying to establish why the price moves from point A to B. Unfortunately, there’s no one answer since countless factors cause a market to travel in a particular direction.

Therefore, all we have are theories. However, it’s fair to assume support and resistance is a self-fulfilling prophecies. When price approaches a stand-out price level, every trader is aware of it through market psychology based on what has been taught.

Let’s think about it this way: why would drivers in a particular country all drive on the right-hand side of the road? Although there may be some deep science behind this decision, the simple truth is that’s the standard being followed.

However, if, for whatever reason, enough people decided to drive on the left-hand side instead, everyone else would eventually follow suit. Therefore, SnR is just a natural occurrence that all traders are aware of, whether using discretionary or mechanical strategies.

Ultimately, the price was designed not to move in a parabolic fashion primarily due to support and resistance.

Curtain thoughts

Any ambitious trader wants to attain three things; consistently determine the correct market direction, time an entry, and establish exit points for profits and losses. Support and resistance is the framework used to achieve these objectives.

Here are some tips for better understanding this rationale in your own trading:

- Identifying key levels requires looking at higher time frames (from the 4HR and up). You will see many more of these lines if you observe lower charts, resulting in a ‘noisier’ interpretation.

- One common error made by newer traders is looking at SnR at exact prices. Instead, it’s better to view these as roundabout zones. This is especially true when considering stop loss placement.

- It’s a misconception that the more times a market tests a support/resistance area, the stronger that level is. Before deciding on the strength or weakness, you first need to observe how price reacts in those zones through price action, indicators, etc.

- Another big mistake to avoid is trading purely off SnR; it’s not the be-all and end-all. You should use this concept among many other confirmation factors in your decision-making.

You should use this concept among many other confirmation factors in your decision-making.

Leave a Reply