No market exists that exceeds the foreign exchange (forex) market in terms of market activity and liquidity. In its annual reports on forex, the Bank of International Settlements (BIS) has always noted values above about $5 trillion as average daily transactions. The reason for this significant amount of activity in forex is that many investors have learned how to automate day-to-day activities.

Automated forex trading now comprises a significant part of the market. Almost all of the large forex investors use automated systems to trade. Since such investors move large amounts of value in a single order, there is no question that they need algorithmic trading systems. In this level of trading, no error is permissible, however minuscule it might be. Consider an investor who moves billions of dollars in value in a single trade. The sheer size of the transaction greatly amplifies small errors to millions of dollars.

Retail investors, on the other hand, mostly carry out low-value trades if they juxtapose them to large traders. However, this is not to say that these players do not utilize algorithmic FX trading systems. The popularity of these automated systems continues to grow as more market participants know how they work. Perhaps, on account of beginners whose understanding of the systems is low; let us preview the concept of algorithmic trading.

What is algorithmic trading?

Algorithmic trading refers to the use of specialized computer programs following predetermined parameters to analyze the market and to execute orders. These programs can perform both fundamental and technical analysis based on available market data. Such automated trading systems function at high speeds that no human can match.

High-speed trading is not the only merit of algorithmic trading. This system increases the chances of profit maximization since they exclude the psychological factor prominent in human trading. By removing emotions from trading, these systems make the marketplace operate systematically. Forex expert advisors are the ultimate manifestation of automated FX trading. On aggregate, algorithmic trading delivers more liquidity in the forex market.

Support and resistance levels in forex

A forex robot uses robust algorithms to gather and analyze market data. Subsequently, the robot provides insights in the form of signals. Depending on the program’s configuration, it may act on the signals without human input, or a human might have to do it. These signals identify the best possible market entry and exit points from which the trade might generate the highest profits possible.

To arrive at the signals, automated trading systems develop trading strategies using different technical indicators. The process that goes into this development is what investors call technical analysis. Technical analysis entails numerous forex charting tools to find support and resistance levels, as well as the trend of price action.

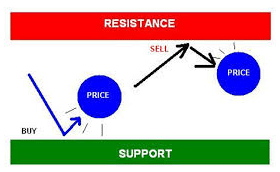

For starters, support and resistance levels are critical non-permanent barriers that show regions past which the market is unable to move. Resistance is the price at which the price reverses its upwards trend. On the other hand, support is the price below which the market seems unable to break.

Using these support and resistance levels in algorithmic trading

Robots use the best forex indicators for automated trading to spot regions of support and resistance. Just as a human would do, these automated systems use various support and resistance strategies to detect appropriate chart patterns. One such strategy is a double-tested resistance or support.

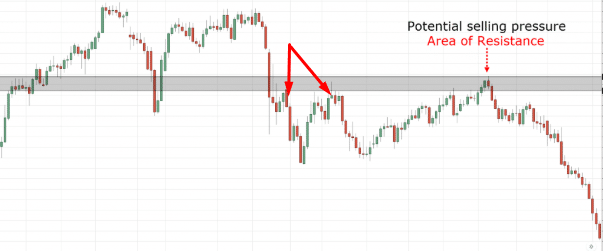

In the figure above, notice that the price action tested the area of resistance twice and then descended into a sharp bear slide after the third attempt. If you instructed the algorithmic trading system to sell when such a pattern appears, then it would execute the trade in the area after the double testing.

This strategy also works when you have programmed the robot to go long. Say your instructions tell the forex EA to go long when the price tests the support level twice. Notice in the figure below the prices tests the support level thrice before climbing after the fourth test. In the first three instances, the very first test is not decisive. Typically, one instructs the algorithmic trading software to ignore such unconvincing testing.

Bottom line

The popularity of automated trading systems is in ascendance because of two major reasons. First, the systems make decisions and execute trades faster than any human can ever achieve. Secondly, the systems make decisions based purely on insights gleaned market data. As such, no chance exists for emotions to affect the decision-making process.

Similar to human trading, automated forex trading relies on certain strategies. However, it is incumbent on the user to give instructions that suit the prevailing market conditions. For instance, one can instruct the system to buy when the price action tests the support level twice. The wisdom in this strategy is that the more price tests the support/resistance level, the weaker the price action gets.

Leave a Reply