‘Change is the only constant’ is an adage that fits when talking about Forex. This is because it is a dynamic marketplace that requires traders to come up with constant improvisations in the methods they employ. Volume is one such component in Forex that can be leveraged to capitalize on the big price moves and attract huge profits. Read on to know about volume usage … [Read more...] about Improve Your Forex Trading With Volume

Day Trading

Day Trading

Forex traders have the option of trading in multiple time-frames. But, which style is best suited for those who want to trade within a day? Day trading is exactly that style. It involves short-term trading in one day to earn profits in the financial market. Those who are venturing in the forex jungle need to know certain basic ideas and styles about trading that will let … [Read more...] about Day Trading

Choose Your Trading Approach: Discretionary Trading Or Mechanical System?

Forex trading: Discretionary or Mechanical Mechanical Trading strategy removes the need to predict by laying down some rules. The system informs the trader when to enter and exit the market and how much to risk so that they don’t have to make predictions. The Discretionary Trading strategy focuses on the intuition, market knowledge, and gut feeling of the trader. … [Read more...] about Choose Your Trading Approach: Discretionary Trading Or Mechanical System?

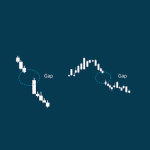

Top Fundamental Setups: Sunday Gap

It’s important for a trader to examine, conduct research, and understand as many trading approaches as possible. This helps them in the adoption and incorporation of one that’s really suitable for their trading style. There are primarily seven setups that are extremely useful when it comes to technical analysis. No matter which trading approach one takes, a trader should always … [Read more...] about Top Fundamental Setups: Sunday Gap

Easy Guide to Moving Average (MA) For Trade Entry And Risk Management In Forex

A simple moving average of SMA is the average price of a security over the past “N” number of periods. Older prices tend to fall out of the average as time passes, being replaced by newer ones. As a general rule, the shorter the period in the Moving Average, the more volatile it is, and the better it can track the price of the security. The length of your SMA will depend … [Read more...] about Easy Guide to Moving Average (MA) For Trade Entry And Risk Management In Forex