SIEA Zen works on all 28 trading pairs and has built-in features that allow it to handle risk and swaps on the portfolio. It has three different series, which differ based on profitability and drawdown. Our article will discuss if the promises made by the developer on the EA are true and whether you should consider it for your trading.

Detailed Forex robot review

The indicator is available to download after you purchase it from the MQL5 marketplace. Traders can then install it on the MetaTrader platform, enable the auto trading button, and place it on charts to begin trading.

Vendor transparency

Daniel Stein is the author of the EA who resides in Germany. He has a total rating of 4.8 for 415 reviews. The developer has 15 products published on the MQL5 marketplace and has 102 subscribers for his services. He has experience of seven-plus years.

Features

The robot has the following set of features:

- It has a built-in risk and swap management system

- It can turn off during important news events

- It closes all the trades at the end of the month and starts a new cycle

- It works only on the MT5 platform

How does it work?

The algorithm can be downloaded after purchasing it from the MQL5 marketplace. Traders can then refresh the experts’ tab in the MT5 platform and enable the auto-trading button. Placing the robot on respective charts will begin trading.

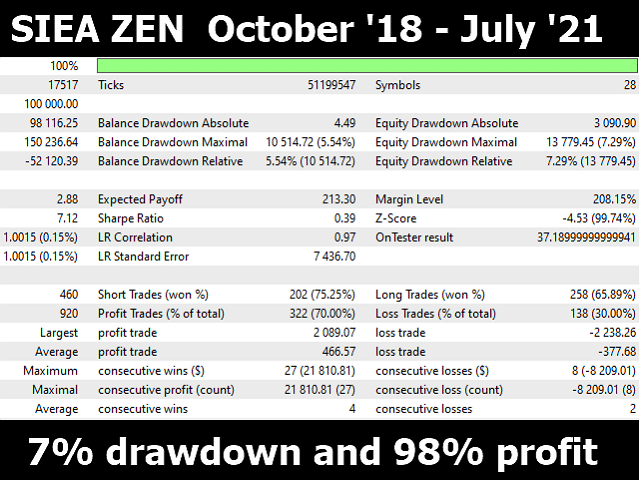

SIEA Zen strategy tests

The robot works on 28 pairs based on major currencies, including USD, CAD, EUR, CHF, GBP, AUD, NZD, and JPY. The developer states that the EA holds trades for an average trade duration of 4 days and maintains a low drawdown. The EA spots reverse entry opportunities by doing a volume analysis. On the trading history on Myfxbook, we can see that there is no stop loss attached with trades, and the average duration of trades is much higher, i.e., seven days.

The developer only shares an image of backtesting results which does not share the pair and input settings. The relative drawdown for this was around 7.29%. The winning rate was 70%, with a profit factor of about 2.88. The best trade was $2089.07, while the worst one was -$2238.26. We can not conclude anything from such bogus results as there is no detailed statement present.

Live trading results

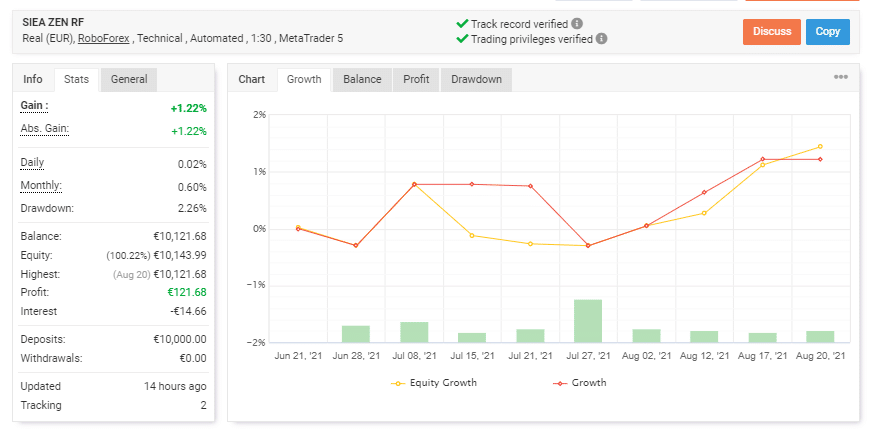

Real trading results are tracked via Myfxbook. They show the EA performance from June 21, 2021, till the current date. Since then, the robot has had an average monthly gain of 0.60 with a drawdown of 2.26%. There were 10000 Euros in deposit and $0 in withdrawal. The balance of the trading robot was 10121.68 Euros. The winning rate stood at 57%, with a profit factor of 1.83. The best trade was 61.90 Euros, while the worst was -82.11 Euros. There were a total of 14 trades.

Pricing

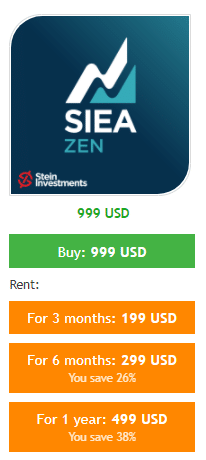

The indicator can be bought via the MQL 5 marketplace for a one-time price of $999. There is no money-back guarantee. The asking price is high considering the performance of the system.

Customer reviews

There are only two reviews available at the MQL 5 marketplace. A customer states that the robot is not trustworthy because it has live records for a short duration.

SIEA Zen robot has recently started to track its performance on live accounts. Until now, the drawdown value is high, which means more risk on your account. We have to wait and see how the algorithm will perform in the future.

Leave a Reply