Virtually all traders first introduced to the world of forex learn about technical and fundamental analysis. It’s fair to conclude that the former sets the prices to enter, while the latter is believed to move those prices.

Traders generally use these two methodologies when trading the markets and look for scenarios where both are in harmony.

Yet, even if you spot a bullish pattern on the euro, along with favorable fundamentals, you’ll never know how other market participants are feeling. Of course, we’re trading with millions of investors whose behaviors are highly dynamic but exhibit a predictable herd mentality.

Therefore, how a large group of people will react is influential in the resulting price movements; this is where sentiment analysis comes in. Let’s explore why sentiment is an edge-defining framework to apply in your forex trading.

What is sentiment analysis?

It’s best to think of any forex market as a group of living people, and like any human being, they have emotions. Therefore, forex sentiment is about how traders feel about a particular currency pair, whether optimistic or pessimistic.

It’s virtually impossible to pinpoint why sentiment might be bullish or bearish in particular cases, other than assuming a mixture of emotions such as euphoria, greed, and fear.

We measure sentiment primarily using a sentiment indicator. These are numerical or graphical tools reflecting how participants are positioned within a list of specific markets, whether net-long or net-short.

Why sentiment is often a contrarian indicator

A distinct feature of many sentiment tools is how they are used in a contrarian manner. In simpler terms, traders use these to bet in the opposite direction to the masses.

For instance, if position summary data from a broker shows an overwhelming number of net-long orders, the actual sentiment tends to be bearish (and vice versa).

Firstly, if most people have long positions, there’s a perception that very few people are left to keep driving the market higher, meaning the price can only go in the opposite direction.

Another common cause is how most retail traders ‘pick tops and bottoms,’ meaning trading against the dominant trend. For instance, if the trend on EURUSD was bullish, yet sentiment showed more net-short than net-long positions, prices are likely to continue rising.

There’s a belief that institutional traders trade against the average retail trader and have enough power to drive the markets in one direction, even when most are going the other way.

How traders use sentiment analysis in forex

As with any tool, it’s not recommended to act on sentiment alone. However, one of the things sentiment analysis can do is confirm a trend.

Although you can identify the predominant trading direction to trade with either technicals or fundamentals, sentiment analysis can be an extra supporting factor.

A tried-and-tested way of truly confirming a trend is looking for ‘extremes’ between net-long and net-short orders. In other words, you want an overwhelming percentage of buyers/sellers against sellers/buyers, at least 50% but preferably above 70%; the wider the gap, the more likely powerful the trend is.

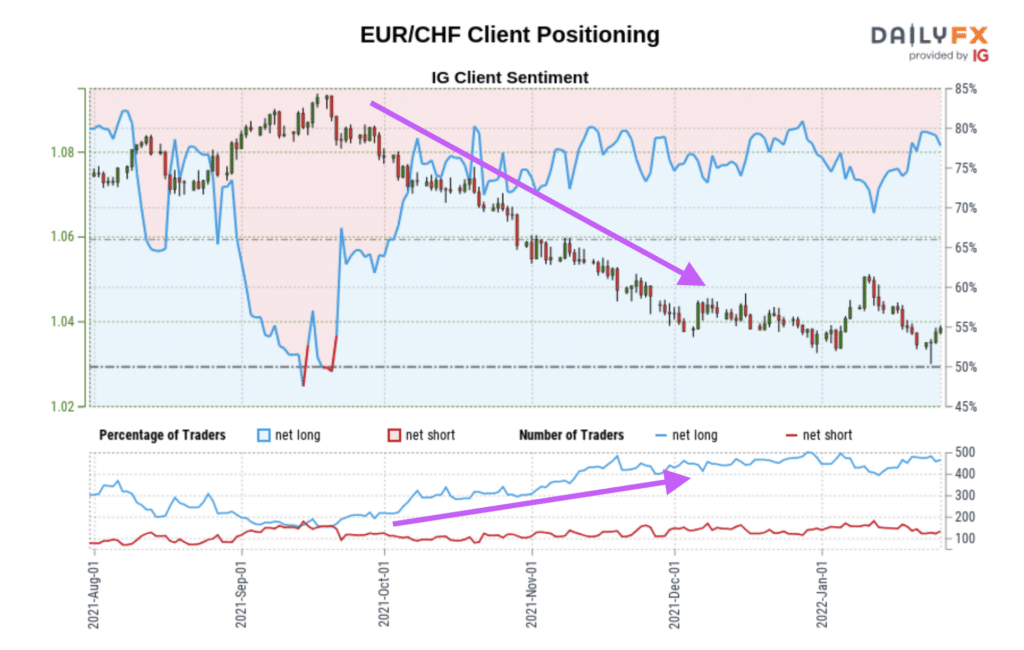

Let’s consider recent EURCHF client positioning from IG’s client sentiment report (chart 1).

In the image below, we have drawn two arrows to show the negative correlation between the increase of net-long positions and the continuously declining prices.

As sentiment is typically a contrarian indicator, price kept falling even as more and more people had long orders. Likewise, sentiment analysis could help show you early trend changes by gradually observing an increase of orders on one side versus the other.

Another method is using sentiment analysis to find any mismatch in your technical or fundamental analysis.

For instance, if your technical and/or fundamental results presented a selling opportunity for a particular pair, but sentiment data reflects otherwise, you may pass up on this setup or consider it as not reliable enough.

List of popular sentiment indicators in forex

Let’s now outline some of the most popular sentiment indicators in forex and a few good and bad things about them.

It’s worth noting that the main disadvantage of each of these is they provide a macrocosmic view as trading currencies are decentralized or non-exchanged traded.

Therefore, such indicators don’t necessarily reflect the sentiment of the entire forex market, but in most cases, the behavior shown is typical. Also, while other tools like the VIX, fear and greed index and open interest are referenced in sentiment articles, these don’t apply pertinently to forex.

Commitment of Traders

The Commitment of Traders, published weekly by the Commodity Futures Trading Commission, reports net-long and net-short positions by retail and institutional traders on the currency futures markets traded on the Chicago Mercantile Exchange.

These directly correlate with the spot forex, which is why this report can provide you with an edge. Unlike other sentiment indicators, this tool is quite significant as it shows the positioning of the largest players in the markets.

Although you can still derive value from the CoT, the main problems are:

- The report only comes out weekly. Therefore, it may be lagging by the time you see it.

- The report doesn’t show positioning data for pairs but individual currencies, meaning you need to compare two sets of information, leaving room for unwanted interpretation.

IG Client Sentiment

Numerous brokers like Dukascopy, Saxo Bank, FXCM, OANDA, and Axi provide the positioning data of their clients. However, IG is probably the best and most popularly used.

The IG Client Sentiment Index reflects the net-long and net-short positions of the +/- 240 000 retail and professional clients trading through their brokerage. This indicator covers 14 forex-related markets and a few other non-forex securities.

One of the benefits of this tool is how easier it is to interpret than the CoT. IG provides a brief written analysis of the daily changes between buyers and sellers, a graphical representation, and a resulting bias.

The main downside is that it covers a small percentage of clients. However, it’s sufficiently reliable as a sentiment indicator based on popularity, ease of use, and accuracy.

Final word

As with any tool, you shouldn’t use sentiment indicators in isolation nor to time the markets. Sentiment analysis can be the first or last point of reference as you gather any other evidence or data to fully support the reasons for going long or short in the markets.

Nonetheless, sentimental analysis is a forward-looking tool and can explain market movements that may be uninterpretable by technical or fundamental metrics.

Leave a Reply