Traders carry out technical and fundamental analysis to analyze future price direction in the forex market. Contrary to perception, they are not the only strategies deployed by millions of traders worldwide. Some traders also pay close watch to seasonal tendencies that take place in the $4 trillion marketplaces.

What Is Seasonality Trading?

Seasonality trading is a concept whereby traders base trading decisions on how the forex market moves and behaves at certain times of the year. It’s become increasingly clear that the forex market tends to move in somewhat predictable patterns throughout the year.

For instance, the month of September has always elicited high volatility levels, presenting unique trading opportunities for forex traders. Likewise, the U.S dollar tends to perform strongly at the start of the year, in January and falls clearly as the year comes to a close.

Given that the forex market tends to behave in a certain way, it is possible to incorporate seasonality patterns into various forex trading strategies at certain times of the year.

However, while seasonality trading does present profit-making opportunities, it is important not to base all trading decisions on seasonal patterns. Forex seasons should only be used to supplement and confirm the technical and fundamental analysis.

Popular Seasonal Tendency in the Forex market

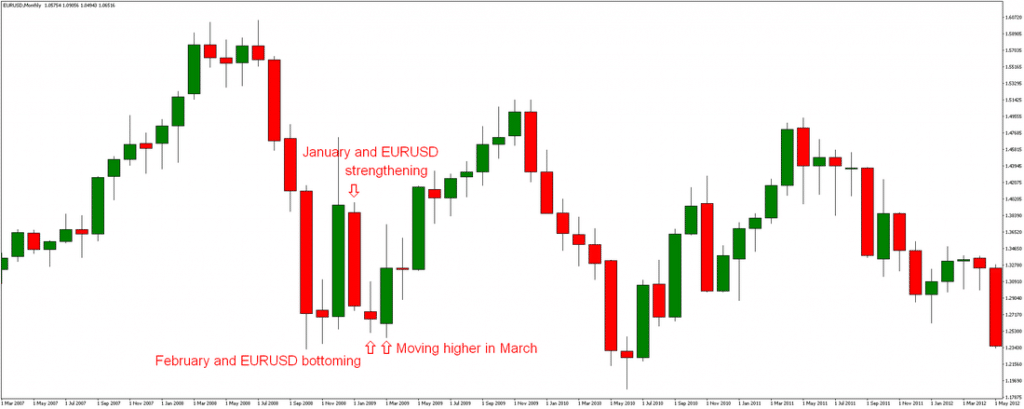

EUR/USD January Sell-Off

The year’s start tends to trigger a sell-off of the EUR/USD pair, which accounts for a huge chunk of trading activity in the forex market. It is partly because lots of foreign currency, mostly in dollars, is usually sent overseas for investment purposes at the beginning of every year.

Increased investments on the dollar cause the greenback to strengthen across the board, conversely sending the EUR/SD pair lower.

Analysis of the forex market indicates that the EUR/USD pair is usually under pressure, 80% of the time during January. The sell-off pattern tends to reverse in March with the pair rallying once again by the end of April.

USD/CAD May Sell-Off

The Canadian dollar being a commodity currency sees its sentiments in the forex market influenced a great deal by movements in oil prices. Likewise, the CAD tends to strengthen when oil prices increase and weakens as oil prices drop.

Likewise, the USD/CAD pair price action depends a great deal on how oil prices move. In the March to April period, oil prices have been found to tend to increase. A surge in oil prices often leads to strengthening the Canadian dollar, conversely sending the USD/CAD pair lower.

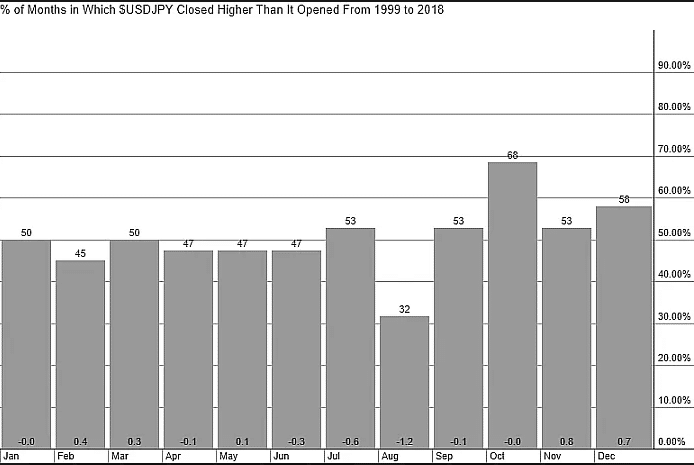

USD/JPY July Rally

The USD/JPY is another currency pair that tends to show seasonality throughout the year. For instance, it’s been found that the pair manages to end the month of July strongly, 68% of the time. While there is no logical explanation as to why the pair behaves this way, the same could be attributed to the start of the United States Second half of the year and end of Japan’s first quarter.

Likewise, forex traders that base trading decisions on forex seasonality tend to open long positions on the pair at the start of July, anticipating gains as the month comes to a close.

Similarly, a good chunk of the gains made in July is often erased in August. It is partly because the Japanese Yen tends to strengthen in August, conversely sending the pair lower.

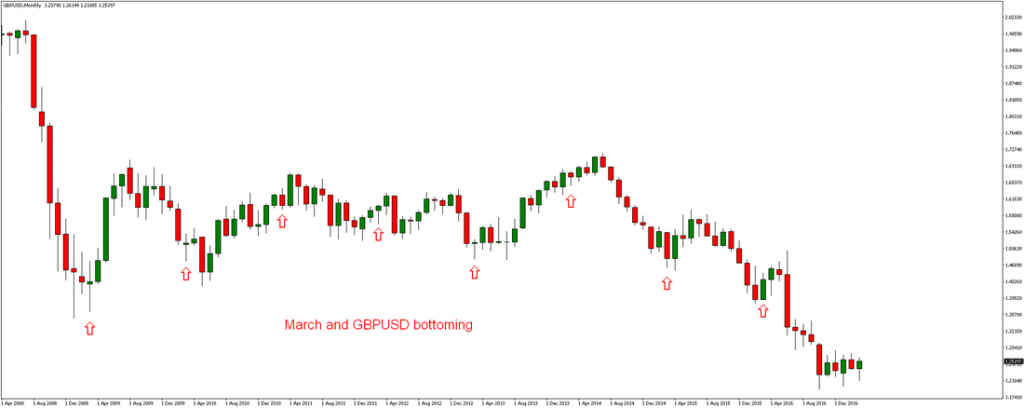

GBP/USD forex Seasonality

GBP/USD is another currency pair that shows unique patterns throughout the year. It’s been found that the pair tends to bottom in March after coming under pressure in the first quarter of the year due to the strengthening of the U.S dollar.

However, at the start of the second quarter, the pair tends to move higher on the Pound strengthening against the dollar. In the chart below, it is clear that April often starts with a bullish GBP/USD candlestick ending with the pair rallying.

The pair tends to move higher in April and peaks in August.

Are Forex Seasons worth Betting On?

Forex seasons provide insights as to how currency pairs behave at certain times of the year. However, they should never be used as the basis of any trading strategy. Carrying out in-depth technical and fundamental analysis is a sure way of having an edge when it comes to forex trading.

Forex seasonality should only be used to supplement a given trading strategy as well as analysis. For instance, one can leverage forex seasonality to leverage directional movement during the summer months. In this case, fundamental and technical traders can utilize seasonality to put more weight on trend trades that occur as the year comes to a close

Bottom Line

Seasonal tendencies are real and influence a great deal trader’s sentiments in the forex market. Being familiar with these seasonal tendencies is a sure way of staying ahead of the pack and having an edge when it comes to forex trading.

However, season trends should never be the basis of any trading strategy in the forex market. Seasonal patterns don’t duplicate themselves 100% of the time. Currency pairs fluctuate due to several reasons. Likewise, they are likely to shrug off any seasonal tendencies in response to underlying developments at the time.

Similarly, seasonal tendencies should only be used to supplement technical and fundamental analysis strategies that have proved to be highly effective in future price determination in the forex market. Traders should only apply the knowledge of seasonality to improve their trading strategies.

Leave a Reply