Saxo Bank this is an investment bank, which is leading retail broker of Europe. The organization was founded in 1992 in Denmark. The headquarter based in Copenhagen.

Saxo Bank is a quite saved broker. Which is regulated all over the world by more than 10 different regulators. The main regulator is the UK Financial Services Authority.

This forex broker is good for traders whose priority is the quality of the trading terminal and the availability of good research data.

Saxo Bank advantages:

- High-quality training material

- Powerful trading platform;

- Free withdrawals;

- Several basic account currencies;

- Demo account provided;

- Large selection of products.

Saxo Bank disadvantages:

- Absence of chat support service;

- Slow opening of an account, up to 3 days;

- Penalty for inactivity;

- There is no possibility to interact with a credit or debit card;

- A minimum deposit of $ 500;

- Expensive Forex, options, and bonds.

Opening account with Saxo Bank

To open an account with Saxo bank is quite easy, but it is not accessible for all. Residents of Iran, Surya, Cuba, the USA, Sudan, and Northern Korea cannot be users of Saxo Bank. This can be also applied to the Canadian provinces of Ontario, Newfoundland, and Labrador.

In order to open an account, you have to fill in the form and upload your documents such as ID card, and proof of registration. After approval, you must deposit your account and then you can start working.

Saxo Bank offers its clients three accounts at choose:

1. Classic with a minimum deposit of $ 500;

2. Platinum with a minimum deposit of $ 50,000;

3. VIP with a minimum deposit of $ 1,000,000;

It worth to mention that more profitable terms and the personal manager are provided for owners of Platinum and VIP accounts.

The users from Great Britain have the possibility to open tax account ISA/SIPP.

Saxo Bank Trading terminal

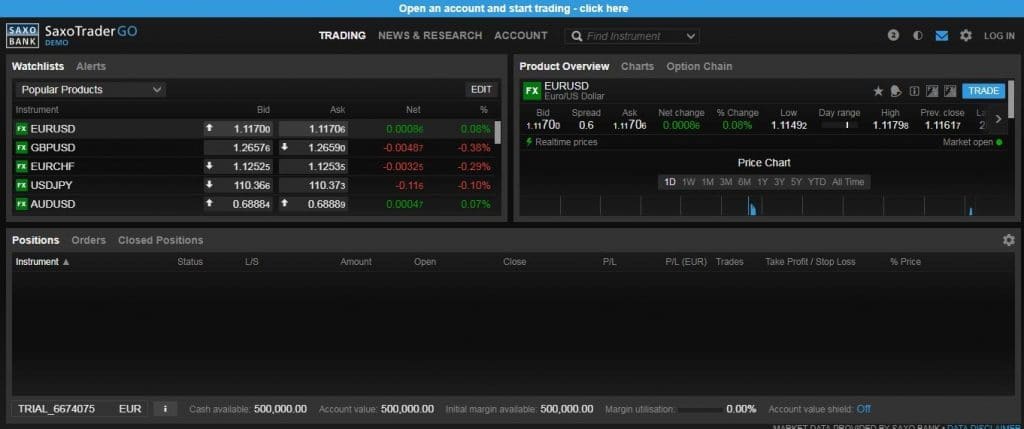

Broker Saxo bank created its personal terminals: web -platform SaxoTraderGO and desktop SaxoTraderPRO. SaxoTraderisavailable on 25 languages, nowadays it is the biggest choice on trading platforms.

The platform SaxoTraderGo is worked out thoughtfully and easy in use. The search functions SaxoTrade is the advantage of the platform, the results are grouped distinctly in different assets classes. Traders can filter the assets classes pushing drop-down list. It is also possible to filter according to regions.

The system of notification is developed on the platform very well. The trader has the possibility to get notifications in the kind of pop-up window or via e-mail.

Many users consider as a disadvantage the absence of two-level login and the restricted possibility of settings diagrams and working area. The trader can change the size of the tabs, but their location cannot be changed.

Trading terminal for the phone is available for iOS and Android

Desktop SaxoTraderPRO is one of the best platforms on the market. Unlike its web version with the settings of diagrams and workspace, everything is fine here. All windows are customizable in size and position.

Saxo Bank Training

Saxo Bank has quite a developed system of training. The fx broker supplies his clients with actual data and also gives the possibility to use valuable analytics’ recommendations on shares and obligations etc. On the webpage tradingfloor.com the trader can find and use training materials from SaxoTraderPRO и SaxoTraderGO.

Saxo bank gives newcomers the opportunity to have training at demo account.

Service desk

The Service desk is not the strongest point of Saxo Bank. The client can have a consultation on the telephone or via e-mail. The service desk work twenty-four-hour five days a week.

The biggest advantage of this service desk is a big amount of languages.

Leave a Reply