Trading in Forex can give you big returns if you have the necessary skills. But not every trader in Forex is equipped to perform well. This is especially true for newbie traders. Luckily, automated trading software systems help to overcome this hurdle. With the help of such trading software, you can see big returns with minimal risk. ROBOCOPY FX is one of the copy trading services that can help you gain appreciable profits. The Metatrader 4 compatible system works on all currency pairs. It uses strategies that have a defined limit for losses on all the orders. This ROBOCOPY FX review brings to you the unbiased analysis of this trading system.

Detailed Forex Robot Review

With the copy trading system, the only thing you have to do is copy the trades sent by the service. Signals are sent via the MT4 platform and the order is executed automatically in your account.

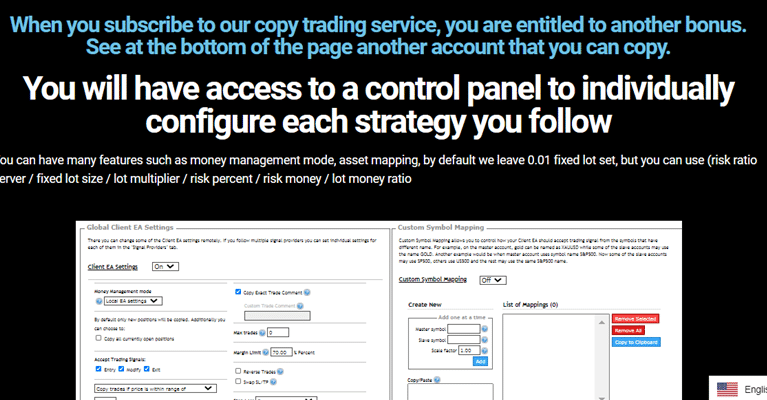

Important feature highlights include strategies with defined stop loss, access to Robocopy FX-1 and FX-2 strategies, a bonus account you can use, access to the control panel for the individual configuration of strategy, and more.

Other features include money management, asset mapping, and various other settings such as risk percent, risk money, lot multiplier, etc.

Robocopy-FX-3 is the system’s manual strategy with up to 6 operations per day. Signals are sent automatically and come with a risk of 0.25% per trade. According to the vendor, no breakeven or drag the stop maneuvers are done. Only stop-loss or take profit features come into play, resulting in real returns.

We are unable to evaluate the system fully because of the lack of info related to the developer or the team behind the system. Due to the lack of transparency, the reliability of the system is not looking good. Further, the vendor does not provide contact info with just an email address provided for queries and complaints from the customers.

ROBOCOPY FX Strategy Tests

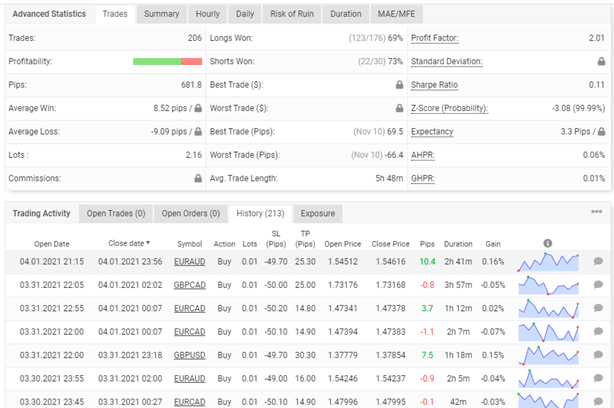

Based on the info given by the vendor, the strategies come with a defined stop loss for all the orders. Two strategies namely FX-1 and FX-2 are given where the former works on the GBPCAD, EURCAD, EURAUD, and GBPUSD pairs. The approach tracks the support points in search of retraction. In the latter approach, a breakout method employed works on the EURUSD, USDJPY, and the GBPUSD pairs. A third strategy, ROBOCOPY-FX-3 uses a manual approach.

No strategy testing reports are revealed by the vendor which is a bit disappointing as the tests will give more info about the system.

Real Live Account Trading Results

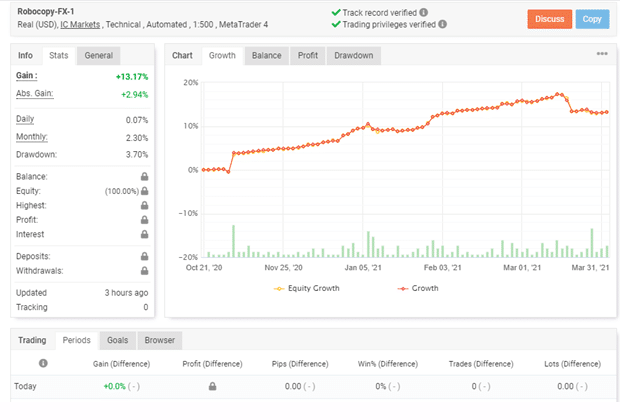

Results of the real live account trading verified by the Myfxbook site are provided by the vendor. A screenshot of the trading results are shown here:

We could see many hidden details in the trading stats. A daily profit of 0.07% and a monthly profit of 2.30% are shown. The drawdown is 3.70%. A major discrepancy in the stats is the big difference between the absolute gain and the profit percentage. While the absolute gain is 2.94%, the gain percent is 13.17%.

Of the 206 traders executed from October 2020 up to March 2021, the average win came at 8.52 pips and the average loss at -9.09 pips. The profit factor for this account is 2.01. Lot sizes are set at 0.01.

Pricing

Pricing for this system is based on a monthly subscription at $127.00. With the monthly subscription, you get the two main strategies of the system, FX-1 and FX-2, and a third strategy, FX-3 which is a manual approach.

A seven-day refund policy is provided by the vendor which is not of many benefits. Compared to the price of competitor copy trading services, this service is an expensive one and with a minimal refund period.

Customer Reviews

We were unable to find user reviews for this copy trading service on trusted third-party sites such as forexpeacearmy, Trustpilot, and more. We prefer reviews from such sites as they reveal unbiased views of the efficacy of the system. Without such reviews, we find it difficult to do a complete evaluation of the system.

Summing up our ROBOCOPY FX review, the system provides verified trading results for its strategies. But there are several hitches that the vendor can rectify to make the system more effective.

These include the lack of vendor transparency, hidden trade stats, lack of backtests, expensive pricing, and short refund period. Until the vendor takes care of these aspects, we would not be able to recommend this system.

Leave a Reply