The principles of R multiples in forex

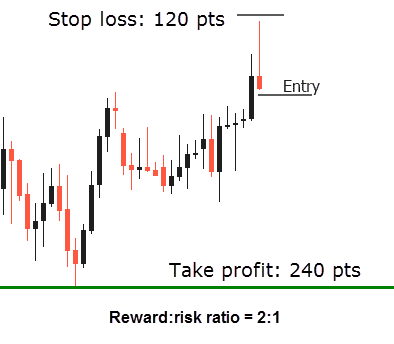

The concept of R-multiples involves risk and reward. In simple terms, R can mean risk and/or reward, which one can measure on an individual trade basis. This multiple compares the distance of a trader’s stop loss against the distance of their profit targets (both measured in pips). Every trader should have specific R-multiples that tell them approximately how big their stops are and how many pips they should be aiming for when it comes to profit.

Traders express this measurement as the R:R/risk to reward ratio. Any R:R that is higher than 1:1, subject to many other assumptions, should produce an upward trajectory in the equity curve. Even with a relatively low win rate, with a very good RR, a trader can be profitable. Such is the power of these multiples since they emphasize that winning percentages are mostly irrelevant.

| win rate | Minimum reward : risk ratio |

| 25% | 3 : 1 |

| 33% | 2 : 1 |

| 40% | 1.5 : 1 |

| 50% | 1 : 1 |

Traders need to understand the real dollar figures they stand to lose on any given trade. However, the R-multiples are mainly a framework of expectancy, risk management, and a guide as to where they should be going. Of course, real money is on the line for every position. However, one should think in terms of how much the reward could be in multiples relative to the risk. Multiples have become the accepted way by the mainstream to express this.

How are the Rs helpful in forex?

The simple basis of R-multiples are defining risk versus potential reward. To start with, the trader decides the dollar amount they can realistically and comfortably afford to lose in relation to their account balance. They may either trade with a fixed stop loss size consistently or vary their stop loss size where they see fit. Position sizing is necessary for this scenario in adjusting the lot size accordingly so that the trader sticks to the maximum dollar amount they can afford to lose. The difference between a lot size of 1 and 1.2 is quite considerable in monetary terms. With the small change in lot sizes can come the resulting change in the R-multiples.

So, the trader, depending on their preferences and other circumstances, may decide to use a 50 pip stop loss instead of a 40 pip stop loss for a particular trade. In an example involving 50 pips, if they chose to aim for 200 pips, the potential reward is expressed as 4R because the reward is four times bigger than the risk, i.e., the target distance of 200 pips is four times bigger than the 50 pip stop. In an example using 40 pips, if they decide to aim for the same 200 pips, the potential reward here is expressed as 5R because the reward would be five times greater than what was at risk.

The most risk-centric approach generally is to not unreasonably increase the risk in the pursuit of a higher RR. It is not necessary to have a rigid reward for every position. Hence, the R-multiples can be adjusted slightly to accommodate a more acceptable risk.

Secondly, the aim is not to have a negative RR ratio because it will prove impossible to be profitable as time goes on. Some traders do not understand how wide or narrow their stop losses are or what they usually aim for as a profit target. With no understanding of R-multiples, there is no consistency in this regard. Though you may get away with consistently using a 50 pip stop only to profit 25 pips, the equity curve will reflect an account that barely breaks even, let alone profits.

The higher the RR ratio, the more chances of substantial account growth, and the quicker the recovery after losses. When the RR is higher than average, it’s possible to recover from a string of several consecutive losses taking you back to where you were previously or even better. Drawdowns are rarely touched upon intricately in the forex world, though they are inevitable occurrences. It is only with a supreme understanding of R-multiples where one can overcome drawdowns.

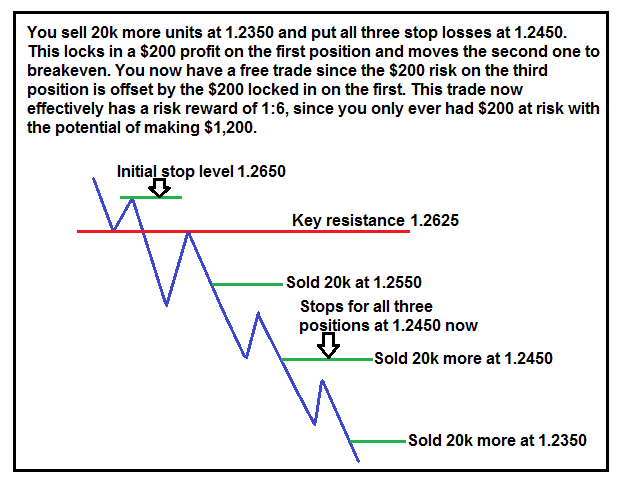

Another situation where R multiples are of use is when traders pyramid their positions. Also known as scaling in, traders add extra positions to their initial trade to potentially increase the reward than if they were stuck with just one. This trading technique is often very risky for one is increasing their exposure and risk of a substantial loss if the market were to move in the opposite direction. Logically, this technique is safer at pre-determined distances where the trader is already in some decent amount of profit rather than adding positions around the same place as their initial entry.

Let’s make an example. Let us assume one takes a trade to net a possible 5R reward. One could decide that once the position has moved to 2R profit, they will add another position at this point and move the stop of their first trade to 1R. So, in doing so, they would ensure not to double the risk unnecessarily. The second position’s stop loss could either go at the 1R point or the entry point of the first position. Assuming the trading account has enough margin, the trader could add more positions in a strategic and risk-centric manner.

Whichever method a trader chooses, the objective would be to keep their initial dollar amount risked despite adding another position/s, with the potential to net more on the same trade. The possibility could turn out to be a trade that nets them above 5R profit. However, the dangers of when this technique can go wrong can’t be understated. Thus, experience and discipline to risk management are vital to the execution part.

Conclusion

Trading is merely a few basic maths calculations that emphasize the elementary principles of adding more than what you lose. R-multiples allow us to do just that. The better you multiply what you add while reducing what you lose, the better your chances of consistent profit.

Leave a Reply