Source: Bloomberg

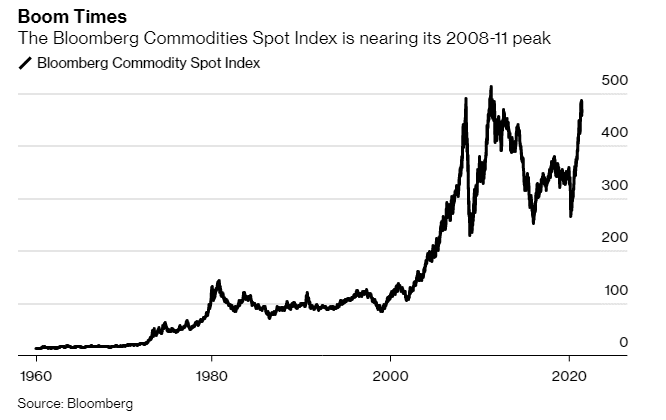

The uptick in commodity prices has sparked inflation talk among policymakers and consumers bearing the burden. For some investors, the boom has been a moment to reap big rewards.

CL1! is down -0.73%, HG1! Is down -1.55%

- The rise in commodity prices has already seen King’s Merchant Commodity Fund, which was founded in 2004, climb almost 50% this year.

- King sees a structural inflation shock, characterized by pent-up demand, with the investor not concerned that the rise could be a temporary snapback from the pandemic.

- With oil hitting $75 a barrel, analysts see a political angle of the commodity boom, with Saudi Arabia and Russia expected to lead global energy markets.

- The commodity boom has been viewed as an uncomfortable development for policymakers, already fighting the impacts of the climate crisis.

- Outgoing CEO of Glencore Plc. Ivan Glasenberg expects commodity prices to persist as supply constraints remain.

Leave a Reply