- Ripple vs. SEC legal tussle

- XRP hits bottom, breakout looms

- Ripple cross border payment edge

Ripple market sentiments have received a boost after coming under pressure amid an ongoing legal tussle involving the US Securities and Exchange Commission (SEC). Reports that the popular mega-cap cryptocurrency is closing in on a big win in court is the catalyst supporting an uptick in XRP price.

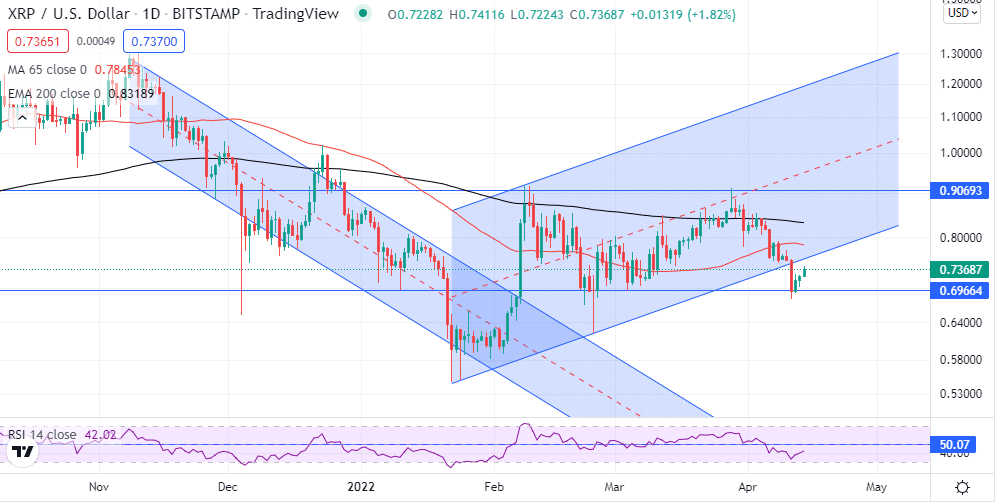

XRPUSD technical analysis

XRPUSD has bounced off the pivotal $0.6966 support level, opening the door for further upside action amid renewed buying pressure. The Relative Strength Index is already pointing upwards, affirming bulls are once again coming back into the fold.

The $0.9069 has emerged as a pivotal resistance level curtailing any upward action. A break above the level should bring to an end the recent consolidation setting the stage for XRPUSD to post further price gains. Below the level, Ripple could remain range-bound.

On the flip side, any sell-off followed by a close below the $0.6966 level could trigger renewed sell-off, resulting in Ripple edging lower in continuation of the long-term downtrend. Below the $0.6966 XRPUSD could tank to 2022 lows near the $0.5400 area.

Ripple vs. SEC tussle

While XRP has underperformed in recent days, its long-term outlook remains bullish. The payment company Ripple Labs behind XRP has scored a major win in court, which continues to offer support to the coin. Judge Sara Newborn denying the SEC request to keep some documents privileged is the latest development shaking up the Ripple vs. SEC ongoing stalemate.

The SEC accuses Ripple executives of engaging in unregistered securities filings in the ongoing lawsuit. Filed on 22 December 2020, the lawsuit alleges that Ripple raised $1.3 billion through illegitimate means by selling XRP as securities. The SEC winning the case will result in XRP and other cryptocurrencies being classified as securities rather than currencies. The standoff has led to general uncertainty, all but affecting XRP sentiments in the market.

Ripple payments prospects

Ripple Labs winning the legal tussle and affirming XRP is a currency rather than security would be a major score that should strengthen XRP sentiments in the market. The cryptocurrency has grown to become a major player in international payments.

Its mainstream adoption and vast addressable market in cross-border payments have been the catalyst behind XRP’s growth to become one of the largest cryptocurrencies. With the digital remittance industry expected to grow at a compound annual growth rate of 13.3% to $42.5 million, tremendous growth opportunities are up for grabs.

Ripple stands to be one of the biggest beneficiaries of the expected growth thanks to its low transaction fees and super-fast processing times, ideal for enabling cross-border payments. Its blockchain can process a transaction in under five seconds for a low fee of 0.0001 XRP tokens.

In addition, Ripple has strengthened its prospects in international payments by inking strategic partnerships with mainstream outlets. It has already partnered with over 100 mainstream financial institutions, including American Express. Its enterprise blockchain network RippleNet has become a preferred platform for processing international payments.

Final thoughts

While XRP has taken a significant beating in recent months, the sell-off has coincided with a deep pullback in the overall market. Renewed investor interest in riskier assets is one factor that should continue to support XRP’s bounce back after the recent correction lower.

Ripple Labs scoring a big win over SEC can only strengthen XRP sentiments. Nevertheless, Ripple’s edge in enabling low-cost, fast international payments affirms its long-term prospects in the highly overcrowded cryptocurrency space.

Leave a Reply