Reversal trading is the ability to identify patterns in the charts and then break it out. In forex, the trend is considered as your friend, and it certainly is. But it doesn’t depend on what direction you want to trade it. The trend is your friend if you’re going to follow it, but also, if you want to trade reversals.

Forex reversal patterns are all over the market and timeframes. So, it is an excellent source of pips if you are trying to make money in forex. Experts around the world and the best forex robots in the market love reversal trading. So, should you do?

Let’s talk about reversal trading and how to identify chart patterns that help you in the identification of reversals. Also, learn what the mean reversion strategy is and, finally, gain one more strategy in forex trend trading.

Table of Contents

What is Reversal trading

Reversal is a change in the direction of the price after a continuous trend. It can happen to the long or short side and in any time frame. In other words, a reversal shows that a unit changes from going up to fall, and from going down to turn up.

Reversals occur after a long run lost its steam, and a change in the direction of the trend is performed. Sometimes, It also can happen after a violent movement which needs a consolidation phase; however, a small counter-movement against the pattern is a pullback.

The significant difference between reversals and pullbacks is the duration of the counter-movement. A reversal keeps the direction of the change for some time and forms a new trend, but the pullback is a short-lived move that lasts quickly, and then the price returns to its previous direction.

Reversal trading is the ability to identify, and even anticipate those changes in the trend and then open a position at the best possible price to make the most pips possible.

That being said, time frames are relevant depending on the kind of trade who you are. If you are a long-term trader, intraday reversals on a 15-minute chart don’t matter to you. However, it will be relevant to a day trading or short term investors.

How to predict a trend reversal

As you may think, one of the most important topics when it comes to talking about predicting a trend reversal is the identification of patterns. In Forex, patterns are everything as it allows you to identify price changes, like reversals, but also points where to act, take profits, or leave the market.

Let’s talk about different ways to predict a trend reversal.

Inside Bar

An inside bar may indicate a possible reversal of the current trend no matter if it is a bullish or bearish trend. It represents a balance between buyers and sellers after a sharp movement, which is usually followed by a change in the direction.

In candlestick charts, an inside bar is a formation where a candle is developed fully inside its prior bar. When an inside bearish candle follows a bullish candle, the signal is for the downside while when a bearish candle is followed by an inside bullish bar, it is considered as a bullish signal.

As a matter of confirmation, the wider the first and second bars are in relation, the better. It shows that the momentum was on its peak and it will dissipate.

Also, the smaller the second bar is as relative to its predecessor, the more violent the change will be, and the stronger the signal is.

Two bar reversal

The two bar reversal shows trend exhaustion. It can be found in any time frame, and traders usually use it as an entry signal. It is formed by two candles when the first must go up and close near to session highs. Then, the second should open and go lower, showing rejection of previous highs.

When the formation tops highs of the session, it signals a bearish reversal; while it suggests a bullish turn when it is close to the minimum of the given session. It works better with persistent trends, the longer and sharper, the better. Check volume for a stronger signal.

Lower lows and higher highs

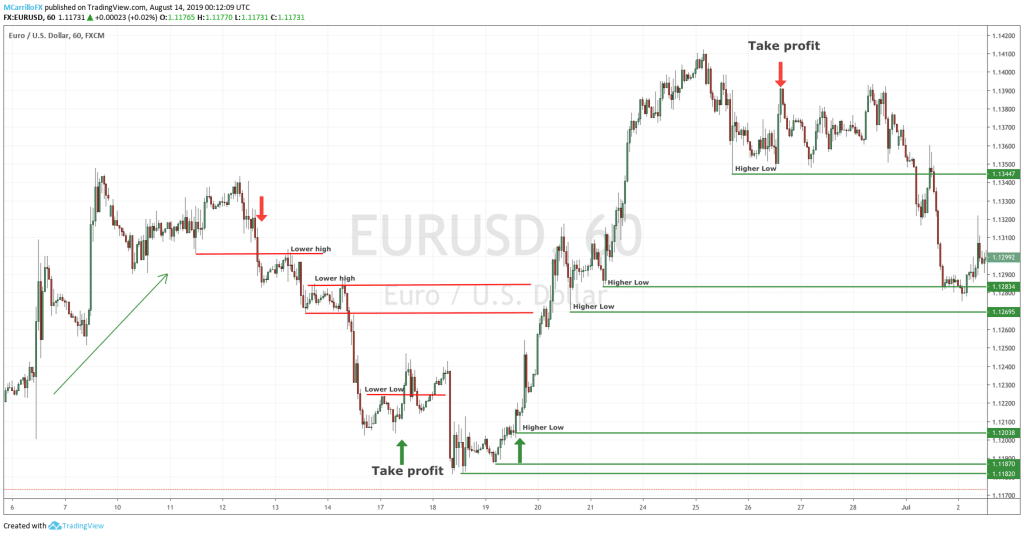

A classical chart pattern analysis as trends usually performs lower lows and higher highs. It is primary, an uptrend will also show higher lows, and a downtrend will have most of the times lower highs consequently. So, the idea behind this pattern is to find divergences.

If you find a lower low in an uptrend or a higher high in a downtrend, it will most of the time considered as a reversal signal.

The strategy says that a downtrend will always follow lower highs, so, at the moment that you find a higher high, you should pay attention to the next candle that should open higher. With the right combination, it will signal a reversal to the upside.

Usually, the entry point will be found after a break above the previous high level.

While the downtrend is in development, you are going to see that the difference between highs are getting smaller until it becomes almost the same level. It would be time to close.

On the other hand, in an uptrend, look for higher lows for trend confirmation, but lower highs as reversal signals. Entre after a level breaking, usually a previous downtrend support; and close positions after the higher low has become a higher-same-level.

Should I trade reversals?

The answer to that question is easy. Do you like to be a renegade contrarian trader? Do you enjoy when in a debate you are driving everybody crazy? If your answer is yes, then you should try the reversal trading.

Reversals are also known as pullback trending, reversion strategy, or trend trading. The approach looks for U-turns in directions, just like when you hear an argument and want to counter-attack with your opinion. Basically, you are trading against the trend, but using it.

Do you like that? Go for it. However, be honest with you and learn the principles and how to do it right. Then, collect your pips!

Great article. Fibonacci is another reversal trading strategy you didn’t mention though. This is the one I use the most. Along with some fundamental analysis it works well for me.

If you use a reversal trading strategy you have to stay on your toes. It is much more likely that a trend will continue rather than reverse course. A trend usually keeps going for several days in a row. But, if you do decide to use a speculative reversal strategy, just make sure you are ready to go back towards the continuation direction again.

I like using the head and shoulders pattern to spot reversals. I also look at the RSI indicator for overbought and oversold signals.

Seriously, double top/bottom and triple top/bottom is the way to go. This is basically the only chart pattern you will need. Great risk to reward ratio.

They work ok for me, but definitely not perfect!

I have a question. Maybe somebody can help me out. How do you determine if a pattern is a double bottom reversal and not just a flag pattern? Having a hard time telling the difference.

Usually a flag pattern is formed following a strong move in one direction. A double top or double bottom is more often than not created following strong countertrend movements. Also, the flag should be formed within a narrow range close to the extreme of the “pole.”

It’s so hard to tell the difference between an actual reversal and just a pull back.

I have the same issue. I think I’m going to quit with the reversal trading and try to trade with the trend.