China’s growing influence can no longer be ignored. The country is home to one of the largest and fastest-growing economies. Likewise, it is backed by one of the most robust export economies. The country’s growing influence has also continued to shed more light on the native currency.

China’s currency is increasingly becoming a key player on the international scene thanks to the volume of its exports. Its growing popularity can be attributed to, among other things, the volume of transactions it processes as China is one of the biggest exporters. Likewise, it’s increasingly becoming a custodian of global reserves.

China’s paper money goes by two names, the yuan and the people’s renminbi. The two terms differ greatly as both are used to denote different aspects of the country’s financial system.

While China’s money system spans back more than 3,000 years, the first paper money came into being in 1948 and became the sole legal tender across the country in 1949. Conversely, the renminbi is the official name for China’s native currency.

It acts as the medium of exchange through which people settle transactions. As a medium of exchange, it allows people to participate in transactions in equal measure. Consumers can use it to purchase goods and services, conversely resulting in a marketplace. Similarly, producers know the products they ought to produce and the price that consumers will pay in the renminbi.

On the other hand, the yuan is used to denote the country’s economic and financial system. It is the unit of account through which prices are measured. As a unit of account, it is applied to services and goods, thus acting as the base value.

The legal tender shares similar attributes to the greenback, which acts as the base paper money for most commodities. The greenback is used to denote commodity prices. Similarly, the unit of account is used to denote goods and services.

The debate can be settled by simply comparing China’s paper money with the UK’s. While the official name of the Kingdom’s legal tender is pound sterling, the unit of account in which most goods and services are priced is the pound.

As the yuan is used daily in the pricing and purchasing of goods and services, so is the pound in the UK. Similarly, when people are talking about the yuan, they are simply referring to the renminbi.

The renminbi will always be the nation’s native currency, as the name ‘people’s currency’ implies. The yuan, on the other hand, is a unit of currency. However, the two are often used interchangeably, given that the country does not have two legal tenders. While the official symbol in international markets is CNY, it is common to find the currency abbreviated as RMB.

Devaluation concerns

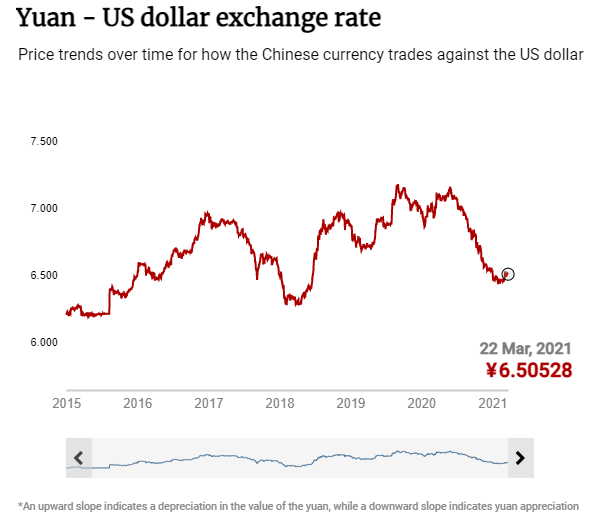

For the longest time, there have always been accusations of the communist party manipulating the exchange to favor the nation’s exchange rate. The efforts have helped the country become an exporting hub, therefore, playing a key role in international trade. Likewise, its fiat is finding increasing use given the booming export business.

Devaluation of the yuan is one of the extraordinary measures deployed to ensure the country’s exports are cheap and competitive. The depreciation has always been the subject of manipulation concerns, which has continued to weigh on the majors’ fiat sentiments.

The central bank also imposes strong capital controls as part of a monetary policy designed to limit foreign capital flow. There is always growing fear that massive capital outflows would spark a crisis on the highly controlled yuan.

In 2015, the country’s central bank sent the markets into a tailspin after carrying one of the largest devaluations. In more than 20 years, the devaluation spree in 2015 weakened the country’s money, conversely fuelling the export business from which the country makes most of its money.

Devaluation effects

Beijing is always in control of the paper money fluctuating rate, the reason why it will always play second fiddle to the dollar as a global currency. While the greenback rate freely floats in the market and changes in response to demand and supply forces, which cannot be said about the Chinese currency.

For the yuan to become a preferred global currency, there should be a lot of rebalancing in its economy. Similarly, the country’s financial markets will have to be open to the rest of the world, and the fiat moved to a more flexible exchange rate.

While the US dollar maintains a dominant position as a legal reserve tender, China is trying to crack on the monopoly. Driven by the need to control international transactions, the country has started promoting the Yuan’s use beyond its borders.

Opening up the Chinese financial markets is one of Beijing’s efforts, designed to promote the native legal tender currency use. Amid the efforts, the country’s paper money still lags and has a long way to go with the capital controls measures still in play.

A clear indication of the buck edge against China’s fiat is evident on reserve holdings. While Beijing accounts for 2% of the reserves, the US buck accounts for more than 60%, affirming its edge as a preferred means by most nations.

While the yuan accounts for about 1.9% of global payments, the dollar accounts for more than 38% of global payments affirming its status as the preferred means of finalizing transactions on the international scene.

Bottom line

China does not have two currencies. Instead, it has the renminbi, which denotes the medium of exchange, while the yuan represents the unit of account. The two names can be used interchangeably as they denote the same thing.

Leave a Reply