Redshift is a Forex EA designed specifically for Intraday Trading that promises an extremely high win rate for its trades. The vendor claims the system is based on backtesting on five different pairs, where it showed exceptional results. But of course, we can’t just go by the words of the vendor, and to assess the efficacy of this robot, we need to look into things like features, trading strategy, trading results, pricing, etc.

Detailed Forex Robot Review

Redshift does not have an official website, and it is only from the MQL5 page that we can get some information about the automated system. Here, the vendor has highlighted the various backtesting results, the recommended trading and indicator settings, pricing details, etc.

Redshift was published on 31st December 2020, by a person called Marco Solito, who is based in Italy. He has a dedicated Telegram channel and has developed systems like Dark Venus and Blueshift in the past. Apart from this, we know nothing about the developer’s background, or whether he has the required experience and credentials to develop a profitable Forex EA.

Redshift trades in the M15 timeframe and you can use it to deal in pairs like USD/JPY, AUD/USD, USD/CAD, GBP/USD, and EUR/USD. The vendor states that it is not a broker-sensitive EA, but recommends using the ECN broker and a low-latency VPN. Additionally, leverage of 1:10 or more has been recommended, along with a minimum deposit of $100.

Redshift Strategy Tests

On the MQL5 page, it is mentioned that Redshift employs a strategy based on the MACD indicator. Risky strategies like Grid and Martingale are not used, and take profits and stop losses are there for managing risk. The user has the option of changing the EMA periods for the MACD indicator from fast to slow and vice versa.

Forex traders often wish to know about the minute details of the trading strategy and they would surely be disappointed by the lack of information in this regard. By knowing the technical details of the strategy, we can better evaluate the efficiency of the system, and we hope the vendor decides to include this information in the future.

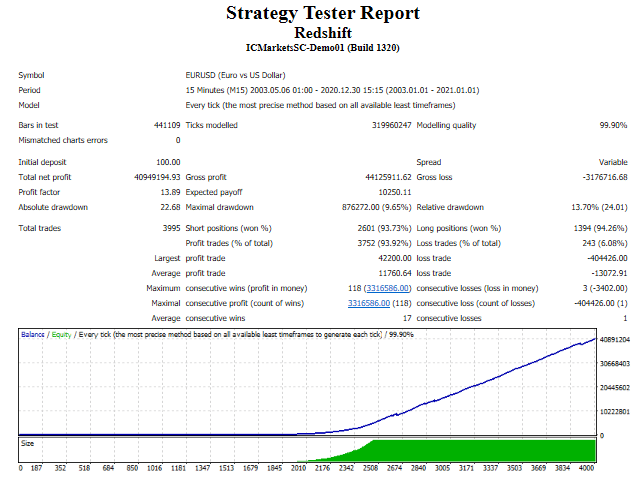

Here we have the backtesting data for the EUR/USD pair conducted from 2003 to 20211 with a 99.90% modeling quality and variable spread. An initial deposit of $100 was made for this test, and the total net profit generated through it is $40949194.93. Redshift has won 93.73% of short positions and 94.26% of long positions, with the percentage of profitable trades being 93.92%.

From the backtesting result, we can see that the system has a profit factor of 13.89, an absolute drawdown of 22.68, and a relative drawdown of 13.70% after placing 3995 trades in total. It has 118 maximum consecutive wins and 17 average consecutive wins, while the number of consecutive losses is only 1.

From what we can gather, this is an authentic backtesting result that tells us that Redshift Forex EA is a system that can generate exponential profits over time.

Live Account Trading Results

No verified live trading results are provided by the vendor on the MQL5 page, and it seems like he only reveals the results to the members of his Telegram group. We find this quite odd, however, because a legitimate system that earns you profits on a consistent basis should furnish proofs of the same. The fact that the vendor does not reveal the live trading results would make a serious Forex trader think twice before investing in the system.

Pricing

Redshift is available for $448, but you can rent it for one month at $348, and a free demo version is also available. There is an offer where if you purchase this EA and leave a feedback on the MQL5 page, you get another Forex EA, free of charge. While the offer is quite tempting, we think $448 for a newly developed system that doesn’t furnish live trading results is a bit too much.

Customer Reviews

There are no user reviews concerning Redshift on third-party websites like Forexpeacearmy or Trustpilot. Since this Forex EA has been launched quite recently, it is possible that not many people know about it yet. But the absence of customer reviews would deter most Forex traders from investing in a robot.

After going through the different aspects of the Forex EA, we have reached the conclusion that this system is not worth your money.

Although the backtesting data shows profitable results, we have no live trading result to compare it to, and we have no idea what kind of strategy the robot uses.

For an unproven system like this, a price tag of $448 is quite unreasonable and you’re better off looking for other options.

Leave a Reply