Types of brokerage models matter?

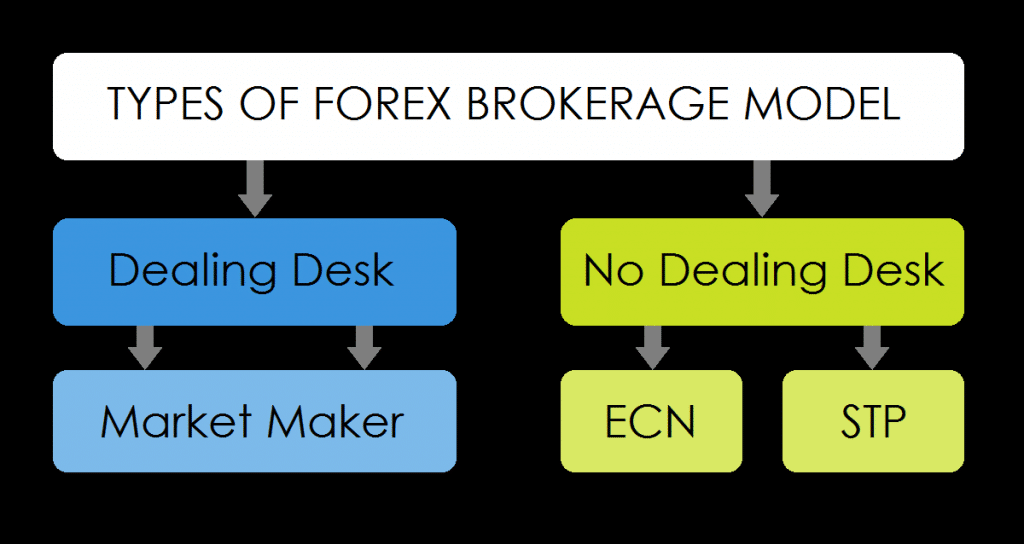

Brokers that deal with the forex markets fall under two umbrellas, brokers that send your orders to liquidity providers or the interbank market, and others that route your orders to their internal intermediary, known as a dealing desk. Being that the forex market is a decentralized market makes it very difficult for outsiders to know, beyond a reasonable doubt, about which execution model a broker honestly uses. Hence, these two so-called brokerage models are always issues of contention in the trading industry. However, there are consistent traits that are visible between the two, which provide clients with advantages and disadvantages through what a broker offers them.

ECN/STP. Simple explanation

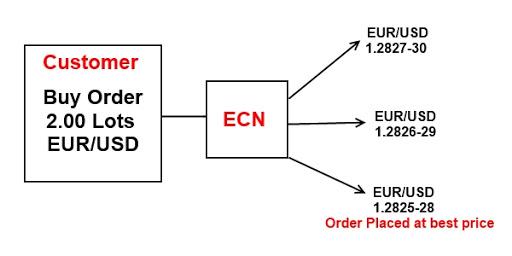

The terms that industry insiders use to describe the former are typically STP (Straight Through Processing) or NDD (No Dealing Desk) due to the practice that they route their clients ‘straight through’ to the interbank market with no middleman or manipulation. ECN and STP are terms often used interchangeably with each other (ECN/STP), where ECN (which stands for Electronic Communications Network) refers to the network of the liquidity providers.

The ECN is merely a gateway for a larger pool of these providers, wherein an STP broker may route to fewer liquidity providers or even one. Therefore, ECN/STP brokers aim to distinguish themselves as brokers that do not manipulate their client’s orders in any way and that they provide access to more liquidity providers, which results in much better execution and pricing for their clients.

The latter execution model is usually referred to as MM (market maker) or DD (dealing desk) since they route their client’s orders to their internal dealing desk. While STP brokers are ‘straight through processing’ brokers, they may just be routing their orders to another brokerage, which they could own rather than the known external liquidity providers. Another point to note is many brokers can alter their products or services between both execution styles to offer different types of accounts.

Pros and cons of ECN/STP brokers

Pros:

- Competitive spreads and lower trading costs overall.

- They allow all types of strategies (including hedging and scalping) and allow EAs (expert advisors/robots/automated trading).

- Deeper liquidity as ECN brokers can connect to multiple liquidity providers, which means better market execution and access to the most accurate forex prices.

- Fewer chances of dealing desk manipulation/conflict of interest. Many of these brokers are also transparent about slippage and requote statistics, as well as the data centers they utilize.

Cons:

- If spreads are floating, they can widen dramatically during periods of high volatility or low liquidity.

- Usually, higher capital requirements.

Overall, ECN/STP brokers offer far more superior advantages compared to their counterparts. The majority of well-known and regulated brokers fall under this tier. Essentially, they are user-friendly both for new and experienced traders as they offer more flexible services that are beneficial for everyone, such as higher leverage and allowing for all trading strategies. The biggest attraction for these brokers is their competitive spreads.

Brokers place a lot of emphasis on low spreads because they are the main cost traders face consistently, aside from any swaps and possible commissions. Lower spreads are particularly crucial for scalpers or traders that trade frequently. These kinds of traders would not benefit from a market maker broker that tends to have higher spreads to compensate for not providing access to a wide range of liquidity providers.

Pro and cons of MM brokers

Pros:

- Most MM brokers offer GSLOs (guaranteed stop loss orders). This type of order, which is usually paid for if triggered, ensures that what the trader would lose remains unchanged regardless of market conditions.

- They typically offer fixed commissions/spreads. In this manner, traders know the consistent cost per trade. Albeit, these can be a little more than with ECN/STP brokers.

- Usually, lower capital requirements.

Cons:

- Due to having a dealing desk, there is a perception of a conflict of interest where such brokers are thought to manipulate the price or their client’s orders

- Most market maker/dealing brokers typically do not use an accessible and well-known platform such as MetaTrader 4 as their primary trading platform.

- Nearly all market maker brokers do not allow scalping, hedging and EAs (expert advisors/robots, automated trading), which means they are not flexible for all trading styles.

Generally, MM brokers are suitable for more experienced traders who may be looking for a particular feature they cannot get with other brokerage firms. These features may include fixed spreads/costs and GSLOs. The biggest complaint with these brokers in the industry is their conflict of interest where practices such as requotes and stop hunting have become somewhat of their staple.

They are essentially buying from traders who are selling and selling from traders who are buying. It is still a very debated issue as to whether they individually manipulate a client’s orders. However, provided they are regulated, being a market maker broker is entirely legal, and many reputable brokers still exist as such.

Conclusion

So, does it matter if a broker is a market maker or not? Technically speaking, yes, but in a more straightforward and practical sense, it all depends on the type of client, their experience, and their trading style. There are other important considerations, such as a broker’s regulation, reputation, and trading costs. Much of these considerations eliminate any of the common malpractices that may persist.

Unfortunately for retail clients, the forex industry has several layers to it, and we only see the action on a surface level. So, while it’s impossible to know where an individual broker fits between the two strands, there are particular characteristics to note that can give one a calculated conclusion and to assess the advantages and disadvantages of each model.

Leave a Reply