Prop Firm EA is a trading advisor that was released not so far ago. The presentation doesn’t look trustworthy and well-explained. We have to ask the devs to get proper explanations.

Detailed Prop Firm EA review

The system has a short presentation. We had to come up with many to write it well.

- The advisor executes orders for us automatically.

- It was released just a month and half ago on August 01, 2021.

- We can work on the account with quite low drawdowns.

- Expected monthly profitability is from 10% to 20%.

- “Prop Firm EA is compatible with funding firms such as FTMO, MY FOREX FUNDS, etc.”

- “After successfully passing the challenge, you will generally be awarded with an account funded up to $200,000 and your earnings on the account will be shared with a profit split between the firm and the individual.”

- The advisor has a news filter implemented. So, we can skip trading during high impact news periods.

- We can trade all available on the terminal pairs.

- The drawdowns should be lower than 5%.

- It doesn’t use Martingale to recover.

- It uses a “top-bottom reverse trading strategy along with grid, internal smart indicator signals and news filter as its trading strategy.”

- We don’t know why they wrote this: “2k, 5k, 10k, 50k, 100k and 200k USD accounts.” It makes no sense.

- It requires $2000 for trading with 0.01 lot sizes.

- The system doesn’t keep orders over the weekend.

Prop Firm EA strategy tests

We have no backtest reports provided at all. It’s a huge con because we cannot predict how the system will work on our account and what win rate and drawdowns are normal for this advisor.

Prop Firm EA live trading results

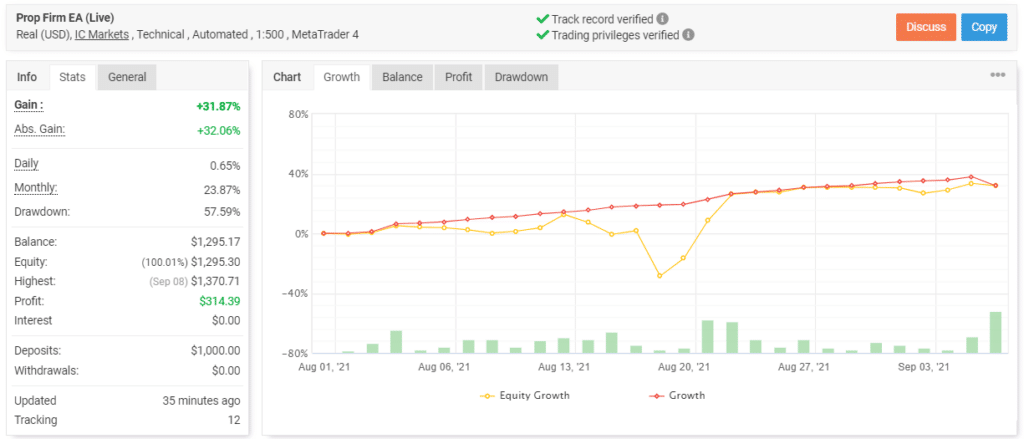

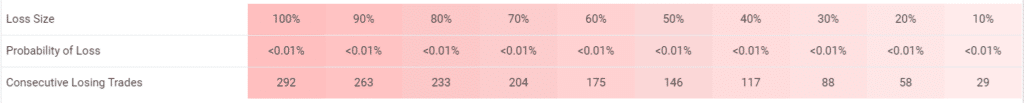

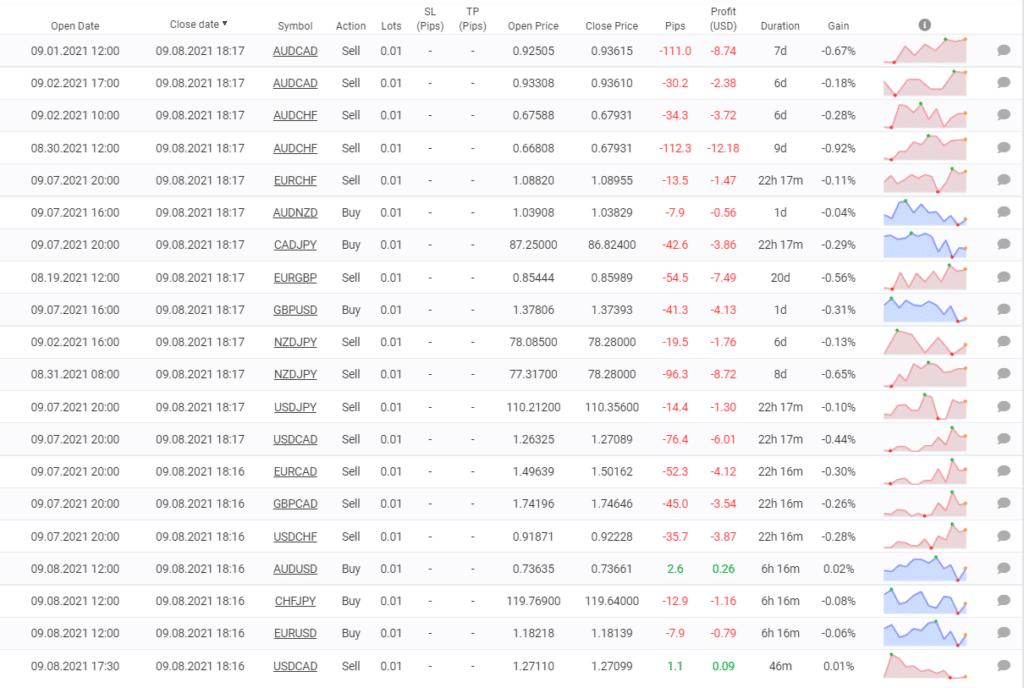

We are sure that the most important part of the system is its trading results. Only present trading activities can show in the best way what we can expect from the robot in the nearest future. The system works on a real USD account on IC Markets automatically with 1:500 leverage on MT4. The account has a verified track record. It was created on August 01, 2021, and deposited at $1,000. Since then, the absolute gain has become 31.87%. An average monthly profit is 23.87%. The maximum drawdown is sky-high – 57.59%. These numbers don’t match the claims of the developers.

The robot has traded 236 deals with 5294.9 pips traded. An average win is 57.72 pips when an average loss is -68.44 pips. The accuracy is okay. For longs, it is 71% while for shorts, it is 72%. An average trade length is three days. The profit factor is 2.07 pips.

It has lost just a single cross pair – AUDCAD with -$1.20.

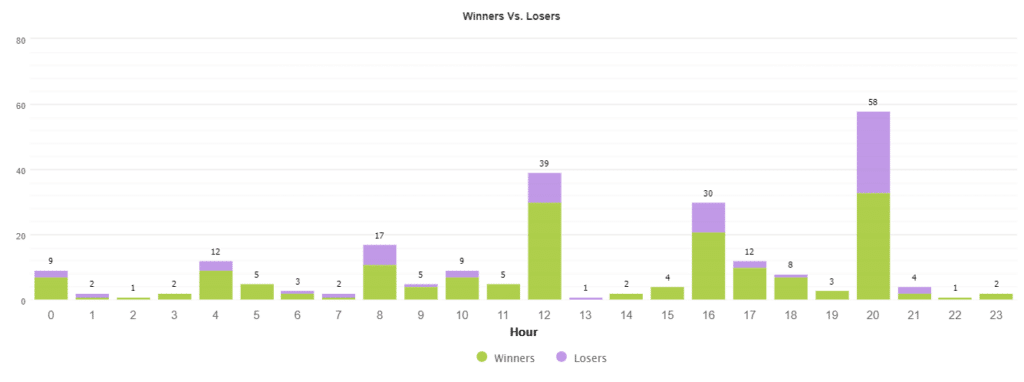

The advisor opens orders during high-impact news during European and American sessions mostly.

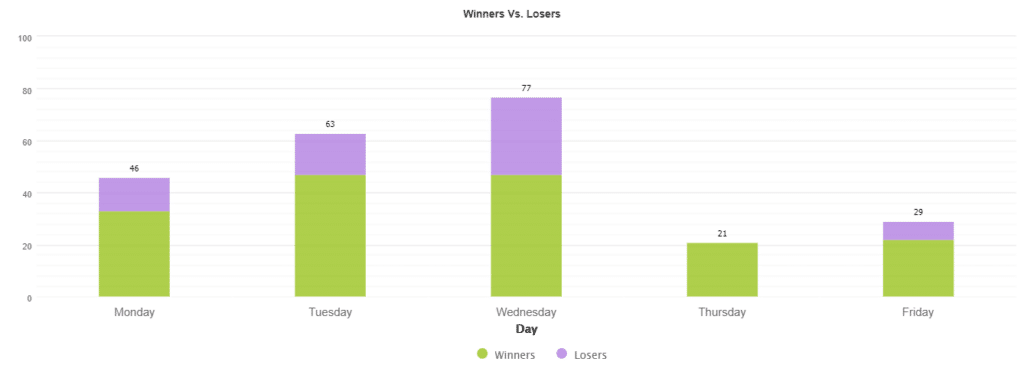

The system trades at the beginning of the week not to keep orders over the weekend.

The system works with medium risks to the balance.

We may note that there were many orders lost in a row.

We’ve got the mid of September and, as you can see, there are losses instead of profits.

Pricing

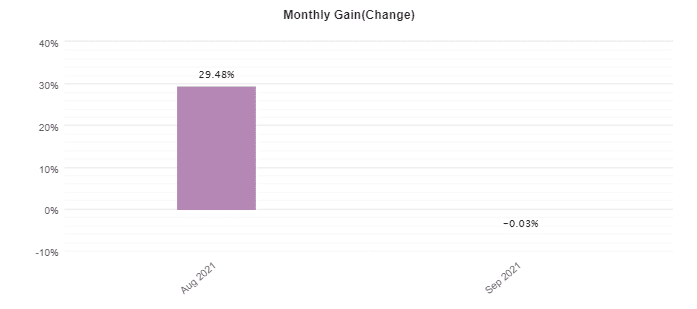

The offer came back from being not active. The annual license costs $588. We can enjoy a short-term refund of 14 days. It’s not enough to test the system properly.

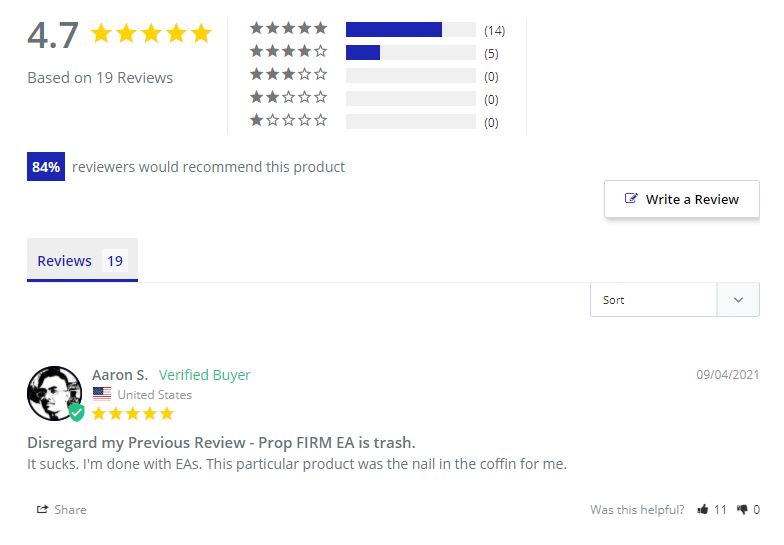

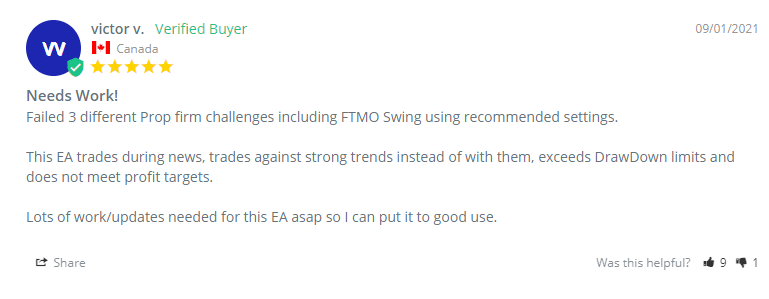

Customer reviews

Even five-starred comments mentioned that the system is a scam as it is. So, the advisor must be updated.

Prop Firm EA is an expert advisor that is based on a Grid of orders. The system doesn’t work stable on the real account. The presentation is short. Clients aren’t happy with the current state of affairs. The system is almost a scam.

Leave a Reply