- The US dollar is under pressure at the start of the week and ahead of a key policy meeting of the Federal Reserve.

- The euro is strengthening across the board, gaining ground against the dollar and the pound supported by impressive economic data.

- Gold is struggling to break above the $1,800 level after recent price gains despite dollar weakness.

The US dollar is on the back foot at the start of the week. A key policy meeting by the Federal Reserve, later in the week, could have a significant impact on the greenback sentiments.

The Federal Reserve chair will again be in the spotlight and could face questions about whether improving the labor market and rising coronavirus vaccinations warrant monetary easing. His remarks could significantly impact the yields, which have been under pressure in recent weeks and are expected to have a significant impact on the greenback.

On the other hand, the euro is on the front foot, having risen to two-month highs against the dollar the past week. The common currency has been supported well by improving economic data, with data from German expected to show improving business sentiment later in the week.

While the New Zealand and Australian dollar did rally to one-month highs, they are likely to track moves in the commodity marketplace. Deteriorating relations between Turkey and the US could continue to pile pressure on the Turkish Lira as the week progresses.

Aussie strength

The AUD/USD is on the front foot at the start of the week, rising to highs of 0.77. Aussie users are increasingly attacking key resistance levels taking advantage of US dollar weakness.

Having already breached the 0.7760 resistance levels, the pair might as well be headed to 0.781, the next key resistance level standing in the way of further upside action. A rally followed by a close above the next resistance level should pave the way for the AUD/USD pair to make a run for the 0.8000 handle.

Pound weakness

The British pound, on the other hand, remains under pressure against the Japanese yen. After initially bouncing off one-month lows on upbeat PMIs and solid British Retail Sales, the GBP/JPY is again under pressure at the start of the week. The corrective phase did not last long.

The pound is under pressure amid rising tensions between the European Union and the UK over the Northern Ireland protocol issues. Immediate reports indicate the UK is under pressure to align its food standards with EU food and safety.

In return, the EU promises to ease import and export checks between the UK and Northern Ireland. Amid the EU standoff, the British pound remains under pressure against the yen, with the GBP/JPY struggling to bounce off one-month lows.

After initially plunging below the 150 level, the GBP/JPY faces immediate resistance at the 149.90 level, a breach of which is needed if the pair is to bottom out and continue powering high.

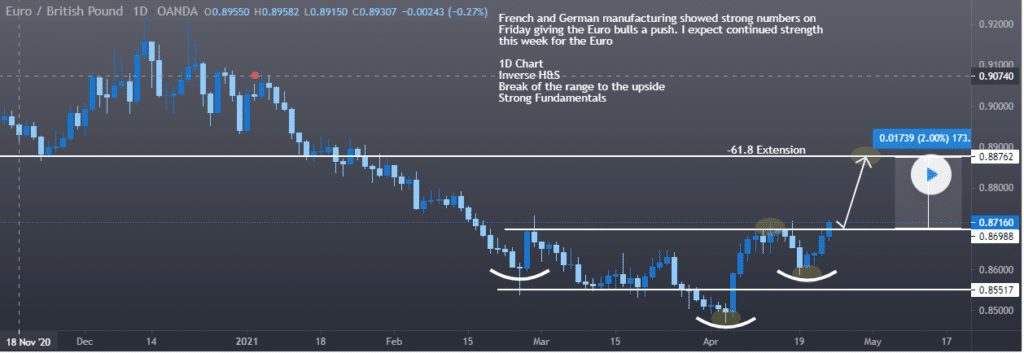

Euro-pound rally

The Euro pound exchange rate is another one climbing high, taking advantage of weakness in the sterling. The euro strengthened as the week came to a close last week on impressive Eurozone PMIs, showing improving economic activities pointing towards an optimistic outlook.

After bottoming out of the 0.8610 level, the pair has continued to edge higher, with traders pushing it higher on euro strength. The pair has since risen to two-week highs of 0.8700 level and showing signs of taking out the 0.8720 resistance level.

A breach of the resistance level should pave the way for the pair to make a run for the 0.879 resistance level. A plethora of economic data from the Eurozone could increasingly sway trader’s sentiments on the common currency. The UK economic calendar is lighter this week, with the focus expected to be on the Eurozone.

Gold eyeing $1,800

Gold is struggling to take out the $1,800 an ounce level after recent spikes. After two trials the past week, the precious metal has corrected lower, with $1,798 emerging as the immediate resistance level.

However, the metal remains bullish amid yields and dollar weakness. The $1,781 handle has emerged as the immediate support level supporting further upside action.

Leave a Reply