- Western Canada is expected to increase natural gas production by 58% by 2030.

- Europe’s TTF gas prices may rise by $3/ MMBtu.

- China’s demand for natural gas from gas-fired plants may soar by 8.6% in 2021.

Natural gas futures traded at a +1.81% change on May 31, 2021, at 3.040 from a previous close of 2.986 from a 10,000 MMBtu contract size.

In the week ended on May 28, 2021, the Energy Information Administration (EIA) indicated that the storage for natural gas had increased by 115 billion cubic feet.

In the next EIA release slated for June 3, 2021, we expect the storage levels to decline and surpass previous estimates at 104 billion cubic feet. As of June 1, 2021, the gas futures stood at $3.074 (+1.12%).

Natural gas futures for July 2021

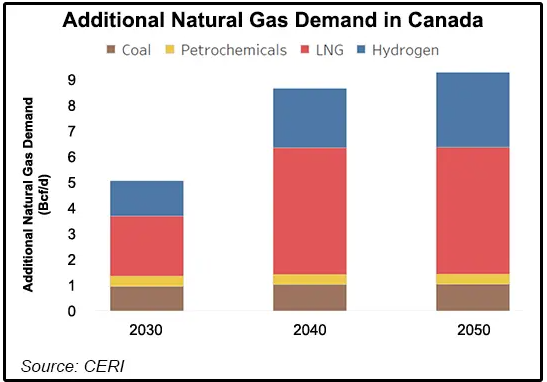

Natural gas production growth in major producing areas such as Canada is likely to be driven by increased exports. According to research, natural gas can be blended with hydrogen to be used as a demand substitute for the new generation of fossil fuels.

In North America, natural gas has posted the strongest growth among fossil fuels due to increased population and clean energy demand. Western Canada, currently 16 billion cubic feet per day (Bcf/d), is expected to increase by 9.2 Bcf/d (+58%) in the next decade.

Projected demand for Natural gas and other fuels from 2030-2050

Azerbaijan that realized the Trans-Adriatic Pipeline (TAP) project towards the end of 2020 increased its natural gas export to Europe in the first quarter of 2021 (January-April) by close to 79.5%. The country has a proven natural gas reserve of 2.8 trillion cubic meters indicating that it is a strategic supplier of the commodity to the European market.

Europe supporting gas price hikes

Europe has sustained the switch from coal to natural gas propping gas prices, especially title transfer facility (TTF) gas by $3/ MMBtu. A tightening gas market has also resulted from supply concerns in Russia due to the cold season and the rush to the recovery of post-pandemic demand.

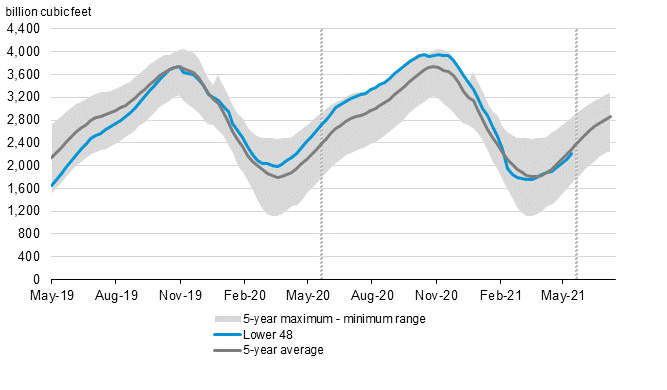

Comparison of the working gas stored underground with the 5-year maximum-minimum range

In the week ending on May 21, 2021, the amount of working gas in storage (WGS) was 2,215 Bcf. It represented a net change of +115 Bcf from the previous week.

However, natural gas stocks declined by 381 Bcf year-on-year and 63 Bcf less than the 5-year average that stood at 2,278 Bcf. This change indicates increased uptake of natural gas in the five years.

Demand recovery in 2021

The demand for natural gas globally is expected to recover in 2021 after dropping 4% in the pandemic year of 2020. While growth estimates between 2019-2025 declined by 75 billion cubic meters (bcm) due to the pandemic, it is expected that natural gas annual growth production may average at 1.5%.

In the US, a gallon of natural gas costs $3.04 as of May 31, 2021- indicating an increase of 58% year-on-year. Restrictions in 2020 caused gas prices to average at $2 per gallon due to large inventories.

US gas prices rally towards a 7-year high, with the national price expected to reach $4.17 a gallon. Prices are expected to soar in June 2021 due to the rush from vacation hotspots.

In China, power plants fired by natural gas are expected to have a strong demand due to the 6% GDP target in 2021 compared to the 2.3% growth in 2020. In Q1 2021, China’s total consumption of power surged 21.2% (year-on-year).

The growth was attributed to increased industrial production at 24.1%. The power plants will reach full utilization in 2021 as they balance the peak demand and the caps to carbon emissions.

China’s demand for natural gas from the gas plants may soar by 8.6% in 2021 (up 0.9%) from the 7.7% growth in 2020. Of the total gas demand in China, consumption from power generation plants in 2020 stood at 17.5%. Increased consumption is expected in 2021 since the country has increased its installed capacity to 8 GW.

Leave a Reply