Traders, as well as forex robots, deploy a wide array of strategies to trade and squeeze profits from the capital markets. Position trading and swing trading are some of the most popular trading strategies that allow traders and Forex Expert Advisors to take advantage of various scenarios within the broader financial markets.

Understanding Swing trading

Swing trading is a common trading strategy that sees traders as well as FX EA open positions in the capital markets and closes them within a matter of days. It is a short-term trading strategy, which takes advantage of short-term price movements upon an analysis of various chart patterns.

However, it differs from scalping, which sees traders open and exit position in a matter of minutes or hours. Also, swing trading differs from trend trading as a trader or Forex EA can disregard the underlying trend and take a trade in the opposite direction.

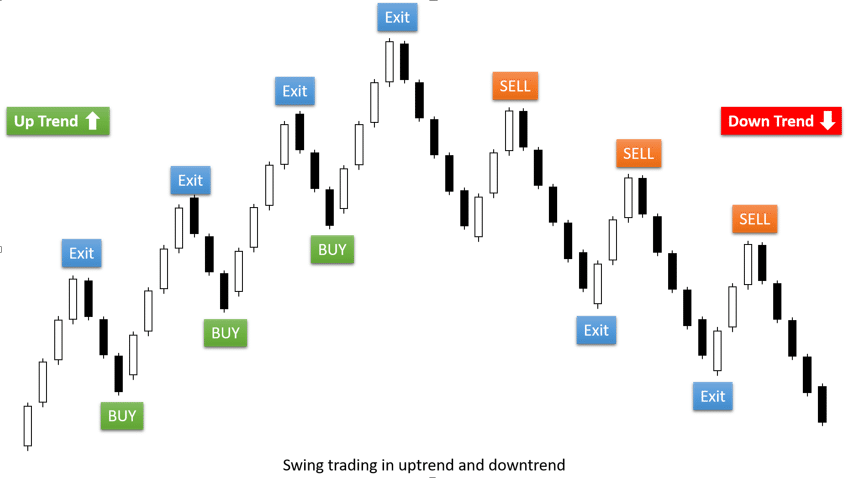

Swing traders, as well as forex trading instruments, seek to take advantage of peaks and troughs to ascertain entry and exit points. The information is often used to predict future price action that traders and FX EA use to generate profits.

Swing trading is an effective trading strategy whenever the market is range-bound and not trending. In such situations, price tends to rise and fall, following well-defined chart patterns. As soon as the market starts to trend, on the upside or downside, the strategy becomes less effective, given the wild swings that accompany such movements.

Likewise, swing traders, as well as tools used in automated trading, capitalize on buying and selling in the interim lows and highs. In this case, traders, as well as Algorithmic FX trading tools, strive to buy at support levels and sell at resistance levels. Similarly, traders take advantage of bounce-backs at moving average to open positions.

Technical analysis is at the heart of swing trading as traders look to identify specific chart patterns to open and close positions. Similarly, some of the best forex indicators for determining whether the market is range-bound for effective swing trading include RSI and Stochastic that shed more light on momentum as well as Fibonacci Retracement.

Swing Trading Advantages

- Swing trading exposes traders to more trading opportunities compared to position trading

- Insulates traders from long term trend reversals as positions are closed faster

Swing Trading Disadvantages

- Reliant on technical indicators to predict troughs and peaks in price action

- A riskier trading strategy as it shrugs off fundamental analysis

- Holding trades overnight exposes traders to significant risks compared to scalping

- Traders don’t benefit from big trends as trading is limited to short term price patterns

Understanding Position Trading

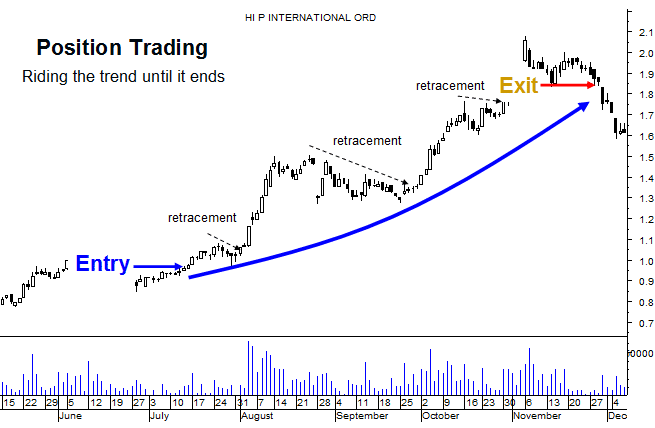

Position trading is an ideal trading strategy for investors focused on long-term returns. Unlike swing trading or scalping, position traders hold trades for months and sometimes for years. Likewise, the trading strategy seeks to take advantage of trending markets as traders, as well as Forex charting tools, pay more attention to daily and monthly chart patterns.

While position traders are more concerned with long term outcomes, they deploy various strategies using technical indicators to ascertain long-term trends. Similarly, the trading strategy pays close watch to strategy using fundamental analysis.

The fact that position traders are more concerned with long-term outcomes means their trading decisions are never affected by daily price movements or short-term market corrections. The trading strategy sees traders allow positions to fluctuate while coordinated with the long-term market trend.

In addition to making good use of technical analysis, position traders rely on fundamental analysis to map out long-term investment opportunities. As one of the most critical forex trading secrets, in position trading focus is usually on long-term price trends. Technical analysis tools, on the other hand, are used to map out ideal entry and exit points.

As essential money-making hacks, it is vital to trade assets that have a strong trending potential but yet to start trending in position trading. Similarly, one can trade assets that have begun trending and are likely to hold a given trend for long.

Position Trading Advantages

- Traders do not need to monitor positions, as it is a long-term investment strategy

- The trading strategy is synonymous with reduced stress levels, as short-term price fluctuations do not mean a thing

- Less risky trading strategy compared to swing trading or scalping

Disadvantages

- Requires a substantial amount of capital to insulate against short-term price fluctuation

- Position trading requires a solid understanding of market fundamentals

- Reduced number of trades can lead to lower profits over a long period.

Conclusion

The type of strategy that one gets to deploy should always come down to short term and long term goals. For people looking to build towards retirement years, then position trading would be an ideal trading strategy. Swing trading, on the other hand, is an ideal trading strategy for traders in need of a consistent stream of income given the increased chances of gains on more trades opened and closed.

Leave a Reply