Founded in 2010, Pepperstone is a Melbourne-based Australian online trading broker, with global offices in both Dallas as well as London. It has an impressive collection of more than 80 instruments in categories such as Cryptocurrencies, stocks, shares, indices, commodities, forex, metals, energies, Bonds, ETFs, and CFDs.

Regarded as one of the largest trading brokers of its type, it provides online trading services to more than 65 countries and processes $8.3 billion of trades on a daily basis (average). It has won numerous accolades for forex broker excellence, innovative technology, and customer support.

Pepperstone is one of the few brokers which incorporates an “execution only” trading model, ensuring direct access to a deep pool of liquidity providers. This ensures that the broker can offer the lowest possible spreads along with fast execution for all types of traders. The team behind Pepperstone has immense experience within the industry and can thus recognise the needs of retail traders.

Regulation:

Pepperstone is under the parent company Pepperstone Limited (UK), an authorised and regulated company under the Financial Conduct Authority (FCA). Additionally, in Australia, Pepperstone Group Limited is regulated and authorised by the Australian Securities and Investment Commission or ASIC. Pepperstone prioritises the safety of their client’s funds and thus hold these funds in segregated bank accounts.

It should be noted that Pepperstone does not accept clients from the United States, Canada, Japan, Iraq, Iran, Yemen, Zimbabwe and some other nations due to legal restrictions.

Some key features of this platform include

- Social Trading/CopyTrading via ZuluTrade

- Low cost Spreads

- Low latency high speed execution

- Negative Balance Protection

- Vast Selection of Trading tools and educational resources

- Auto-Chartist

What types of account are offered?

Pepperstone caters to the individual needs of traders and thus provide different types of trading accounts to its users. All the accounts are offered within margin limits and retail trading leverage. Under FCA regulations, leverage for accounts is 1:30. However, qualified professional clients can apply in order to trade with higher leverage.

Users have a choice between opening a commission-free account with variable spreads starting from 1 pip and a commission-based accounts with spreads starting from 0 pips. However, this account also charges a $3.5 commission fee. Apart from real accounts, Pepperstone also offers users a choice of opening a 30-day demo account to test the platform.

The variable spreads for the different types of accounts are given below.

- Edge Standard Account: Variable spreads from 1.0 pips

- Razor Account: Variable spreads from 0.0 pips.

- Edge Active Traders: Variable Spreads from 0.0 pips (rebate of 10%+)

- Edge Swap Free: Variable Spreads from 1.0 pips

Typically, the Standard account has higher spreads with an average of 1 to 1.3 pips, while the Razor Account has lower spreads with an average of 0 to 0.3 pips.

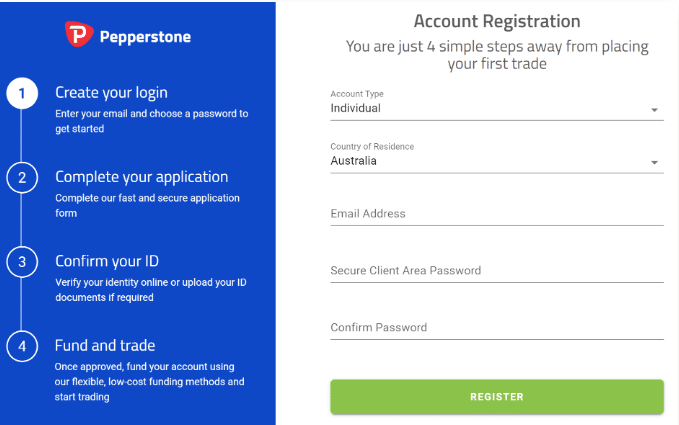

How to Open an Account at Pepperstone?

Opening an account at Pepperstone is seamless, quick, and user-friendly. The required minimum deposit is $0. Users have an options choosing either a Standard or a Razor account, both of which differ in their respective pricing structure.

Users can open accounts through the official Pepperstone website. The online application usually takes anywhere between ten to fifteen minutes. Accounts are typically approved within one to three business days. Users can click on the “open live account” located on the upper-right hand side of the official website to get started.

Steps to follow:

- Users need to first register their email address and password. After confirming their password, they can proceed to the “Secure Client Area”.

- Some personal information is required to be filled in, after which the user can set the base currency of their account.

- Users are then required to complete a trading expertise survey before moving forward.

- Finally, they have to upload a copy of their national ID/passport and a proof of address such as a utility bill.

Users facing any problems or having any queries regarding the process can reach out to their customer care staff via live chat or email.

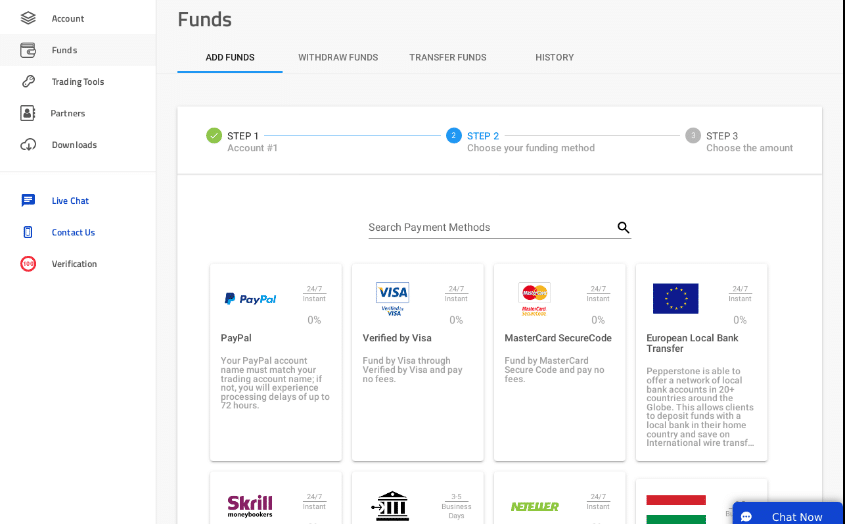

Money Management

Pepperstone offers users several convenient and user-friendly methods for depositing and withdrawing. This includes Bank transfers, Credit or Debit Cards and a range of payment processors such as PayPal, Neteller, POLI, Skrill, UnionPay, and BPay. Users have the option of opening accounts in any one of 10 base currencies, namely USD, EUR, GBP, CHF, NZD, JPY, CAD, HKD, SGD and AUD. This is great for users who want to avoid high currency conversion fees.

Payment with a credit or debit card is instantaneously processed. However, a bank transfer can take several business days. Also, at Pepperstone, a user can only deposit money from accounts that are in the specific name.

Withdrawal Fees and Options

Users can withdraw their money from Pepperstone free of charge if they use debit or credit cards or electronic wallets with the exception of Neteller and Skrill. Bank transfers for customers in the European Union and Australia are free as well. However, $20 charge is applicable for clients in other countries. Withdrawals using Neteller and Skrill have a $1 fee.

Withdrawing Money from Pepperstone

Users can withdraw money from their Pepperstone accounts by following some simple steps, mentioned below.

- Users should first login to their Pepperstone account.

- They can then navigate to the left hand side of the page and click on the “Funds” tab on the menu.

- They are then instructed to click on “withdraw funds” after which they are required to choose a withdrawal method.

- After completing the above step, users should proceed to select the account they want to withdraw from and enter the desired amount.

- Finally, users can click on the right arrow found on the right side of the panel to go to the next step and finish their request.

Commissions, fees, and charges

When it comes to fees, Pepperstone charges low fees for both forex and equity index. There are no inactivity fee or account fee associated with a Pepperstone account, and other non-trading fees are low as well. However, on the flipside, the fees for holding CFD positions overnight, are quite high.

Trading Fees

There are different trading fees associated with the standard and the Razor account. To better calculate the fees for the purpose of this review, The Razor has been tested on the MT4 platform, which also charges a commission. Also for the examples presented below, a $20000 position is chosen for forex while a $2000 position has been chosen for stock index and stock CFD transactions. The leverage used for forex and the stock index CFDS are 30:1 and 20:1 respectively.

Fees for Forex Trading

The fees associated with Forex in Pepperstone is comparatively low as compared with other online brokers and trading platform. In a $20000 long position with applied leverage of 30:1, the forex benchmark fees for the different currency pairs are as follow:

- EUR/CHF: $3.7

- EUR/GBP: $10.6

- AUD/USD: $11.9

- GBP/USD: $12.5

- EUR/USD: $14.9

Fees are included in the commissions and spreads. Commissions usually depend on the trading platform chosen by the user. For instance, the commission for opening and closing a $100,000 position are given below.

- For cTrader: $7

- For MetaTrader 4: $7.53

- For MetaTrader 5: $7

Fees for CFD Trading

When it comes to CFD trading, Pepperstone has a low fee structure compared to many of its peers. The fees for two CFDs, each for a $2000 long position held for one week are as follows.

- Europe 50 Index CFD fee: $1.6

- S&P 500 Index CFD fee: $2.0

Non-Trading Fees

Pepperstone does not charge any additional account fees or inactivity fees. Withdrawals are free for credit and debit cards as well as for some electronic wallets. However, there is a $20 charge for bank transfer withdrawals for users outside of the EU and Australia.

Available Markets

Originally starting put as a forex broker with interbank execution, Pepperstone has since expanded to include other trading instruments such as Cryptocurrencies, Commodities, Stocks, Shares, metals, indices, Energies, CFDs, Bonds and ETFs. They strive to maintain the lowest possible trading costs across all these markets.

One thing to be noted is that Pepperstone doesn’t allow users to change leverage levels. This is considered a drawback, as changing leverage manually can allow users to lower the risk of their own trade.

Forex Trading

Pepperstone offers a total of 80 currency pairs which are a mix of major, minor, cross and exotic currency pairs. Some of the currency pairs include the following:

- Major Currencies Pairs: 6 (Examples: AUD/USD, EUR/USD, GBP/USD, USD/CHF, USD/CAD, USD/JPY)

- Minor Currency Pairs: 10 (Examples: AUD/CAD, GBP/AUD, AUD/CHF, GBP/CHF, AUD/NZD, NZD/USD)

- Cross Currency Pairs: 11(Examples: AUD/JPY, GBP/CAD, CAD/CHF, GBP/JPY, CAD/JPY, GBP/NZD

- Exotic Currency Pairs: 31(Examples: CHF/SGD, EUR/ZAR, NZD/CAD, USD/NOK, USD/ZAR, EUR/CZK)

Metals

PepperStone offers 7 markets to trade metals such as Silver and Gold. They provide markets such as XAG/USD, XAG/EUR, XAU/USD, XAU/EUR, XAU/AUD, XPD/USD and XPT/USD

Energies

PepperStone offers three energy markets for users to trade. These include XTI/USD, XBR/USD and XNG/USD

CFD Trading

Pepperstone offers both Future CFDS as well as Index CFDs to trade with. This includes JPN225, AUS200, US500, US30, UK100, NAS100, GER30, EUSTX50, FRA40, SPA35, IT40, US2000, HK50, CN50 and USDX.

Cryptocurrency Trading

Pepperstone offers Cryptocurrency trading to its users with leverage of up to 5:1. There are no commission fees with the ability to hedge on a single account. They offer a total of 5 cryptocurrency derivative products, namely, Bitcoin(BTC), Bitcoin Cash(BCH), Dash(DASH), Litecoin(LTC) and Ethereum(ETH).

Trading Platform and Features

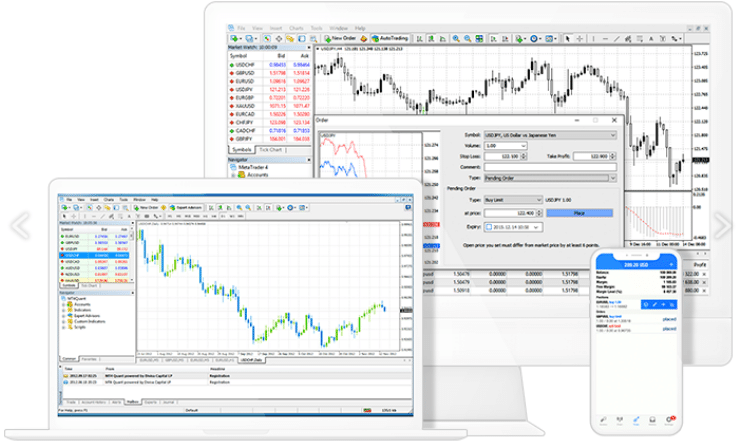

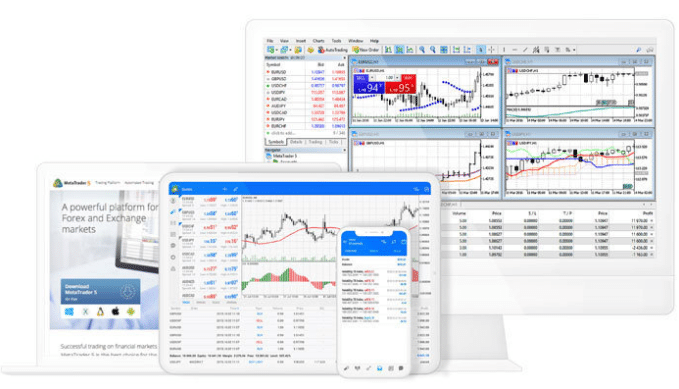

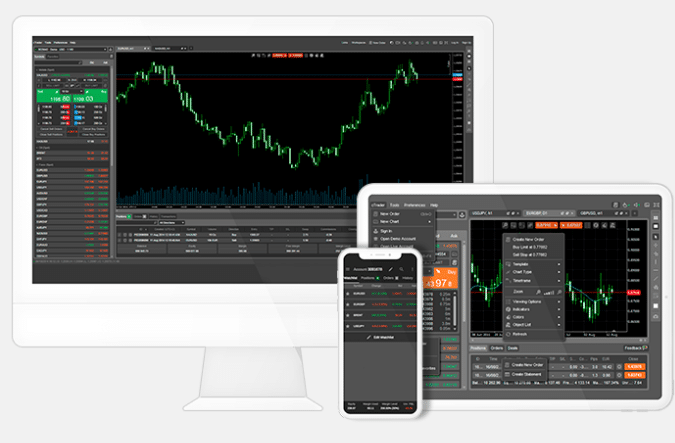

Pepperstone offers a total of 11 online trading platforms and tools to choose from. Including the very popular MetaTrader 4, cTrader, WebTrader as well as their respective mobile apps for both iPhone and Android. Besides this, Pepperstone also provides copytrading/social trading, through some of its partners. We shall now discuss each, one by one.

- MetaTrader 4: Arguably one of the topmost used trading platforms in the world with millions of users, MetaTrader 4 is supported by Pepperstone. Developed by Russian software company MetaQuotes, it is known for providing an array of implemented trading tools and technical indicators, all inside a comprehensive, intuitive, user-friendly interface. Using MetaTrader4 can allow users the following functions and capabilities.

- Users can customize MT4 charts and indicators according to their preference.

- They can develop and run automated trading systems also known as Expert Advisors.

- They have access to a wide range of technical indicators as well as EAs with smart tools.

- The Autochartist analysis software helps identify high probability trades.

- Users can access Historical data

- It also provides Social/Copy Trading functionality.

- MetaTrader 5: MetaTrader 5 is the latest instalment in the MetaTrader series. It retains many of the important features present in MetaTrader 4, along with some added features and functions. Some features of the MT5 trading platform are given below.

- MT5 has similar features to MT4, but with more timeframes, indicators and charts.

- It has customizable charting facilities and indicators.

- It has depth of market and offers additional order types.

- It supports code custom indicators and multi-currency EAs.

- Faster processing fees.

Both MT4 and MT5 also provide mobile versions for their app for both Android and iOS devices.

- cTrader: cTrader is another professional grade online trading platform which offers an intuitive platform design. With cTrader, users can control slippage and order fills, access FIX API, code in C# programming language using cTrader Automate, and adjust session times.

CTrader also provides cloud-hosted profiles, along with a useful mobile app.

Other Trading Tools

Apart from the world-class trading platforms provided above, Pepperstone also offers a great selection of advanced trading tools to help them manage their trading risk, stay up-to-date with market movements and improve their trading strategies. Some of these are mentioned below

- Smart Trader Tools: Both MetaTrader 4 or MetaTrader 5 provide a total of 28 tools, indicators and expert advisors for use.

- API Trading: Pepperstone provides API Trading facilities to their users. This allows a user to access industry leading liquidity fee directly from the platform. This is great for users who want to implement their own customised trading solutions.

- Autochartist: Autochartist is Pepperstone’s Technical analysis software which is provided to users free of charge. It has the ability to scan selected markets continuously for finding potential trade setups. Autochartist is a great way to remove market noise, enabling traders to focus solely on trade opportunities.

Autochartist comes equipped with a built in pattern recognition tool that alerts users when trading opportunities have been identified. This can only be filtered by probability based on historic success. Subscribers also receive market reports daily, covering market analysis and economic news releases.

Mobile Trading

Both MetaTrader 4 and MetaTrader 5 come with their respective mobile App, available for Android and iOS devices on their respective app stores.

- MetaTrader 4 Mobile: MetaTrader 4 mobile platform comes equipped with almost all the features in the regular App. It provides real-time market quotes, several types of trade executions, a set of trade orders including pending orders, and a detailed online history.

- MetaTrader 5 Mobile App: MetaTrader 5 ‘s mobile app comes with the advanced features present on the original MT5 app. It allows users to receive stock prices and currency quotes., analyse financial markets and view trading history, from the comfort of their mobile devices. It is a great app for trading on the go, no matter where one is.

Social Trading

Pepperstone works with several notable partners to offer copy trading facilities to its users. Copy trading allows users to copytrading signals from other strategy providers and implement them in their own trades.

It provides an automated trading solution, allowing users to specify their own risks and choose strategies which suit their own style. Pepperstone works with the likes of ZuluTrade, myfxbook, DupliTrade and Mirror Trader to provide social/copy trading facilities. Additionally, both cTrader and MetaTrader have copy trading functions.

ZuluTrade is a well-known social trading platform which works with several reputed brokers in the industry including Pepperstone. It allows Pepperstone users to copy trades directly into their trading account from existing ZuluTrade users running their own strategies on the platform.

- Myfxbook: Myfxbook is an account mirroring service, allowing users to copy trades without the need of running any software. Users can create their own portfolios without any fee requirements.

- MirrorTrader: MirrorTrader is one of the most renowned marketplaces where users can trade and evaluate more than 3000 global, tested and verified algos. Users can control their account by adding or removing algos at any time. Profit and loss targets can also be set to each algo.

- DupliTrade: DupliTrade is a marketplace for trading strategies which allow users to automate their trading. They have a collection of signals from proprietary traders which users can implement on their own trades.

- MetaTrader Signals: MetaTrader Signals allows users to access a multitude of strategies from MetaTrader’s social platform. Signals can directly be copied to the user’s Pepperstone account.

Research

- Economic Calendar: Pepperstone provides an economic calendar which is helpful for users to keep up with the latest financial news events along with the forecasted impact they can have on the market. It’s a pretty useful tool that can often be used as part of fundamental analysis.

- Webinars: Free Webinars are a great way for beginner and novice traders to learn how to trade and to improve their trading. Pepperstone provides webinars from experts as well as an archive where traders can catch up on previous sessions. It covers a range of topics including trading basics, trade management and trading strategies.

- Market Analysis: Pepperstone’s global market analyst’s team provide traders with expert commentary, videos, and high impact economic event coverage. It provides a great space where users can be aware of major world financial events, which have affect market volatility by a great deal.

Education

- Trading Guides: Educational resources such as guides can serve as a perfect tool to dispel any misconceptions or confusions that a beginner trader might have. Pepperstone provides a large catalogue of free trading guides which are regularly updated. It covers diverse topics including trade analysis, money management and trade planning.

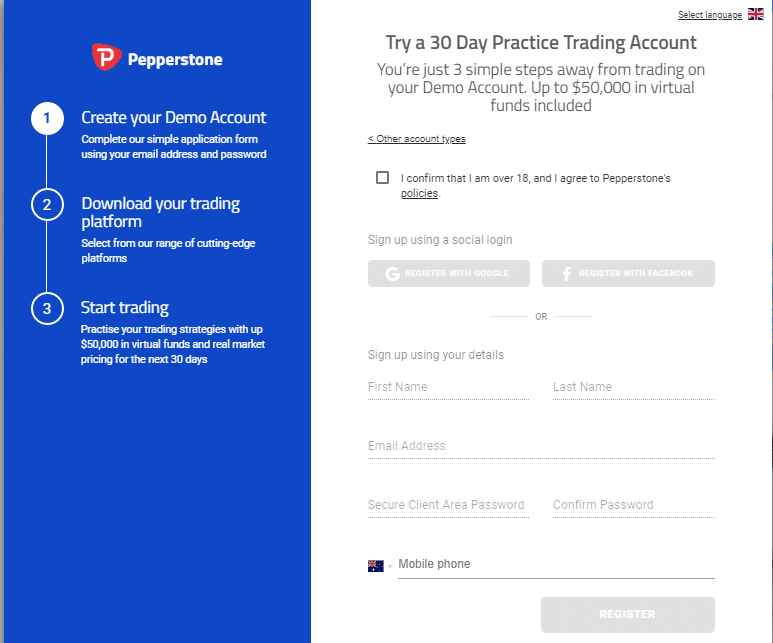

- Demo Accounts: Demo Accounts are a great way for both experienced as well as novice traders to try out the features of a platform before they invest their own money. In this case Pepperstone provides the option of opening a demo account for users.

Users can open a demo account by clicking on the “or try a 30-day demo account” option on the homepage. They will be redirected to the registration page.

Here, users have to confirm their age, enter details such as first and last name, email address and their preferred password. After entering all the information, they can click on register to complete the process.

The demo account provides virtual money for traders to try out the trading capabilities and features of the Pepperstone platform.

Support Service

Pepperstone provides customer support on a 24/5 basis. Users can get in touch with them via chat, email or phone. Their customer service has won many accolades and is known to be responsive when dealing with customer queries and issues. It supports multiple languages including Spanish, Russian, Polish, French, and Laotian to name a few.

Safety and Security

Apart from being regulated by both the FCA for EU Clients, and the ASIC for Australian clients, Pepperstone has some provisions for investor protection. For instance, EU clients are protected by the UK’s investor protection app which can fund up to £85000. However, clients outside the EU are not eligible for such protections.

Leave a Reply