Prices of aluminum have surged more than 21% this year, enabling it to overtake copper as the second-best gainer on London Metal Exchange. Aluminum futures are currently up +0.56%. HG1! is up +1.46%.

- With 18% gain, copper now trails aluminum as the second-best performer to leading metal tin, which has surged 48% this year.

- The gains in aluminum have been fueled by a tight global market, which has offset concerns of planned metal reserve releases by China.

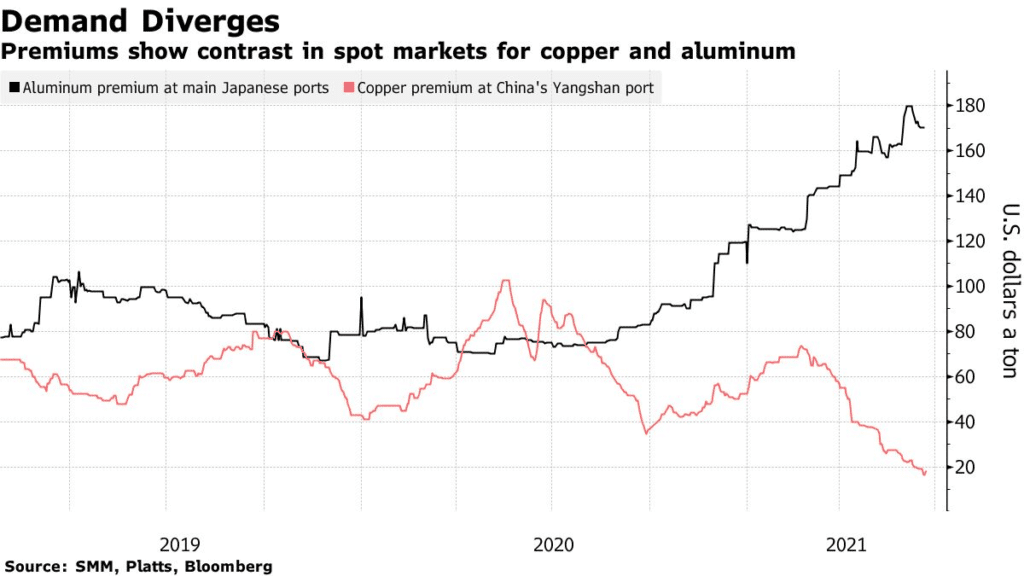

- Copper and aluminum have been muted by China’s efforts to tame commodity inflation, with the latter benefiting more from diverging supply conditions.

- Canceled warrants for copper reached the lowest level in almost a decade on Monday, while those of aluminum have risen to a record level since the beginning of the pandemic.

- Aluminum rise has been fueled by demand for metals used in planes and cars

- As of 11:57 a.m. aluminum traded at $2,406 a ton on the LME, down almost 8% from its mid-May peak as copper exchanged hands at $9,204 a ton, down more than 14% from last month’s high.

Leave a Reply