OctaFX is a company with a very inconvenient site where it is difficult to find even general information about the project. Evaluate our suffering by the example of how we searched for the year the broker was founded: you need to go down to the footer of the site → select the tab “Media” → the subsection “Video” → next you need to find the record dated August 25, 2017, where some company extols OctaFX and says that the broker began work in 2011. We do not understand why such basic information cannot be published in the About us section. It’s also not clear to us whether the company has a license – the Cypriot CySEC regulator is listed on external sites in all reviews, but there is no data on the site anywhere. We reason this way: if the broker did not indicate the license in the footer of the site and did not give a link to verify the information, then there is no license or it is invalid. We have dealt with the basics and proceed to the analysis of the remaining conditions.

General information

| Year of foundation | 2011 |

| Regulation | No |

| Platforms | Metatrader 4, Metatrader 5, cTrader |

| Markets and products | Forex, cryptocurrencies, CFD-contracts |

| Spreads | From 0.2 pips |

| Minimum deposit | 100 $ |

| Maximum leverage | 1: 500 |

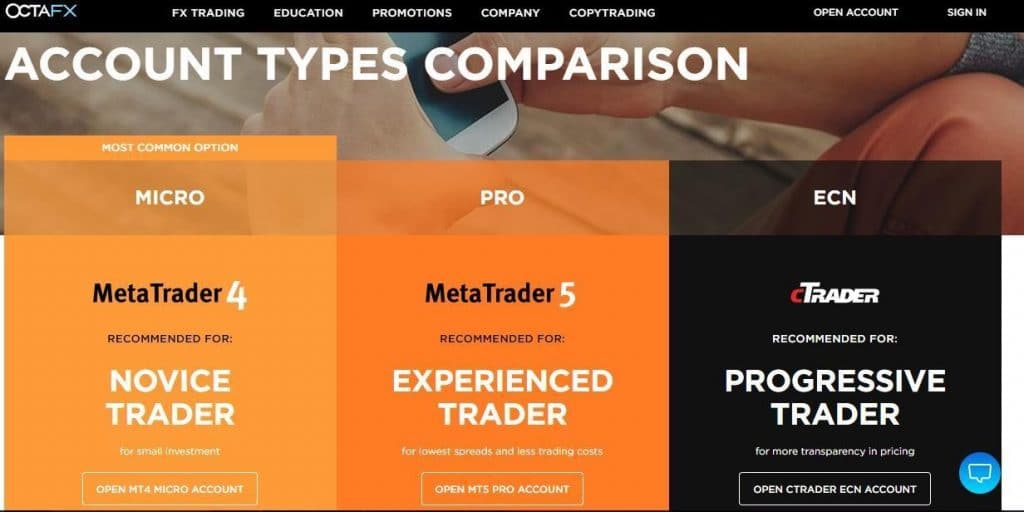

| Types of accounts | MICRO, PRO, ECN + Islamic accounts |

| Deposit and withdrawal | Bitcoin, Neteller, Skrill |

Broker reliability level

The company is regulated not only by the Cyprus organization. Financial monitoring is also carried out by FCA (the British regulator, which is considered the gold standard for the quality of monitoring financial companies). By standards, every customer deposit is insured, so in the event of force majeure, you can count on an objective response from the supervisor.

In addition to the regulators above, the company also has a license from the Caribbean Independent Financial Supervision Organization FSA.

Types of accounts and trading conditions

This forex broker is positioning itself as STR and as an ECN company. Accordingly, transactions can be displayed on the interbank market or processed on OctaFX servers. This allows you to select rational trading conditions.

You can open any of the following types of accounts:

- Mini account (minimum deposit $100)

- Professional account (minimum deposit $500)

- ECN type account (minimum deposit $100)

The company offers customers a small selection of financial instruments for trading. For example, only 30 assets are available for mini accounts for trading, among which 28 are currency pairs. For a professional account, there are just over 50 assets to choose from.

The average spread for the most volatile asset categories is 0.6 points. Additional fees are not charged when processing payments.

You can trade through the terminals: cTrader, MT4 and MT5. The programs are free. They have no restrictions on the use of scalping and external analysis tools.

Trading platforms

There are all kinds of Metatrader 4 and Metatrader 5 terminals, as well as the cTrader platform for working with ECN accounts. cTrader is the same Metatrader, but with a large number of graphical tools and options for auto trading.

Trading Instruments

The whole layout of available assets looks like this: there are 28 currency pairs, 10 indexes, 3 cryptocurrencies, and 6 commodity market instruments. The problem is that these tools are scattered between trading accounts and many traders need to do the following before replenishing the deposit: open the “FX Trading” section → select the “Trading conditions” section → find the “Account types” category → compare MICRO, PRO and ECN accounts → choose the type of account on which there are the necessary tools for implementing the developed trading strategy. In our opinion, this is too sophisticated a procedure that can be easily avoided. Unfortunately, OctaFX executives do not share our view and choose difficulties.

How to deposit and withdrawwith OctaFX

OctaFX broker offers several ways to deposit the account and withdraw funds from the deposit. The minimum sum of processing payment is $5. Through electronic payment systems, you can make deposit $50 and withdraw one-time not less than this sum. The main thing is that all transactions are carried out as quickly as possible, without delay. Use VISA and MasterCard, NETELLER, Paypal for this.

The site states that withdrawal requests are processed within a few hours during working hours. This means that within one day the money will be transferred to the client requisites.

Fees and charges

OctaFX does not charge a fee for deposit/withdrawal of funds, however, there are nuances:

- If you conduct a transaction through Neteller or Skrill, then the minimum transfer amount must be at least $ 50 – the service commission will be charged here.

- If the transaction is carried out through a Bitcoin wallet, the transfer amount should start from 0,00045 BTC – a commission is also provided here, which is calculated by the rules of the payment system.

Additionally, you will have to pay a spread, the size of which can be fixed or floating. Details can be seen before choosing the type of a trading account – there is a whole set of conditions with which to deal for a long time.

Support

For communication with technical support, the Contact US section is provided here – it says that managers are in contact from Monday to Friday 24 hours a day. You can get a consultation in the following ways:

- By phone: there are numbers for the UK, Hong Kong, and Indonesia. Separately, a number was made in WhatsApp, but it only accepts text messages.

- Through a template form that provides for the entry of a name, mail, account number, captcha and message text. Plus you need to choose the department to which your question is addressed.

- Using an online chat, the launch button of which is located in the lower right part of the screen. Click → indicate the name, mail, phone number → write a message. If the operator is available and you correctly formulated the sentence in English, then the answer will arrive within a few minutes. In other cases, difficulties arise.

In the section “Contact US” mail is not provided. However, if you accidentally get into the footer of the site and open the “Privacy policy” section, then it will have the mail [email protected]. Why is everything so inconveniently organized – we do not understand.

Educational program

The site has a section “Analysis & Education”, which is responsible for training novice traders. It has articles, videos, instructions, a dictionary, and answers to frequently asked questions. The knowledge base is publicly available and can be studied without prior registration. The only difficulty is that the content of the OctaFX broker is not adapted for most languages and machine translation will not allow beginners to deal with the features of working in the forex market.

Features

Each user can claim a welcome bonus in the amount of 10-50% of the deposit when replenishing from $ 50. The nuance is that trading bonuses are assigned to these bonuses, without which you will not be able to use the donated money. You can see the rules of the bonus program in the section “FX Trading” → “50% deposit bonus”. You can also participate in the battle of demo accounts, get a bonus and try to convert this bonus into real money.

What bonuses can a customer count on?

Customer loyalty is enhanced through the introduction of several active loyalty programs. For example, each newly registered user has the right to receive a bonus (to a support account). At the same time, the client chooses the amount of reward himself, from 10% to 50% of the sum of replenishment.

The only condition for this is profile verification (personal identification). Choosing the size of the bonus is a relatively new solution from forex brokers. But this is correct, as some traders and investors do not want to face restrictions on withdrawing funds from their account until the bonuses are converted into real profit.

You can receive bonus rewards after each deposit. Therefore, such conditions can be called flexible and loyal to the trader.

OctaFX: advantages and disadvantages

Benefits:

- No hidden charges.

- Competitions are held for beginners, which allows you to win a cash prize with a demo account.

- There is a cTrader terminal, which is available for free download.

- You can connect a multi-level affiliate program and receive for attracting customers to the OctaFX website.

- There is free educational content and you can connect to the service of copying transactions of other traders.

Disadvantages:

- Inconvenient communication with technical support. It is especially difficult for an audience that does not speak English – managers do not work with machine translation and you need a translator to prepare a request.

- The site has a news blog where most publications are limited to three lines and the whole point boils down to the following: congratulations on the holiday → there is the reason to open an account → if you make a payment right now, you can use the welcome bonus. A similar situation with all the video materials that the broker publishes on the site and the YouTube channel – there is regular content, but most of it is advertising in nature and is useless to most existing customers.

- The broker’s activities are not controlled by financial regulators.

- A limited number of methods of crediting and withdrawing funds. Moreover, available payment systems are not connected with the bank and in case of problems will not be allowed initiating a chargeback procedure – that is, in which case you will not be able to protest the transaction.

- Not a profitable bonus program, which provides for the processing of accrued funds.

- A limited number of trading instruments.

OctaFX is an uncomfortable and unlicensed broker, all of whose content is geared towards receiving a continuous stream of new customers. The company has no unique offers and services, so we will not recommend OctaFX.

OctaFX is an uncomfortable and unlicensed broker, all of whose content is geared towards receiving a continuous stream of new customers. The company has no unique offers and services, so we will not recommend OctaFX.

Leave a Reply