The NZD/USD pair rallied for the fifth consecutive day as investors reflected on the latest Reserve Bank of New Zealand (RBNZ) interest rate decision and the ongoing rally of treasuries. The pair rose to a high of 0.7380, which is the highest it has been since February 2018. It has risen by more than 35% from its lowest level last year.

RBNZ interest rate decision

The New Zealand economy has done relatively well in a difficult period. The economy rebounded by about 14% in the third quarter while the unemployment rate fell from 5.3% in Q3 to 4.9% in the fourth quarter. The growth is expected to continue, with the debt market pricing-in a 1.5% overall recovery this year followed by 2.6% in 2022.

This performance is mostly because of the composition of the country’s economy and the overall response to the pandemic. A substantial part of the country’s economy is made up of agriculture, an industry that does well even in downturns. Furthermore, people will always eat. In total, the country recorded just 25 Covid deaths.

It is against this backdrop that the RBNZ conducted its first monetary policy meeting of the year. As most analysts were expecting, the bank decided to leave interest rates unchanged at 0.25% where they have been for months. Also, the government committed itself to continue with the Large Scale Asset Purchase (LSAP) or quantitative easing program whose limit is at N$100 billion. It also left its funding for lending program unchanged.

In the statement, the governor said that while the economy has recovered, the central bank and the government needed to do more. The NZD/USD is therefore rallying since it seems like the RBNZ will not implement negative interest rates.

The decision came a day after the country’s statistics agency published relatively weak retail sales. The data showed that the overall retail sales dropped by 2.7% in the fourth quarter after rising by 28% in Q3. The sales rose by an annualised rate of 4.8%. This performance was mostly due to the lockdowns that happened in Q4 and the weak performance in the hospitality sector.

Jerome Powell testimony

The NZD/USD is also rising because of the relatively dovish Federal Reserve chairman. In his testimony to Congress, the Fed chair said that the US economy is uneven and that the current easy-money regime will continue.

The statement came at a period when the overall treasury yields in the US have been rising as investors brace for a quick economic recovery as Congress prepares a large $1.9 trillion stimulus package.

Therefore, many investors interpreted his statement to mean that the bank will not be in a hurry to increase interest rates. In fact, a few months ago, the Fed committed to leave interest rates unchanged even when the rate of inflation rose above its 2% target.

NZD/USD technical outlook

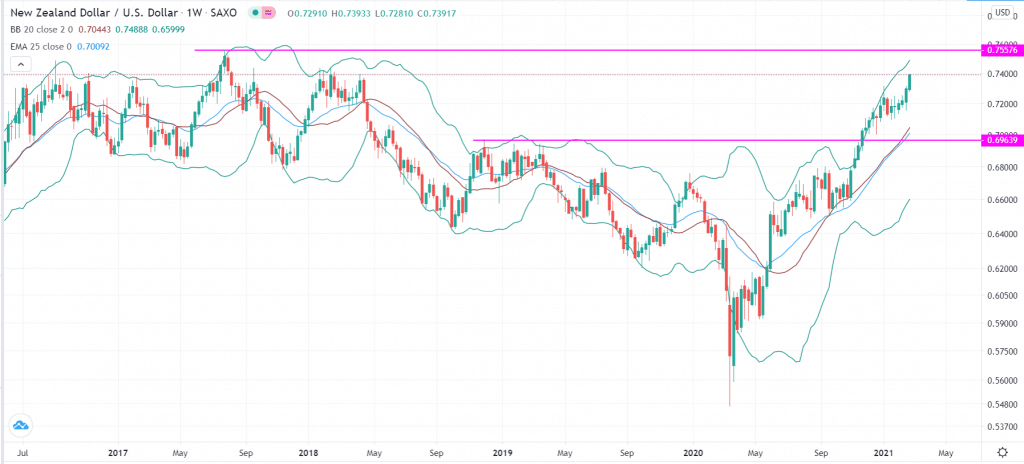

The weekly chart shows that the NZD/USD pair has risen for the past six consecutive weeks and that it is at the highest level since February 2018. The pair is also about 2.14% below the highest level in 2017. This uptrend is also being supported by the short and longer-term exponential moving averages.

It is also slightly below the upper side of the Bollinger Bands. It also seems to be forming a cup and handle pattern. Therefore, the pair will likely continue rising as bulls target the important resistance at 0.7557.

Leave a Reply