- The Reserve Bank of New Zealand (RBNZ) is expected to increase its official cash rate (OCR) in August 2022.

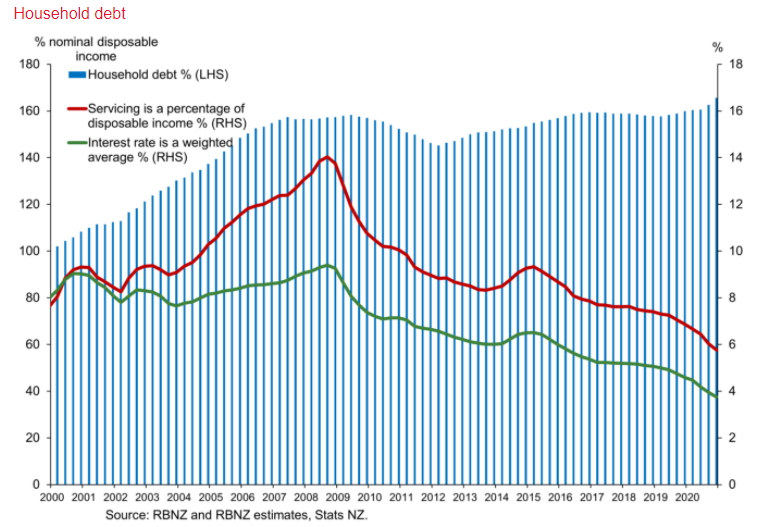

- Household debt-to-income reached 165.60 into 2021, up from 162.60 as mortgage borrowing reached NZ$10.487 billion in March 2021.

- US banks may cut down up to 200,000 jobs by 2030 due to Fintech integration post-pandemic.

The NZD/USD traded at a -0.61% price change on May 17, 2021, hitting a low of 0.7216 from a high of 0.7251. The decline was closer to the weekly price change at -0.89% (-44 pips). New Zealand announced that it would lower the intake of skilled and temporary migrant laborers as a way to attract and create local jobs for citizens.

To curb the spread of Covid-19, the government reduced migrants from over 7 million to 165,000 after borders were closed in March 2020.

The US dollar edged slightly after the Empire State Manufacturing Index recorded strong growth at 24.30 from a previous record of 26.30. Earlier forecasts had indicated that the index would reach 23.90.

Net long-term financial transactions by the Treasury International Capital (TIC) rose to $262.2 billion from a previous reading of $4.3 billion. The first quarter of 2021 saw heightened demand (by foreigners) for domestic security.

Interest rates

The Reserve Bank of New Zealand (RBNZ) is expected to increase its official cash rate (OCR) in August 2022, earlier than expected. However, the government is reluctant to remove any long-term stimulus. The bank is of the view that while it expected solid growth towards the end of the year, it would have to increase rates to 1.25% in 2023.

New Zealand Interest rates 2017-2021

The RBNZ kept interest rates below 2% from 2017 until it hit 0.25% in 2020. The Large-Scale Asset Purchase (LSAP) initiative stood at NZ$100 billion as of April 2021, with the monetary stimulus program allowed to continue until August 2022. However, coupon rollovers (upon the expiry of the LSAP) and principal maturities may extend for several years.

Further, with inadequate employment opportunities among the Kiwis, the debt-to-income (DTI) ratios, especially among home buyers, have skyrocketed.

New Zealand household debt

Household debt-to-income reached 165.60 into 2021, up from 162.60.

March 2021 saw mortgage borrowing reach NZ$10.487 billion. New mortgage commitments among first-home buyers in Auckland with a total DTI above 6 reached NZ$815 million in March 2021 up from NZ$537 million in February 2021.

It is important to see whether the RBNZ may consider raising the OCR before the US Fed or Australia’s Reserve Bank.

US Covid-19 vaccine distribution

President Biden announced plans to distribute 80 million vaccine doses globally by the end of June 2021 to help combat the pandemic. The US government hopes to have produced adequate vaccine doses by the end of the second quarter of 2021 to cover American citizens.

As the economy struggles to get back more than 10 million jobs lost from the start of the pandemic, US banks may cut down up to 200,000 jobs by 2030.

Analysis by Wells Fargo indicates that the integration of Fintech and other financial technologies could encroach the employment space eliminating a myriad of job opportunities.

While the move is aimed at spearheading efficiency, it is left to be seen how technology will influence the banking organizational structure. US bank branches have declined since 2012, with the total number of bank employees at 1.94 million as of 2019, down from 1.96 million in 2012.

Technical analysis

NZD/USD reached fundamental support at 0.7116. There has been heightened buying activity with the 14-day RSI at 56.16 amid declining volume.

NZD/USD Trading Analysis

The chart shows the pair’s rise above the 0.7254 psychological level may propel it to reach resistance at 0.7400.

Leave a Reply