The NZDUSD price held steady after the relatively strong New Zealand GDP data published on Thursday. The pair is trading at 0.7115, which is a few pips below this month’s high of 0.7170.

New Zealand GDP data

The New Zealand economy outperformed expectations in the second quarter as the country continued to open up. According to the country’s statistics agency, the economy expanded by 2.8% in the second quarter after rising by 1.4% in the previous quarter. This increase was better than the median estimate of 1.3%.

This growth translated to a year-on-year expansion of 17.4%, which was better than the first-quarter growth of 2.9% and the median estimate of 16.3%. This growth was fueled by robust consumer spending, with the retail trade and accommodation boosting its performance.

Other sectors that led to substantial growth in the economy were business services, higher fixed asset investments, and exports. Exports rose by 63% in the second quarter.

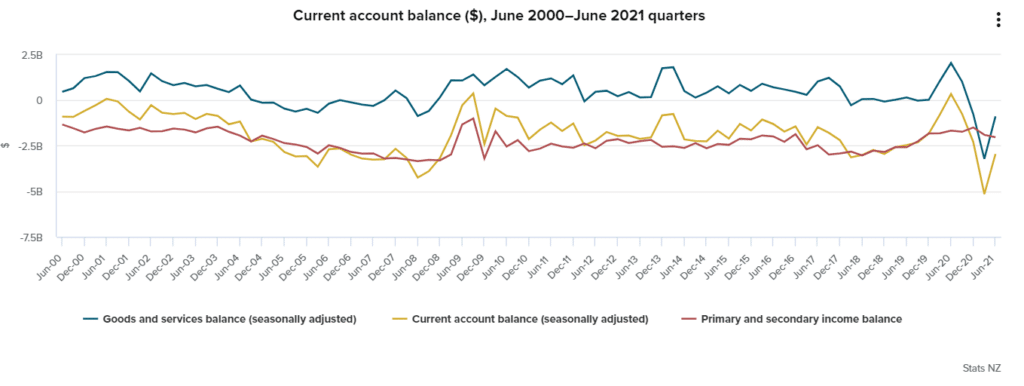

These numbers came a day after the statistics agency published strong trade numbers. The data revealed that the strong export numbers had narrowed the current account deficit to n$3.0 billion. This happened as the value of goods exports rose by n$1.4 billion and services rose by n$1.7 billion.

Still, these numbers had a minimal impact on the NZDUSD because situations have changed materially in the third quarter. Recently, the country has had to move to a higher alert level as the number of Covid cases jumped in places like Auckland. As such, the gains made in the second quarter and early in the third quarter will be undone.

The country will nonetheless record a strong rebound now that the government has managed to lower the number of new infections. It recorded just 15 cases on Wednesday, lower than last month’s high of 80.

Therefore, the NZDUSD has held steady because analysts believe that the Reserve Bank of New Zealand (RBNZ) will likely sound hawkish in its October meeting. In its last meeting, the bank decided to postpone its rate hike as it maintained a wait and see approach.

US retail sales data

The NZDUSD is also wavering as the market reflects on the latest American inflation data. The numbers showed that the country’s inflation declined from 5.4% in July to 5.3% in August. The core CPI, which excludes the volatile food and energy prices, declined to 4.0% from the previous 4.3%. This decline was mostly attributed to a sharp drop in airfares and new car prices.

Looking ahead, the next major data for the NZDUSD will be the American retail sales numbers that will come out on Thursday. The data is expected to show that the headline and core retail sales declined in August as consumer prices remained stubbornly high and wage growth remains low. The US will also publish the latest initial jobless claims numbers.

NZDUSD technical analysis

The four-hour chart shows that the NZDUSD has been in a consolidation mode in the past few weeks. The current price is slightly above 0.7088, which was the highest point on August 4th. The pair has also formed a bullish flag pattern that is shown in black.

It has also remained slightly above the 25-day and 50-day moving averages and the ichimoku cloud. Therefore, the pair will likely maintain its bullish trend as investors price in a hawkish RBNZ. This view will be validated when the price moves above this month’s high at 0.7170.

Leave a Reply