The NZDUSD pair remained in a bearish trend as investors reflected on the Reserve Bank of New Zealand (RBNZ) decision and the country’s reopening plans. It is trading at a key support level at 0.6880, where it has struggled moving below before.

RBNZ interest rate decision

The RBNZ delivered a relatively hawkish interest rate decision on Wednesday. As was widely expected, the bank decided to hike interest rates by 25 basis points to 0.75%. This year, this was the second interest rate hike, making it the most hawkish central bank in the developed world. The bank has already ended its asset purchases program.

Most importantly, the bank signaled that it would implement more hikes in the coming months. Precisely, it expects to raise interest rates to about 2% by 2023. Surprisingly, the Reserve Bank of Australia (RBA) has signaled that its first interest rate hike will come in 2024.

The idea behind the rate hike was easy to see. The country’s economy has done relatively well in the past few months, helped by the sharp decline in Covid-19 cases.

Inflation has jumped as the price of oil and gas has risen. The RBNZ expects that the headline inflation rate will rise to 5% in the near term. It expects that the rate will slump back to the target of 2% in 2023.

Additional numbers have been relatively strong. For example, the country’s unemployment rate has dropped to where it was before the pandemic started. Retail sales have also risen substantially as more people boost their spending. Wages have also risen.

Most importantly, the housing market has been red hot as people take advantage of low-interest rates. Also, the lack of enough supply has pushed prices higher.

And on Thursday, data by the country’s statistics agency showed that the volume of trade is rising. Exports rose from N$4.36 billion in September to more than N$5.36 billion in October. Similarly, imports rose from more than N$6.57 billion to more than N$6.64 billion. Meanwhile, the country has also announced plans to reopen to foreigners soon.

Hawkish RBNZ and Fed

There are two main reasons why the NZDUSD pair retreated after the hawkish RBNZ. First, the 25-basis points rate hike was in line with what analysts were expecting. This means that no one was surprised by the bank’s actions.

Second, analysts have now refocused on the future actions of the Federal Reserve. The strong economic numbers from the US have led to fears that the Fed will become more hawkish going forward.

For example, on Wednesday, the US published relatively strong data. The data showed that the US initial jobless claims tumbled to the lowest level in more than 50 years. This was a surprise since initial claims jumped to a record high of more than 20 million last year.

Additional data showed that personal incomes rose in October as the economy recovered. The rise in income also led to a sharp increase in consumption.

NZDUSD forecast

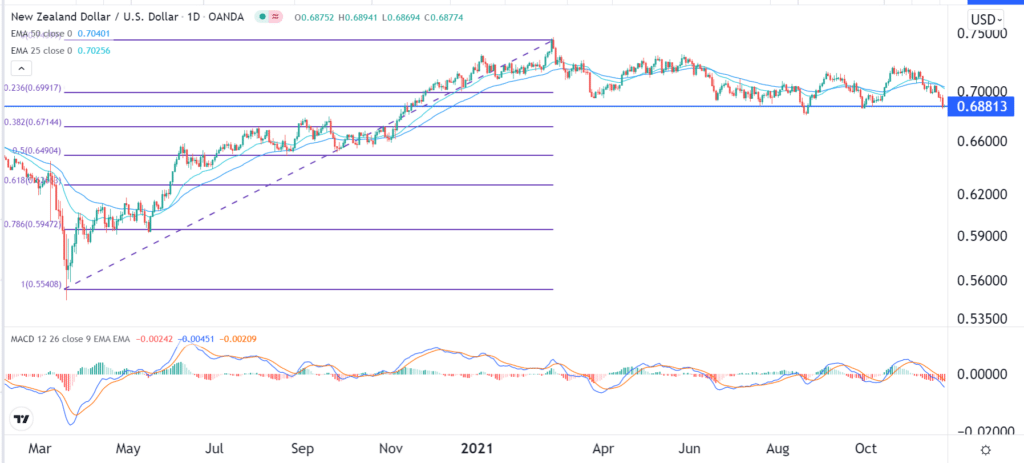

The daily chart below shows that the NZDUSD pair is stuck at a critical support level. The pair is trading at 0.6878, where it has struggled to move below several times before. The 25-day and 50-day Moving Averages have also made a bearish crossover pattern.

At the same time, it has moved below the 23.6% Fibonacci retracement level, while the MACD has dropped below the neutral line. Therefore, the pair will likely continue falling as bears target the key support level at 0.6600.

Leave a Reply