- The spike in Covid-19 cases amongst New Zealand’s largest trading partners could hurt NZD further.

- New Zealand-China trade key to NZD’s trajectory.

The NZD/USD pair gained some ground on Thursday to trade at 0.69924, at 1412 GMT. The kiwi overcame reports of a -3.8% in its July business confidence, as new concerns arose concerning the spike in Covid-19 cases in the region.

July has been hard on NZD

NZD has been struggling against the USD, and today’s gains will be keenly watched as a potential turnaround. Many traders will also be keen to watch whether NZD’s descent from last month’s high of 0.7288 will precipitate a breakout, considering that NZDUSD is currently below its 200-day Simple Moving Average.

NZD’s fortunes are certainly far from impressive, considering that this is the first time in a year when the currency has gone that low. If you are bullish for NZD, you might also need to be aware that it reached its lowest point this year in July when it registered 0.6881.

Going by its recent trend, therefore, barring a significant shift in market fundamentals, the short-term performance of NZD is likely to be underwhelming.

In early Thursday trading, the kiwi looked to have benefitted from a slightly weakened US dollar which had been driven by the Fed’s decision to keep its hands off US inflation. In addition, China’s equities fell earlier in the week, driven by tightened regulations in the education industry. This led to Asian stocks losing ground and providing more impetus for forex.

Growing fears in the Asian-Pacific zone creating an uncertainty

Of greater concern for traders should be the surging cases of the Delta variant of the Covid-19 pandemic in New Zealand and the wider Asia-Pacific region.

The spike in infections has brought new restrictions, including lockdowns and stay-at-home orders in neighbouring Australia. Eight of New Zealand’s top 10 trading partners are within the Asian-Pacific zone, underlying the significance of the current containment measures on the country’s economy.

New Zealand’s management of the virus has so far been impressive, with the country’s closure of her borders preventing the spread. However, that may also be counter-productive, with reduced economic output possibly hurting NZD in the coming days. The immediate concern will be around looming job losses and reduced consumer spending, which could derail the economic recovery.

Therefore, the US monetary policy may not have as much influence on NZD as the pandemic. Importantly, New Zealand’s exports to China rose in June, and Australia’s continued spat with China means that the figures could rise further.

According to data released by Stats NZ, China took up 32% of New Zealand’s exports, representing a 17% rise year on year and underlining China’s key role in the kiwi’s valuation. A further rise in Chinese imports of New Zealand’s goods and services in July could help cushion NZD against the new Covid-19 pressure.

Technical analysis

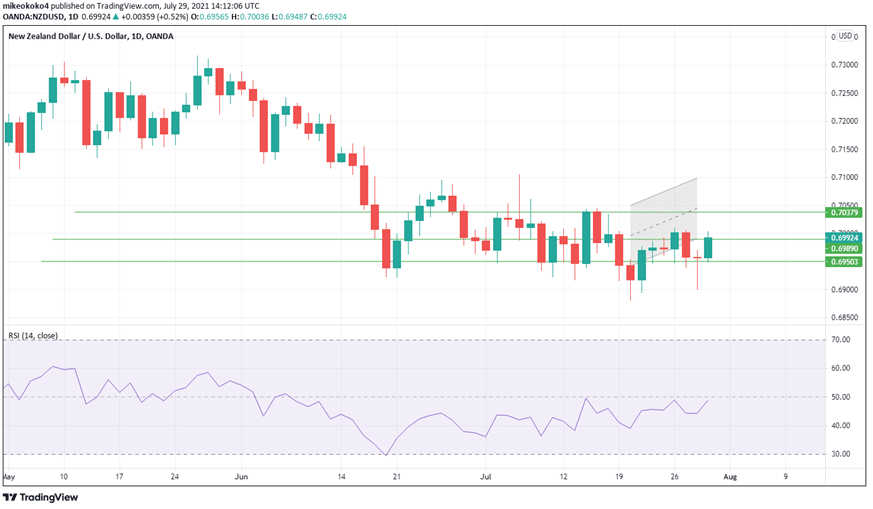

NZDUSD looks to be gaining momentum, with the Relative Strength Index at 51. The bulls are currently in control, and they are likely to push it up to 0.70379, where it’s likely to meet resistance.

A bullish control beyond that point could see the pair reach the monthly high of 0.71071. On the other hand, a bearish charge is likely to pull the pair down to the first support at 0.69890, and a further downward movement will find the second support at 0.69503.

Leave a Reply