- Japan’s leading index for May 2021 (MoM) declined to -1.2% from 1.4%.

- The Bank of Japan (BOJ) downgraded nine economic regions with upgraded zones dependent on the export economy.

- New Zealand has maintained a pause to the extension of quarantine-free travel from New South Wales (NSW) and Queensland despite announcing the opening of air travel routes.

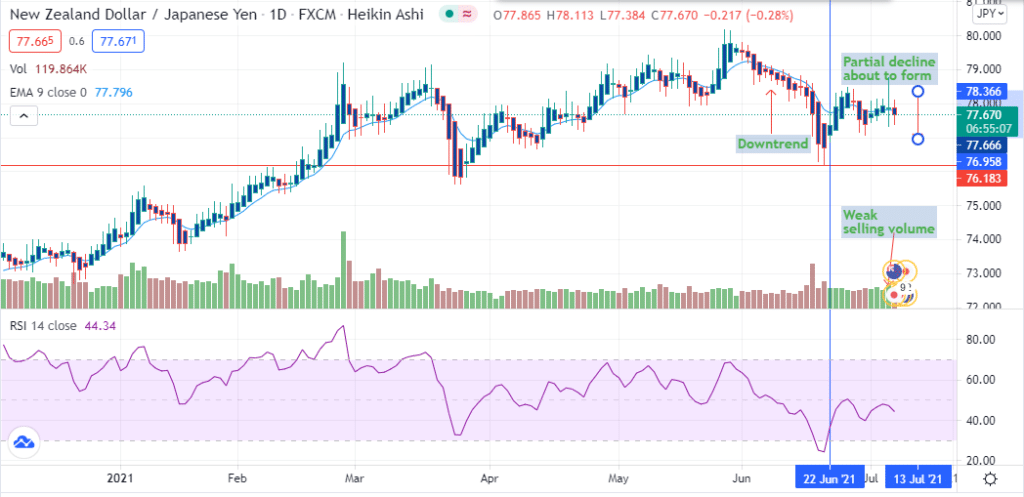

The NZDJPY pair added 0.52% as of 7:19 am GMT on July 7, 2021, from the previous day’s close. It opened at 77.53 and traded to a high of 77.93.

The Japanese yen inched lower after the coincident indicator (by Japan’s Cabinet Office) for May 2021 (MoM) decreased to -2.6% from a previous high of 2.4%.

Additionally, the leading index (covering at least 12 economic indicators) for May 2021 (MoM) also declined to -1.2% from 1.4%. Up to 60% of Japan’s GDP is made up of private consumption, making these metrics significant.

The yen is still reeling from the effects of the Bank of Japan’s (BOJ) downgrading of the nine economic regions in Japan on Monday- July 5, 2021. Due to the slow post-pandemic recovery, the BOJ saw it necessary to downgrade Chugoku and Shikoku with less than 21 days to the Olympics.

However, strong demand for vehicles from the US has made auto-manufacturers outpace the service sector in order delivery. The pace of demand has been offset by a shortage in chips that has continued since May 2021.

Among the areas considered for an upgrade by the BOJ include Kinki and Hokuriku. Others such as Tokai and Kyushu-Okinawa have realized a slight economic peak due to an increase in exports and production.

As of June 2021, Japan’s Government Bonds (JGBs)- and their outright purchases had declined 1.15% from 5,051,194 in May 2021 to 4,992,995 in June 2021. The outright purchases of Japan’s Treasury discount bills also decreased 5.22% from 312,489 in May 2021 to 296,165 in June 2021.

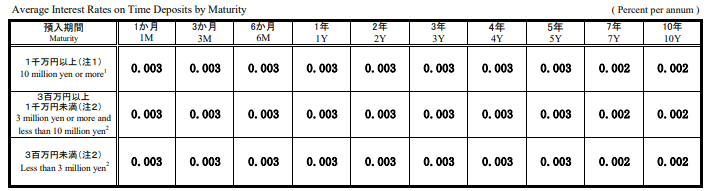

Japan has seen a stagnant average interest rate (by maturity) on time-based deposits. 1-month to 5-year deposits retained a rate of 0.003%, while the 7-year to 10-year deposits stood at a rate of 0.002%.

Mean interest rate

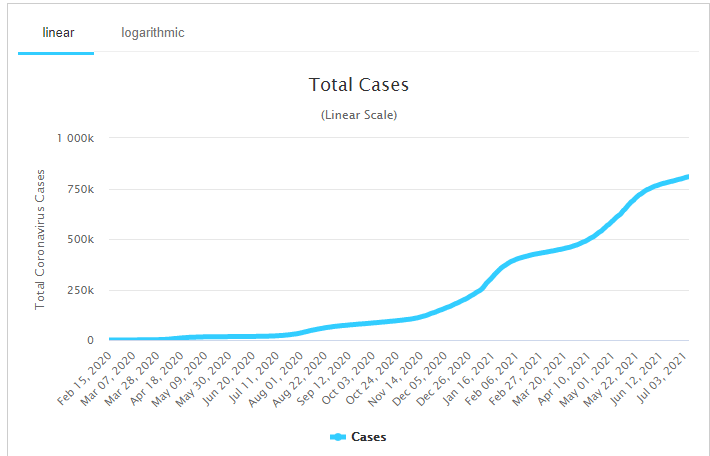

Coronavirus situation

Japan’s coronavirus case-load as of July 6, 2021, reached 807,951.

The linear chart below shows the continual progress of the pandemic with up to 14,882 deaths (2% of the population). Tokyo alone confirmed up to 593 Covid-19 cases (+24.58%) on July 6, 2021, from 476 recorded in the previous week leading to July 2, 2021.

Japan’s total coronavirus cases

Organizers at the Olympic Village of Tokyo announced that the center was hit by two cases of coronavirus adding pressure to a no-inhouse audience.

Resurging NZ economy

New Zealand is looking at a resurgent economy in Q3 2021, especially in the tourism and hospitality sectors. Air transport in routes that were suspended in early 2020 is being returned by the NZ Government in efforts to improve the country’s trade. Investors had forward expectations of rate hikes into 2022 as the country looked forward to a Covid-19-free economy in Q2 2021.

The increase in coronavirus cases in Australia has caused the extension of quarantine-free travel pause from New South Wales (NSW) and Queensland into NZ. However, total deaths (resulting from coronavirus) in Australia have remained 910 since April 13, 2021, with new cases at 517 as of July 6, 2021.

Technical analysis

The NZDJPY pair is likely to form a partial decline. Prices may decline towards the support at 76.958.

At 77.666, the pair is already trending below the 9-day EMA, which is at 77.796. The 14-day RSI is above the oversold zone at 44.34. There is still a potential for an uptrend and move towards 78.366.

Leave a Reply