- BREXIT deal negotiations have disrupted Norway’s fishing business that is likely to affect economic growth into 2021.

- Norges Bank may likely choose to maintain zero interest rates in 2021 as the government focuses on recovery.

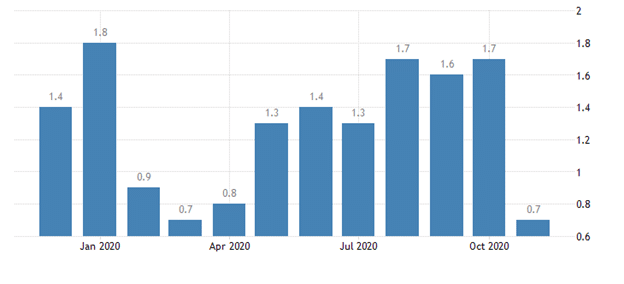

- The low inflation rate of 0.7% at the end of 2020 resulted from reduced housing and utility prices.

Ahead of its policy rate pronouncement on January 21, 2021, Norges Bank officials will maintain low-interest rates and boost economic growth. Norway finished 2020 with a change of 0.7% YoY in its Consumer Price Index (CPI), signaling a slight increase in inflation. In the first quarter of 2020, the mainland GDP (excluding the gas and oil business) contracted by 1.9%. Many utility industries were brought to a standstill. Export of frozen salmon declined by 29% in 2020 (YoY). There is unrest concerning BREXIT and how Norway will react to the trade bureaucracy agreements initiated in 2021.

BREXIT negotiations

Norway’s fishery industry began 2021 on a losing streak in the wake of BREXIT deal uncertainty. The UK banned Norwegian fishing vessels from its territorial waters to force the Scandinavian country into a new agreement. Faroe Islands were also excluded alongside Norway to mark Britain’s novel autonomy status as it seeks to have a fresh start outside the EU’s trade block. Norway is not part of the EU member states, and there is hope that the fishing disagreement will be resolved soon, as the fisheries are an essential facet of the economy.

In 2019, a total of 2.7 million tons of fish was exported by Norway at a value of NOK 107.3 billion ($12.6 billion). In comparison to 2018, this export volume represented a decrease of 3% but an increase in value at 8% (NOK 8.3 billion). The UK’s demand for frozen cod was significant in 2019-2020, with more Britons willing to pay more for the Norwegian seafood. Resolving the BREXIT agreement is paramount not just for the UK but for Norway as well.

The fishing business accounts for 0.4% of Norway’s GDP share. It is ranked third largest in the country’s exports after oil/gas and metals with a market share of 4.6%. In the wake of the BREXIT deal, the UK seeks to enter the negotiation as an independent coastal region, the first time in 40 years. In turn, Norway has vowed to close its fishing economic region to the British and EU vessels if it does not get a deal at the beginning of January 2021. However, the agreement is bound to increase tariffs between these two countries. Trade negotiations are being conducted in independent fishing quotas instead of the bloc.

Inflation rate

While the government planned to spend NOK 1.44 trillion to avert the COVID-19 crisis towards the end of 2020, there was a robust decline in the inflation rate to 0.7. The economic output at the time grew faster than the credit and monetary supply in the economy. Delayed recovery into 2021 was also due to the slow growth of industrial production and decreased oil prices.

There was an imbalance between export and domestic demand as the latter increased for four consecutive months towards 2020. Prices of utilities and rental costs reduced sharply towards the end of 2020, leading to low inflation records. Low transport prices resulting from the containment measures to reduce the rate of infections also reduced inflation.Additionally, there was an increase in savings as opposed to expenditures. The government needs to increase the availability of working capital to promote growth. The draft budget announced for 2021 tallied to NOK 315 billion ($35 billion). It comprised 10% of Norway’s mainland GDP. The measure is a vital expansionary plan that will grow the GDP to 3.3% in 2021.

Leave a Reply