Source: IHS Markit. China’s general manufacturing PMI improved in September, supported by a renewed upturn in total sales and a softer reduction in output. CSI 300 Index up +0.67%, CNY USD up +0.14% The headline seasonally adjusted Purchasing Managers’ Index (PMI) improved from 49.2 in August to 50.0 in September.The improvement signaled that business conditions … [Read more...] about China’s Manufacturing Activity Picks Up in September as Supply Chain Delays Raged On

Forex News

USDJPY Price Prediction: JPY Gains More Ground as the US Faces a Debt Crisis

Credit panic seems to be favoring the greenback. The looming US debt crisis could weaken the USD.Japan has a PM-designate, but Covid-19 remains a big challenge. The US dollar was marginally down against the Japanese yen in early trading on Wednesday, and the greenback was trading at 111.291 at 0749 GMT, which was 0.17% lower than its price 24 hours earlier. For the last … [Read more...] about USDJPY Price Prediction: JPY Gains More Ground as the US Faces a Debt Crisis

US Commercial Crude Oil Inventories Climb to 418.5 Million Barrels

Source: EIA US commercial crude oil inventories continued to climb as both refinery inputs and imports posted growth. Crude oil inventories for the week ending September 24 climbed by 4.6 million barrels to 418.5 million barrels. This is about 7% below the five-year average.Total motor gasoline inventories increased by 0.2 million barrels, distillate fuel by 0.4 million … [Read more...] about US Commercial Crude Oil Inventories Climb to 418.5 Million Barrels

American Pending Home Sales Hit Seven-Month High in August

Source: National Association of Realtors US pending home sales rebounded in August to carve the highest level in seven months, driven by higher supply and moderating prices. XHB is up 1.00% The Pending Home Sales Index (PHS) stood at 119.5 in August, the highest since January’s 123.4. An index of 100 is equal to the contract activity levels in 2001.The latest reading is … [Read more...] about American Pending Home Sales Hit Seven-Month High in August

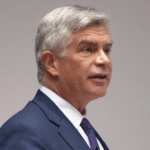

Fed Official Says Time to Taper Bond Buying ‘Soon’

Source: Federal Reserve Bank of Philadelphia Federal Reserve Bank of Philadelphia President and Chief Executive Officer Patrick Harker believes it may soon be time to cut down on the Fed’s bond-buying program. DXY is up 0.31%. Harker said it would soon be time to slowly and methodically “frankly boringly” cut down on the $120-billion monthly bond-buying program.The Fed … [Read more...] about Fed Official Says Time to Taper Bond Buying ‘Soon’