Source: Bank of England

The United Kingdom’s rate on newly drawn mortgages was at a series low of 1.50% in November, with the rate on the outstanding stock of mortgages also at a bottom low of 2.02%. FTSE 100 is up +1.26%, GBPUSD is up +0.21%.

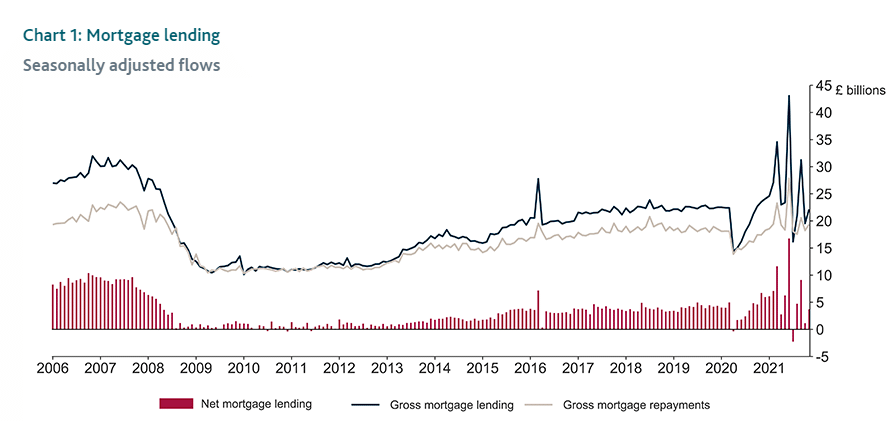

- Mortgage approvals for purchases of houses held steady at 67,000, close to the 12-month average. Individuals’ net borrowing of mortgage debt was 3.7 billion pounds.

- In November, UK consumers borrowed 1.2 billion pounds more, with the effective rate charged on new personal loans rising to 6.43%, the highest since March 2020.

- New inflows into deposit accounts by households lowered to 4.5 billion pounds, while the effective interest paid on new time deposits with building societies and banks improved to 0.37%.

- Large businesses borrowed the most from banks at 2.8 billion pounds, with the small and medium-sized entities repaying 0.8 billion pounds. Private non-financial entities redeemed 1.0 billion pounds.

Leave a Reply