Naragot Portfolio is a Forex expert advisor that was launched on 17th October 2020. It is compatible with multiple currency pairs and you can run it on the MT4 and MT5 trading platforms. The developer claims that they have traded the trading schemes of this EA for several years on real accounts with significant funds.

Detailed forex robot review

On the MQL5 product page, the vendor has listed all the advantages of the expert advisor. We have installation instructions and descriptions of the EA settings. The vendor has also shared some testing recommendations and a few screenshots showing the backtesting results.

Alexander Mordashov, the lead developer, is a resident of Russia. They claim to be a trader with 4.5 years of experience in public trading. However, they have been present on the MQL5 website for roughly a year. We don’t have any background information on this person or the people they work with. Apart from this EA, they have another system known as Naragot Portfolio Lite.

This EA trades in liquid pairs like USD/JPY, XAU/USD, GBP/USD, and EUR/USD. With each order, it uses a stop loss and a take profit, and until the position is closed, their values remain unchanged. The take profit always exceeds or equals the stop loss. Naragot Portfolio refrains from using dangerous money management techniques like curve fitting, martingale, or grid.

In the EA settings, you will find a parameter labeled EET offset. It lets you divide the trading week into five 24-hour candles. The default value is zero, but you ought to change it in case a different time is used by the broker.

You have the option of trading with a fixed lot and a fixed balance. Alternatively, you can enable the Auto Lot parameter which will prompt the EA to calculate the trading volume based on the account balance. The drawdown for each trading scheme is around 15% by default, but you can change the values.

Naragot Portfolio strategy tests

This robot is based on breakouts of support and resistance levels and concepts of volatility breakout. There are a total of seven strategies employed by the robot. It does not trade every day and does not profit each week. Naragot Portfolio prefers to make infrequent, but precise entries. It leverages major trends.

The EA only conducts trades in the direction of the trend. It is not a curve fitting or a tester grail system. Rather than using indicators, it follows a pure price action principle.

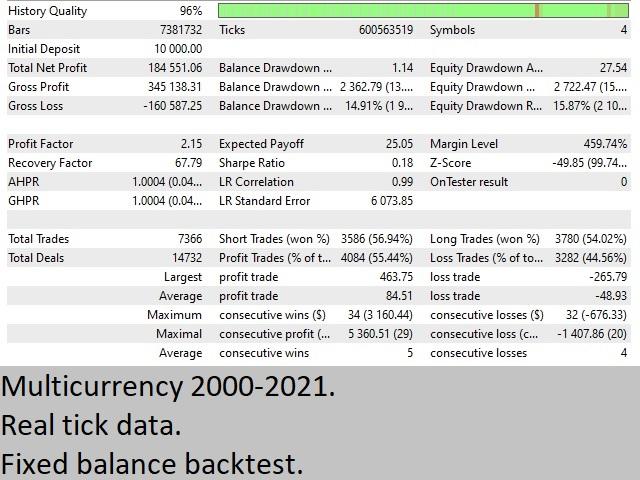

This backtest was conducted from 2000 to 2021 with a history quality of 96%. The EA started with an initial deposit of $10,000, conducting a total of 7366 trades and winning 55.44% of them. At the end of the test, it generated a total profit of $184551.06. During the testing period, the robot managed to win 34 trades back-to-back. The number of consecutive losses was 32. At 15.87%, the relative equity drawdown was quite acceptable.

Real account trading results

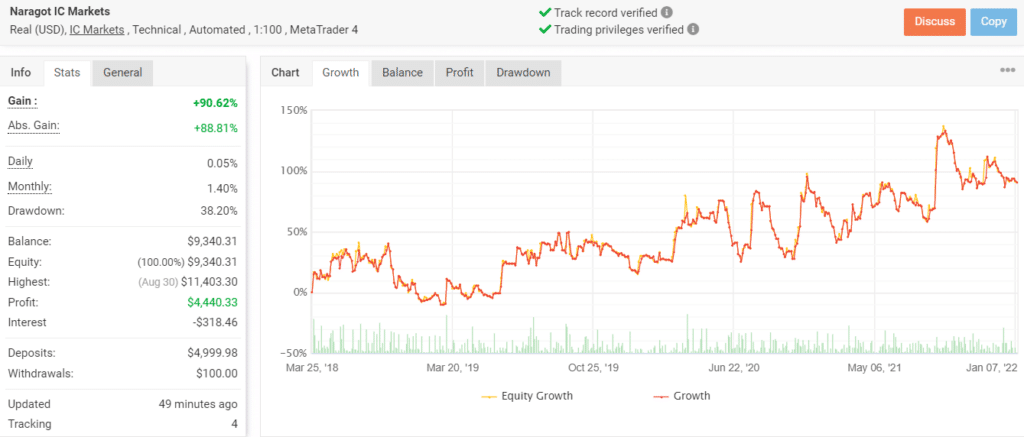

Since May 25, 2018, the EA has conducted 6322 trades through this account. It currently has a win rate of 40%, which is quite low compared to other systems. The time-weighted return for this account is 90.62%, while the total profit is $4440.33. Compared to the live results, the EA had a much higher win rate for the backtest, and a lower drawdown. Here, the drawdown is a bit high at 38.20%, and this tells us that Naragot Portfolio trades with a fair amount of risk.

Currently, the daily and monthly gains for this account are 0.05% and 1.40%, respectively, while the profit factor is 1.10. It is interesting to note that the vendor has set the trading history to private. As such, we are not able to analyze the recent trades.

Pricing

The current price of this EA is $333, which makes it quite affordable. There is a free demo version available for download, but no refund policy exists.

Customer reviews

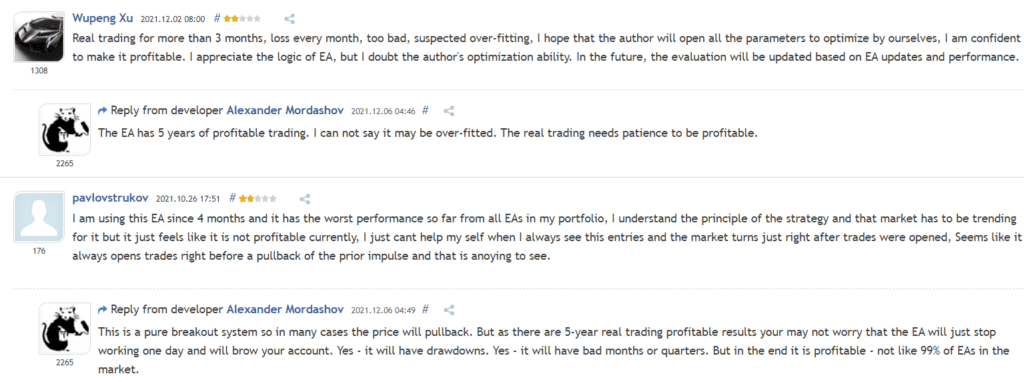

There are no reviews for this EA on third-party websites. While there are some reviews on MQL5, we cannot verify their authenticity.

Naragot Portfolio is an EA that shows decent performance in a backtest but fails to reproduce it in the live market. It has a low win rate compared to others, and the vendor does not offer a money-back guarantee. Also, there is very little information on the developer.

Leave a Reply