- US dollar under pressure amid waning consumer sentiments

- Yen strengthens across the board amid a spike in demand for safe-havens

- Gold bounce back on track as bullseye $1800

- US indices under pressure amid COVID-19 concerns

- Bitcoin march to $50,000 on track

The US dollar was on the front at the start of the week, recouping some of the losses accrued last week early Monday morning. The trigger behind the dollar bullishness was a string of disappointing economic data from China that raised serious concerns about the world’s second-largest economy. Fast forward, the greenback is losing some steam as the debate on whether the Federal Reserve will taper as consumer sentiment continues to weaken.

Japanese yen strength

The Japanese yen is yet again in the spotlight amid the building dollar weakness. The USDJPY has since retreated to two weeks lows after bears pushed the pair below the 110.00 level. A retreat below the 109.00 level could be on the cards with the pair under pressure for the fourth successive session.

A sell-off followed by a close below the 109.00 level could result in the pair tanking to the 108.60 level, the next substantial support level.

On the flip side, bears’ failure to break through the 109.00 psychological level could result in the pair rerating higher.

The bid tone on the yen against the dollar has been influenced by traders flocking safe-havens amid the fallout triggered by the Delta variant. US Treasury yields edging lower amid growing concerns on when the FED will start to taper worked in favor of the yen strength. The greenback, on the other hand, lacks obvious catalysts following the disappointing ISM manufacturing data last week.

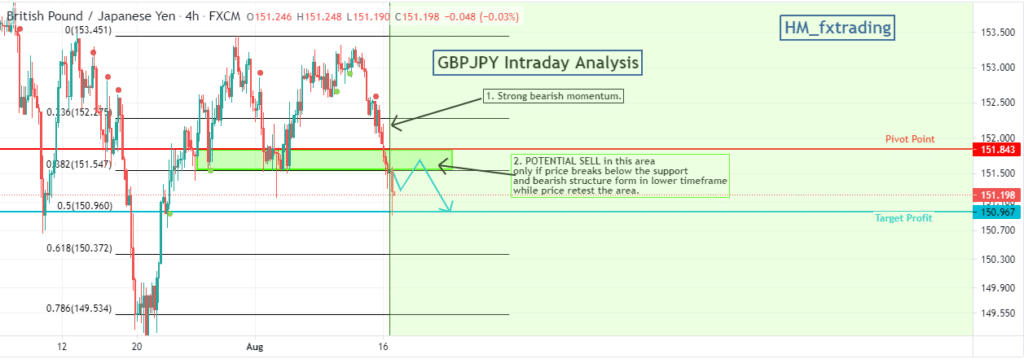

GBPJPY weakness

The British pound is another currency under immense pressure against the Japanese yen. The GBPJPY has since retreated to three-week lows after dropping below the 152.00 psychological level. With bears in control, the pair could fall below the 151.00 level, with the next potential support level seen at the 150.60 level.

The British pound remains under pressure as traders continue to shrug off riskier currencies in favor of safe havens amid the growing concerns about the deteriorating Covid-19 situation. Covid-19 cases edging higher in the UK is an emerging point of concern that continues to work against the pound’s strength.

Gold bounce back

In the commodity markets, gold has regained its positive traction, with bulls eyeing the $1800 an ounce level. The precious metal has started the week on the front foot, powering through the 1780 level. XAUUSD is seen rising towards the $1790 level in the absence of crucial economic releases from the US.

Treasury yields edging lower have continued to curtail greenback strength, all but working in favor of the bullion strength. A rally followed by a close above the $1780 level has once again paved the way for bulls to push the precious metal towards the $1800 level.

The Federal Reserve delaying bond tapering will only result in the printing of more US dollars, which should lead to further greenback devaluation, consequently, send the XAUUSD higher.

US indices under pressure

In the stock market, major US indices are under immense pressure struggling to hold on to gains at record highs. Tech heavy NASDAQ has pulled lower, with the S&P 500 also pulling lower. The Dow Jones remains flat at the start of the week.

Sentiments in the US stock market have taken a significant hit in the aftermath of retail sales and industrial production activities cooling down in China. A slowdown in the Chinese economy is already fuelling fears that sectors closely linked to the health of the US economy will also feel the pinch.

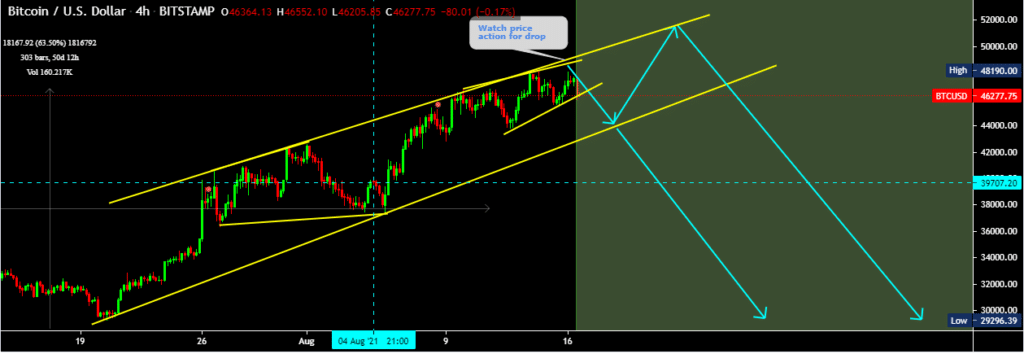

Bitcoin resurgence

In the cryptocurrency market, Bitcoin rally to the $50,000 remains on track, with BTCUSD powering through the $47,000 level early Monday morning before pulling back. With Bitcoin leading the rally in the industry, the overall crypto market cap has already surpassed the $2 trillion market cap at the highest level since May.

Standing in the way of Bitcoin taking out the $50,000 psychological level is the $48,000 level that is emerging as a critical resistance level. The Bitcoin rally comes on the heels of massive accumulation while trading below the $50,000 level a few weeks back. Short sellers exiting the market have also worked in favor of a spike in BTC prices.

Leave a Reply