A trading platform helps you carry out all your executions in the market. It has various useful features such as many types of orders, charting tools, strategy tester, EA support, indicators, etc.

Brokers’ cooperation with third-party companies, such as MetaTrader, results in advanced trading software; however, brokers also have their programs with much better support and tools. Keep a lookout for supported platforms by brokerages. An excellent application to access the financial industry will ensure that you stay in the winning 10% of traders.

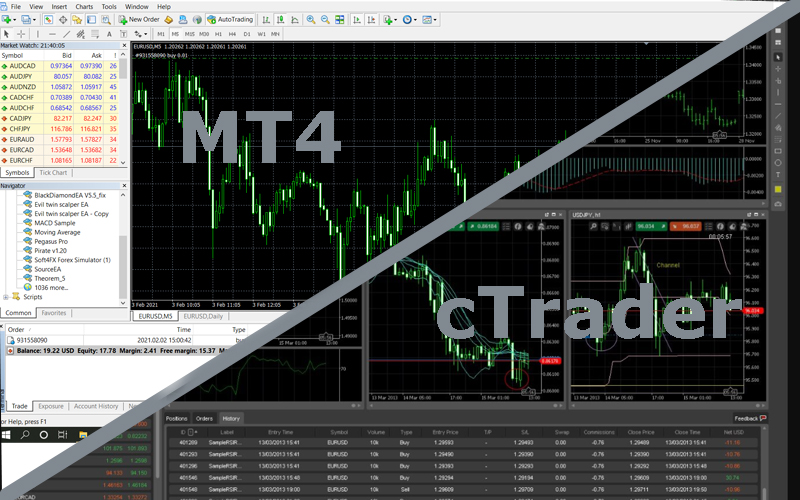

MetaTrader trading platform

Developed by MetaQuotes Software and released in 2005, MetaTrader is the first choice among many traders to fulfill their trading needs. Utilizing C++ MetaQuotes language, code the program. Almost all the top brokers get a license for the platform, which is then provided to their respective clients. There are currently two versions of MT:

- MetaTrader 4

- MetaTrader 5

MT 5 is an update to the fourth version and has more features, including time frames, strategy tester tweaks, and order types. MT 4 system is also flexible with three execution modes, two market, four pending and two stop orders, and trailing stops. 9-time frames and 30 technical indicators are at one’s disposal. Copy-trading services include portfolios of thousands of traders with the ability to filter out the best ones.

Image 1: MetaTrader 4 trading platform. On the top left, you can see the broker’s name who owns the license, which is FBS in the current case.

Furthermore, a wide range of expert advisors is available in the library alongside technical indicators. One also codes his own robot as MetaTrader has a perfect environment for developing, testing, and optimizing EAs. Trading is at hand on the go through the company’s mobile apps. You can also get alerts for various critical financial events.

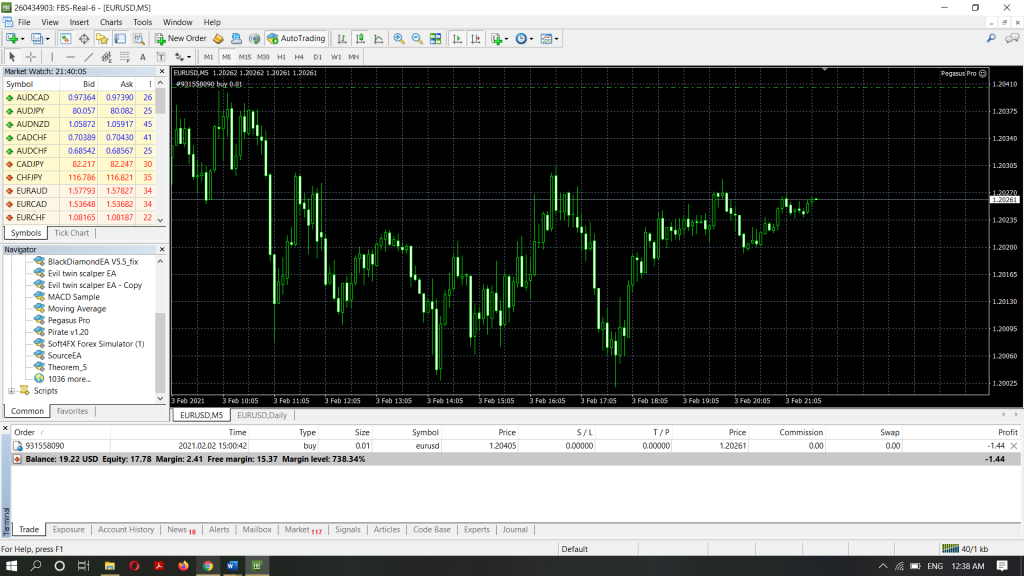

cTrader Trading Platform

cTrader is a trading platform by Spotware Systems who have their headquarters in Limassol Cyprus. The program was initially developed to cater to ECN brokers, the first ones being FxPro and adding other firms’ support later on.

Image 2. A visual representation of the cTrader platform.

The first look at the platform will make you realize how soothing it is for your eyes. The layout is extremely friendly, customizable and will make you fall in love with it at first sight. cTrader is a comprehensive software having 26 prebuilt chart views alongside 50 chart templates and 70+ preinstalled indicators. Furthermore, there is an online glossary where you can download more of these. cTrader also allows traders to peek at the market depth and forward orders using one-click trading. You can program algorithms as well so that they match your style/strategies.

Many types of orders help in lowering your overall risk. Visual backtesting gives you access to a vast market history with quality tick data. Trade optimization and performance reports are also available in cTrader. The trading platform has support for mobile, web, android, and iOS.

Benefits of MT4 over cTrader

MetaTrader has the following benefits over cTrader:

- Language support. Used by a majority of traders MetaTrader platform has support for many languages. Non-English speakers will certainly prefer MT over cTrader if the former depicts their tongue.

- Trading robots. MetaTrader 4 has a ton of trading robots and indicators on their platform and website. Most of the market’s EAs are developed and supported mainly for MT as it is the industry standard. You can filter them out based on the risk factor, percentage gain, drawdown, reviews, etc.

- Available brokers. MT4 is the clear winner when it comes to the number of brokers that support it. Traders can switch between brokerages without having to turn the platform on and off again.

- Online content. As MT4 is the first choice of many, there is a lot of online material that uses it. Most trading mentors and videos explain their strategies by the industrial standard MetaTrader.

Benefits of cTrader over MT4

cTrader has the following advantages over MetaTrader:

- Market depth. One of the noted services of cTrader over MT4 is the availability of level two data for market analysis. The platform was released after MetaTrader 4, where the company understood the importance of market depth. VWAP view is also available to traders.

- Charting. Many different charting tools are present in cTrader, including one-click pending orders, market sentiment, exporting charts, 26-time frames, and volume calculation in units.

- Orders. With cTrader, you get tons of different market orders to get in and out of positions quickly. Reverse position, double position, scaling, and close all traders are a few to name.

- User interface. Even though MetaTrader has a perfect outlook, the overall interface in cTrader is much more user-friendly. The user interface may be a personal preference; however, novices are more inclined towards the easy usage offered by cTrader.

| MetaTrader 4 | cTrader | |

| Web trading | ✔ | ✔ |

| Andriod and iOS apps | ✔ | ✔ |

| Hedging | ✔ | ✔ |

| Signals Trading | ✔ | ✘ |

| One-Click Trading | ✔ | ✔ |

| Reverse and Scaling | ✘ | ✔ |

| Built-in Market News | ✔ | ✘ |

| Time Frames | 9 | 26 |

| CFD and Crypto Trading | ✔ | ✘ |

End of the line

MetaTrader and cTrader have been offering the best services to traders for more than a decade. While MT4 is the primary trading platform for many brokers with much content and support for automated software, cTrader has a user-friendly interface, various order types, and market depth favorable by both beginners and professionals alike. Users who prefer cTrader as they go through the trading program may find it hard to switch over to others after some use due to exceptional features and functionality. In the coming years, Spotware systems will be giving a formidable challenge to MetaTrader cooperation.

Leave a Reply