Mr. Martin is a fully-automated Forex expert advisor that is sold on the MQL5 market. According to the vendor, the robot is well-suited for low-profile investment traders looking to take advantage of the market for the long term. Before we arrive at a verdict for this system, we must thoroughly evaluate its various performance factors.

Detailed Forex robot review

Mr. Martin doesn’t have an official website of its own. It is sold on the MQL5 website, and on the product page, the vendor has shared very little information on the system and its features. We can’t get a clear understanding of the working principle after going through the presentation. There is a video explaining how the robot works, but it’s entirely in Russian. We also have a few screenshots showing the backtesting results.

This is a product from Vasiliy Kolesov, a Russian trader. We have no background information on this person or the people he works with. According to his MQL5 profile, he has experience of more than 5 years. There is no official contact information, so the only way to get in touch with this person is to message him via MQL5. Other expert advisors from this developer include Yellow mouse NEO and EA Monolith.

This expert advisor works on the EUR/USD pair. The vendor recommends using it with M1 charts, and this means the robot follows a high-frequency trading strategy. While trading with it, you should use a GMT+2 setting. In the beginning, you need to deposit a minimum of $1000. The EA has both conservative and aggressive settings, but the vendor has not explained them in detail.

Mr. Martin opens and closes trades on a closed bar. It is compatible with all brokers and can work with any spread. It is advisable that you run the EA on hedge accounts. The vendor states that the system will not work correctly on netting accounts. In case the spread is more than 10, you should reduce the take profit level.

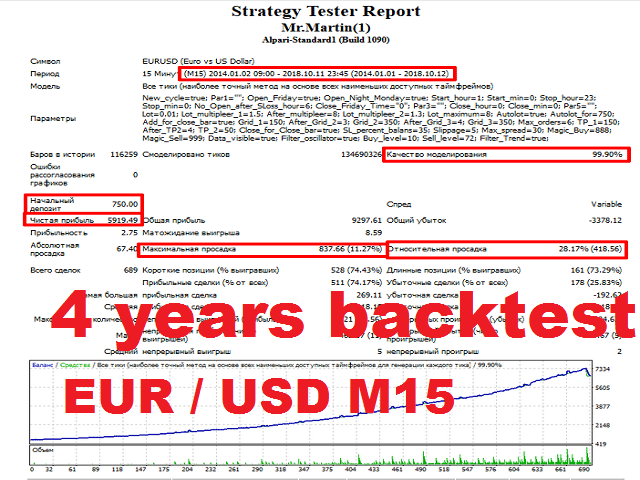

Mr. Martin strategy tests

Mr. Martin uses averaging principles in its strategy. It has a unique input system and uses multiple filters. Now, we don’t know what these filters are and there is not enough information on the input system. The vendor has not shared enough details on the trading strategy, which is very concerning. Different traders have different trading styles, and they often want to analyze the strategy to make sure they can make good use of it.

This backtest was carried out for four years between 2014 and 2018 with 99.90% modeling quality. The EA placed a total of 689 trades for this test, winning 74.17% of them and generating a total profit of $5919.49. During the testing period, the robot had a high drawdown of 28.17%. This tells us that it used a high-risk strategy.

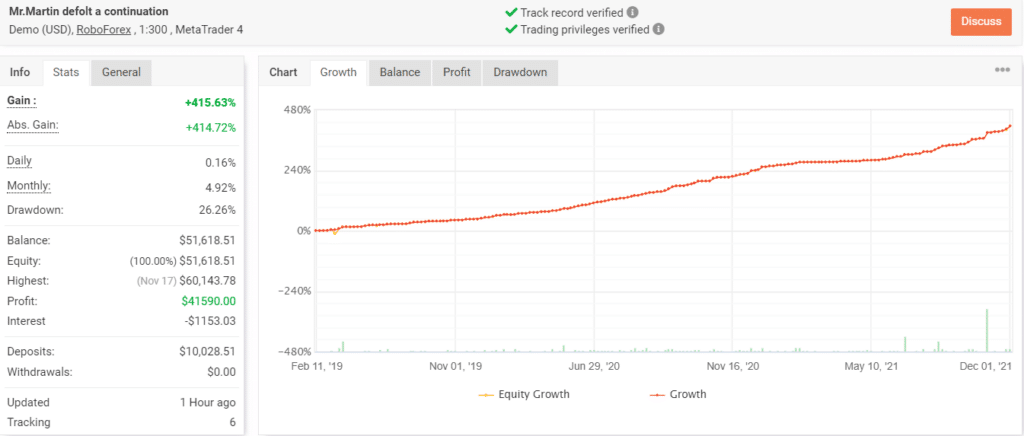

Demo account trading results

This live trading account has been active on Myfxbook since February 2019. After conducting 508 trades, the account currently has a win rate of 72%, and this is slightly lower in comparison to the backtest. The total profit generated through this account is $41590.

While the daily and monthly profits are 0.16% and 4.92% respectively, the drawdown is 26.26%. Although it is lower compared to the backtest, it is still a bit high. The profit factor for this account is 2.47.

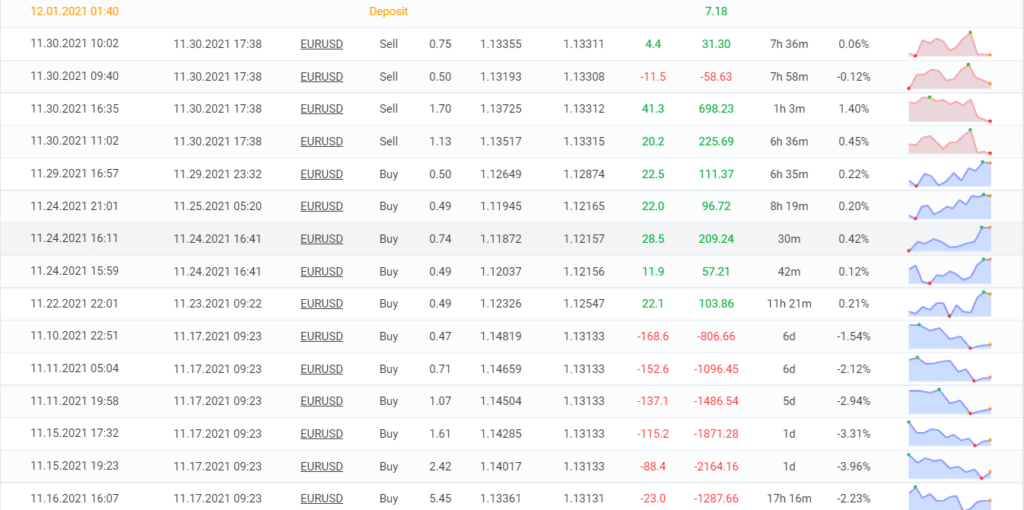

From the trading history, we can see that the EA is prone to losing consecutive trades. This confirms our suspicion that this is a system that carries a high risk of ruin. As such, we cannot consider it a safe investment option.

Pricing

Mr. Martin is available for a price of $560. We don’t think you should spend this much money on a robot on which there is so little information available. If you wish to test the performance using virtual money, you can download the free demo version of the robot. However, the vendor does not offer a money-back guarantee.

Customer reviews

There are no verified user reviews for this EA on third-party websites. Clearly, it lacks reputation and not many people have used it for live trading. There are a few reviews on MQL5, but we cannot trust them to be authentic.

Mr. Martin is not an expert advisor that can consistently bring you profits in the Forex market. It uses an averaging strategy that leads to a high drawdown and causes back-to-back losses. Also, we don’t know much about the developer behind this system.

Leave a Reply