Choosing assets to work in the Forex market is not an easy task, especially for beginner traders, since even the most popular currency pairs on Forex are not always amenable to analysis. Nevertheless, the use of the most traded pairs as a base and quoted is a reasonable option for working on the exchange.

Most traded Forex currency pairs

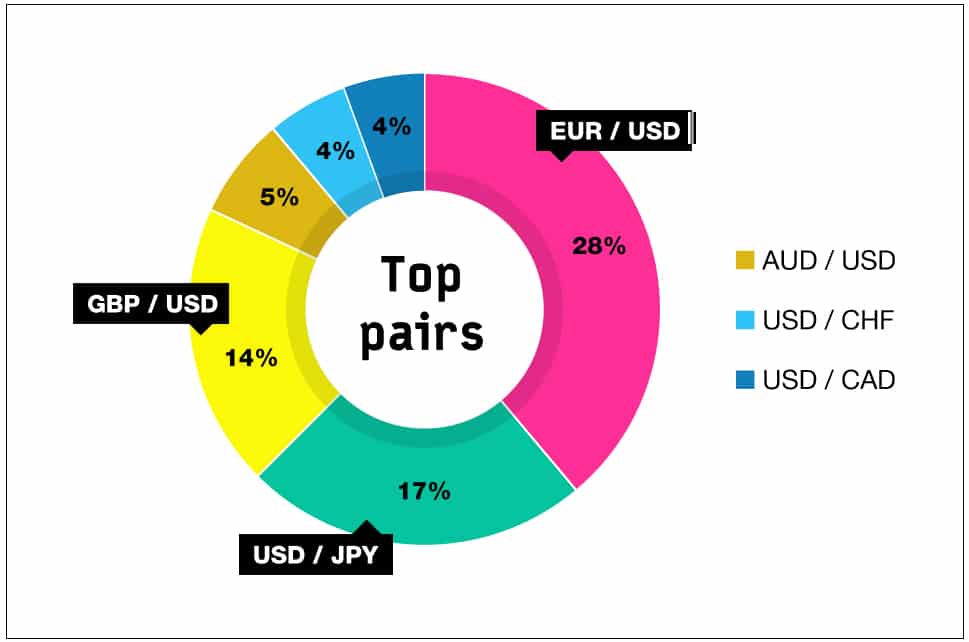

Five leading currencies (USD, EUR, JPY, GBP, CHF) form the four most important currency pairs in interbank trading:

- USD/EUR

- USD/JPY

- USD/GBP

- USD/CHF

Factors that affect the exchange rate in a currency pair are the economic turnovers of both countries (zones). If the GDP of one country grows faster, then the position of the currency of that country is strengthened. And if the economy of another country grows faster, then the other currency in the pair strengthens.

Another important factor influencing the exchange rate in the pair is the interest rate of the central banks of these countries. If the central bank of one country offers a higher rate, then people tend to buy this currency, and its position is strengthened relative to another. And vice versa: if the central bank of the second currency raises the rate, then this second currency strengthens. Let’s take a closer look at each currency pair.

USD/EUR

It is by far the most important currency pair, as it combines the currencies of the most powerful economic machines in our world. The United States and the European Union are leading economic forces in terms of it.

It is not surprising that international companies want to enter the market of these two zones. It often happens: European companies enter the US market, and American companies enter the European market. To work effectively in these two markets, companies need to exchange these currencies (and also insure themselves against the risks of fluctuations in exchange rates, that is, hedge).

The Euro/Dollar pair is the most liquid and quite volatile (volatile), which makes it attractive for speculators of the Forex market. It is with this currency pair that trading often begins with beginner private traders.

USD/JPY

Japan is an essential player in the global economy. Since many international organizations are interested in working with Japan, they must buy Yen to purchase goods from Japan, and therefore, the Yen’s popularity remains high.

It is worth noting the importance of the so-called carry trade strategies for trading yen. In short, carry trade is a trading strategy based on the difference in interest rates. Because in Japan, interest rates are significantly lower than those proposed in the US or the European Union, many traders speculate on this difference. They borrow yens, buy dollars on them, put them on deposit, receive interest, and redeem the borrowed yens, leaving themselves the difference received when paying interest.

USD/GBP

This currency pair made George Soros rich when he threw more than a billion dollars into the Bank of Britain. It is also one of the most important and volatile currency pairs.

One of the key factors in the Pound’s course is the fact that there is a chance of Britain joining the European Union. The course in this pair is very dependent on this probability. After all, if Britain does enter the Eurozone, then it will have to get rid of the Pound as the national currency and accept the Euro.

Pound holders are not happy with this prospect. Therefore, when British politicians say anything in favor of joining the Eurozone, the Pound is losing ground against the dollar. And vice versa: when British politicians oppose joining the European Union, the holders calm down, and the Pound strengthens.

USD/CHF

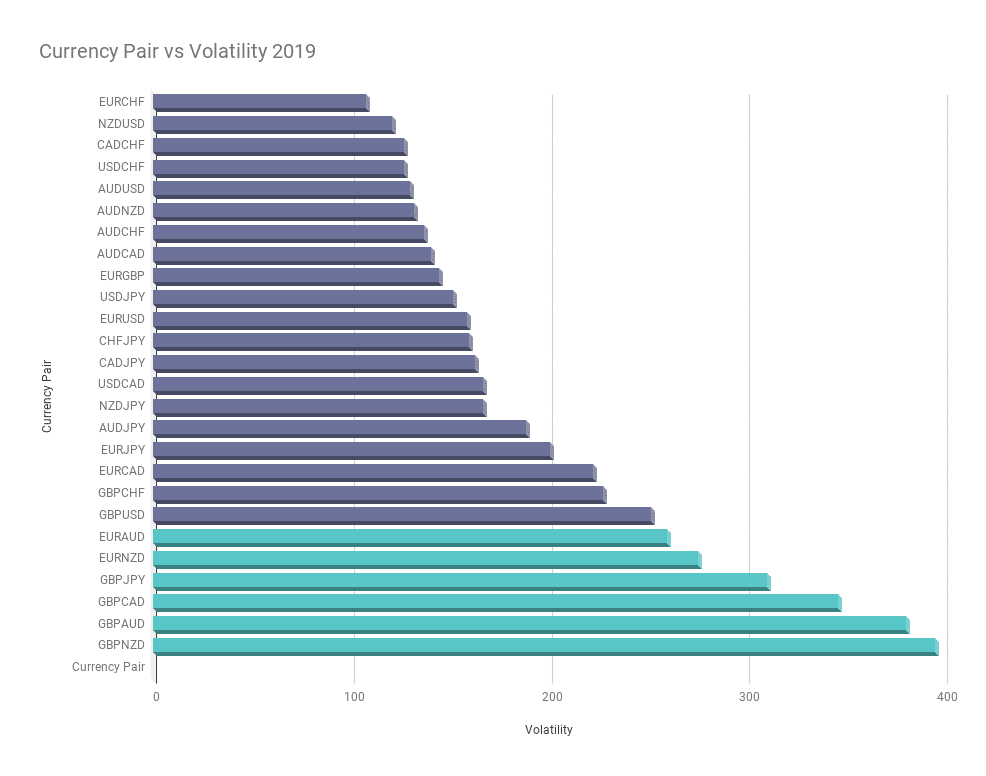

Swiss Franc is less volatile than the Euro or the dollar, and therefore this currency pair is not so fickle. Less volatility is due to the stability and neutrality of Switzerland, which market players see as a haven in a sea of anxiety in the global economy.

When trading the Swiss Franc, it is also worth remembering that it often follows the Euro. If the trader sees that the Euro has risen or fallen against the dollar, then he should think about playing in the same direction as Frank.

Most volatile currency pairs

USD/CAD is a stock ticker that refers to the exchange rate of the US dollar expressed in Canadian dollars. This currency tandem belongs to the category of “majors” or “dominates” because it contains the most potent and sought-after currency in the world. Accordingly, in contrast to the “minor” pair currencies, this inseparable deuce is part of the “basic” Forex pairs, which are characterized by high liquidity and narrow spread corridors.

USD/JPY is the US dollar ticker against the world yen exchange rate. This top currency pair among traders has the pseudonym “ninja” because the heroic character of medieval invisible spies became, at one time, a symbol of Japan. USD/JPY is actively used by large firms and private traders on currency exchanges, ranking second in the ranking of currency pairs after.

In the tandem of USD/JPY, the US dollar is the main currency, while the Japanese yen is the quoted currency. It is popular due to the time difference between American and Asian trading floors allows you to conclude transactions on this pair 24 hours a day.

GBP/USD is a ticker representing the Pound against the US dollar. GBP/USD belongs to the primary category of assets, which are currency pairs with the highest daily trading volumes. As one of the oldest traded pairs, GBP/USD is characterized by high liquidity, offering traders stronger spreads compared to young tandems.

In this currency pair, the British Pound is the base, and the US dollar is the quoted currency. It means that the value of the ticker reflects the amount of US dollars that will be required to buy one British Pound.

Leave a Reply