MMT or Modern Monetary theory mentions that any country which issues its own currency will never face any shortage of money. It means that these countries will never run out of cash, unlike many businesses and people who can. This theory was once just a heterodox macroeconomic theory. In the present times, it is a topic of discussion between the economists and politicians.

MMT Explained

It is an accepted fact that the government collects taxes and pays its expenses from this money. For all other costs, the government issues bonds and borrows money. However, such government borrowings can increase the cost of loans. This means that the interest rate paid by businesses and individuals increase. This is where MMT takes the opposite stance. It argues that all countries which print their currency never face a shortfall of money. These countries do not default because it would mean there is no money for paying the creditors. This situation does not arise as the countries can print money whenever they want.

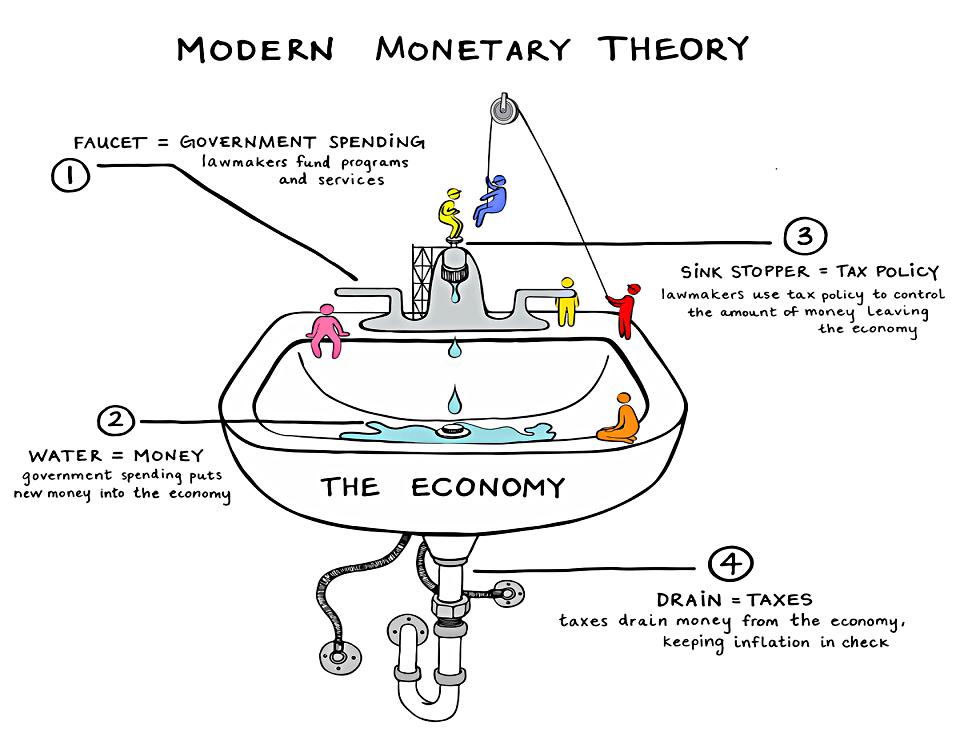

Thus, government spending does not depend on borrowing and taxes. With this theory, the government gets a reasonable leeway and can spend it on public expenditure. There is no worry about government debt or increasing fiscal deficit. Modern Monetary Theory proponents mention that the government’s fiscal policy is just a representation of the money which a government puts in the economy and how much money the economy is taking out.

MMT Core Principles

The main idea is that any country with a fiat currency system should print money it needs for its spending. No government would want to go insolvent, and this is one way out. However, this is different from traditional thinking, where it is mentioned that spending in such a situation is fiscally irresponsible. It will increase inflation, and debt will increase.

However, as per MMT, any significant government debt does not mean it will cause its collapse, as we are made to believe. Many countries can sustain even more significant deficits without any alarming consequence. However, a smaller gap or surplus can prove harmful as it can lead to a recession. This happens because people’s savings are usually from deficit spending.

What the Theorists Explain

According to theory supporters, the national debt is the money that the government pumps in the economy and does not get it back. There is no comparison between the budget of government household expenses. As per the supporters of MMT theory, the only restriction which a government experiences are related to real resource availability. It can be in the form of construction material supplies or workers. Taxes increase the demand for a currency. They are the way to remove money from an economy. However, this idea is different from the traditional theory we follow. Conventionally we know that any government gets money through taxes, which is used in funding various social welfare programs and in building infrastructure.

According to this theory, there is no need to sell bonds if the government needs money, as it can print its money. Bonds are sold to remove excess reserves. Thus, whether bonds should remain or be sold is not based on the government’s need. It is a choice.

MMT Origins

Warren Mosler is a famous American economist who developed MMT. In the 1970s, when Mosler first started thinking about such concepts when he was working as a trader. Eventually, he used all his ideas in smart bets when he founded a hedge fund.

Mosler was not much appreciated when he first came up with such a concept, and the academic world ignored him. Later, in 1993, he went ahead and published ‘Soft Currency Economics, ’ which was a seminal essay. Mosler shared this on Post Keynesian listserv. This was when he found many others like Bill Mitchell, the Australian economist, who agreed with the ideas.

It was in the early 1990s, and Italy was going through a crisis. The majority of investors were scared that Italy would default. Mosler realized that it might not happen. His firm became one of the biggest holders of Italian lira denominated bonds. Consequently, Italy did not default. They made more than $100 in profits.

In the later years, there was plenty of support for the modern monetary theory, mainly due to the internet. Economists went ahead and explained this theory on several groups and personal blogs. The idea related to a trillion-dollar coin was discussed a lot. In April 2019, Google search interest for the term peaked. Even today, when the world is fighting the pandemic, people are still showing sincere interest in the theory and are continuously searching for the MMT.

Leave a Reply