The University of Michigan Consumer Sentiment index is one of the most followed sentiment surveys around the world, and it affects Forex pairs.

Although it covers the United States consumer sphere only, it has a global impact as the US is the leading economy on the planet. Traders around the globe look at it for insights about how the country is doing and how it interacts with retail sales, employment, and inflation, and of course, its repercussions in other countries.

The consumer sentiment has a significant impact on the economy; so every month, traders watch this release to place trades before and after its publication. In this article, we in Forex Traders Guide are going to explore the Michigan Consumer Sentiment, how to understand it, and how to trade it.

What is the University of Michigan Consumer Sentiment Index

The University of Michigan Consumer Sentiment Index, also known as MCSI, is a monthly survey conducted by the University of Michigan which results are published as a consumer confidence index of people in the United States.

Designed by Professor George Katona at the University of Michigan in 1946, the index is built on the back of a minimum of 500 telephone interviews to consumers all around the 50 states of the United States.

Katona built the survey in line of “the important influence of consumer spending and saving decisions in determining the course of the national economy,” as the official website says. He wasn’t wrong, as around 70% of the gross domestic product in the United States responds to consumer spending.

The survey is based on fifty core questions that are asked by interviewers who call main street and average people. Besides, the study includes seasonal topics from time to time to address specific concerns of the moment when the survey is collected.

The fifty questions cover three general areas: business conditions, personal finances, and buying conditions.

The Michigan Consumer Sentiment Index is a monthly data, but it is published in two releases, the preliminary report, which includes about 60% of total results and is posted around the 10th day of the month, and the final report, which is released the first day of the next month.

MCSI Basic Design Survey

As mentioned before, the MCSI deploys a minimum of 500 phone interviews every month. In each call, every interviewed answers 50 core questions that cover their own financial situation, the short-term general economy, and the long-term general economy.

Samples of questions are:

- “How about people out of work during the coming 12 months — do you think that there will be more unemployment than now, about the same, or less?”

- “During the next 12 months, do you think that prices in general will go up, or go down, or stay where they are now?”

- “Would you say that at the present time business conditions are better or worse than they were a year ago?

- “Speaking now of the automobile market — do you think the next 12 months or so will be a good time or a bad time to buy a car?”

The Michigan Consumer Confidence is released with three measures that cover sentiment, conditions, and expectations:

- Index of Consumer Sentiment (ICS): The headline number with the main result, how is the feeling of the consumer.

- Index Current Economic Conditions (ICC): The component of how people think the economy is doing at that moment.

- Index of Consumer Expectations (ICE): The reading of how consumers think their economy and the general economy will be in the future.

How the Michigan Consumer Sentiment is Calculated

According to the University of Michigan and the office of the Surveys of Consumers, the report has different calculations for each item.

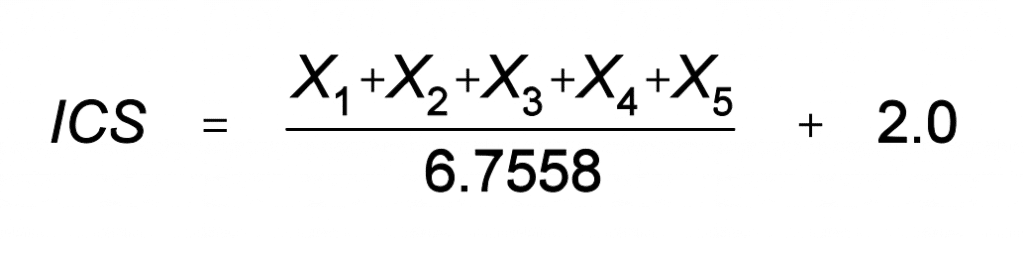

To do the calculation for the ICS, the index identifies the relative score after taking the percent giving favorable replies minus the percent with unfavorable answers, plus 100, for each of the five core index questions. Then, you should round the relative score to the nearest whole number. Finally, you should add the five relative scores and divided it by the 1966 base number of 6.7558 and add 2.0.

The Index of Consumer Expectations and the Current Situation component are calculated similarly. While using the same equation mentioned with the ICS, the ICC and ICE are determined in the following methods:

The five index questions that built the ICS and the other two components are:

x1: “We are interested in how people are getting along financially these days. Would you say that you (and your family living there) are better off or worse off financially than you were a year ago?”

x2: “Now looking ahead–do you think that a year from now you (and your family living there) will be better off financially, or worse off, or just about the same as now?”

x3: “Now turning to business conditions in the country as a whole–do you think that during the next twelve months we’ll have good times financially, or bad times, or what?”

x4: “Looking ahead, which would you say is more likely–that in the country as a whole we’ll have continuous good times during the next five years or so, or that we will have periods of widespread unemployment or depression, or what?”

x5: “About the big things people buy for their homes–such as furniture, a refrigerator, stove, television, and things like that. Generally speaking, do you think now is a good or bad time for people to buy major household items?”

How to read the Michigan Consumer sentiment

As in economy, the sentiment is a critical factor that affects its current and future conditions, measuring the consumer sentiment is clever to have a perspective of how the economy is doing and what could happen in the near future.

According to the University of Michigan, “the Surveys of Consumers have proven to be an accurate indicator of the future course of the national economy.” It is considered a leading indicator, so it can hint how the economy will do in the future.

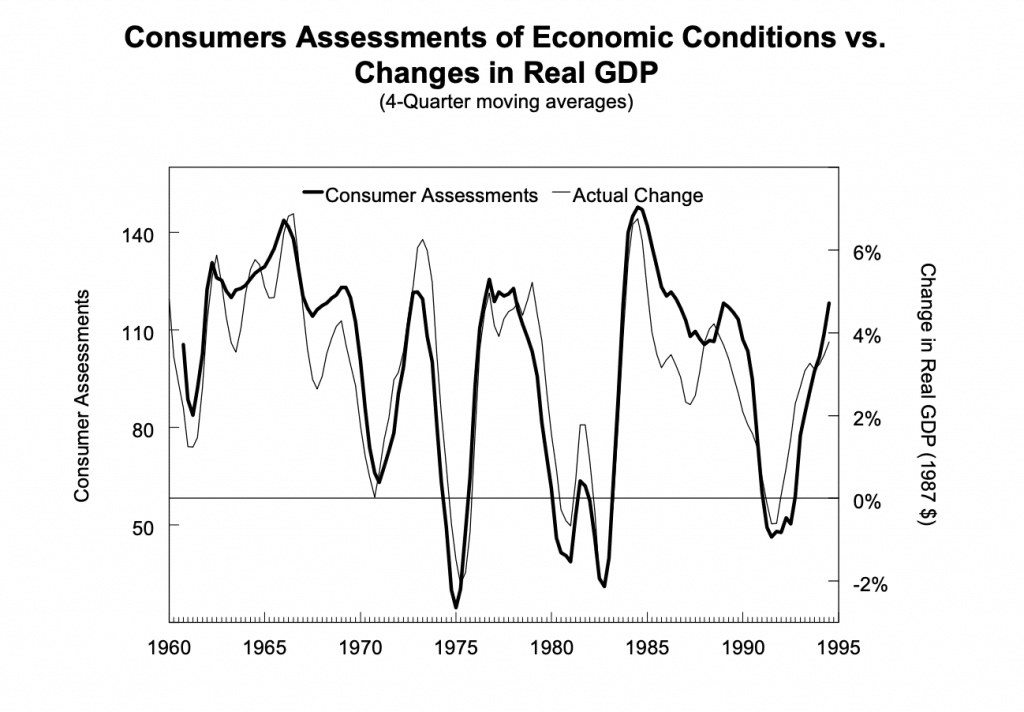

One powerful example is the relation between the consumer assessments of economic conditions and the changes in real GDP. The following chart shows a strong correlation between both lines, hinting that the ICC is a reliable indicator of upcoming changes in the GDP.

How to trade the Michigan Consumer Sentiment in Forex

Investors can use the Michigan consumer sentiment as an indicator of how the economy will do in the future. As consumer spending accounts for 70% of the gross domestic product in the United States, a good reading will hint an excellent economic performance, while a poor number would precede dark economic times.

Both the Expectations index and the current situation are essential as the present condition can be already priced in the economy, but not yet reported. Also, expectations can exacerbate the current situation trends.

That being said, the leading index shows a picture of how consumers are willing to spend or not their money. So, usually, a high reading anticipates a bullish or positive movement in the dollar, while a weaker than expected or ugly number would send the USD down.

When trading the MCSI, traders tend to focus on EUR/USD, USD/JPY, and AUD/USD. Finally, be aware that sentiment is also a component inherent to risk aversion and risk appetite. So, a good number will fuel riskier assets, while a bad number will promote the purchase of safe-haven instruments such as gold and oil.

Leave a Reply