People invest in Forex intending to earn big, but at the same time, they should be aware of the risks present. The risks are high mainly due to the emotional quotient present in trading. With the advent of automated Forex trading software, it is now possible to avoid the emotional aspect of trading. The software settings ensure accurate trade entries and exits occur resulting in minimized losses and good returns.

Medusa X is one such automated Forex trading software. According to the developer Oon Kar Lee, this is a revolutionary system with real trades and real profits. Focused on two main currency pairs, USDCHF and GBPUSD the system is set up to deliver good performance. In this review, we analyze the various features of the system including its functionality, features, performance, price, and more to provide you with a candid perspective of the system.

Detailed Forex Robot Review

Created by Oon Kar Lee, a professional trader with more than 15 years of experience, this system uses revolutionary momentum and pullback algorithms. A Singapore native, Lee has first published this system in December 2020.

Since then, he has done several updates and the present version of the system is 2.0. Lee has developed 11 products and 13 signals and is familiar with advanced hedging and uses quantitative models based on mathematical and statistical analysis. With such a background, we are sure the system will reflect the developer’s experience.

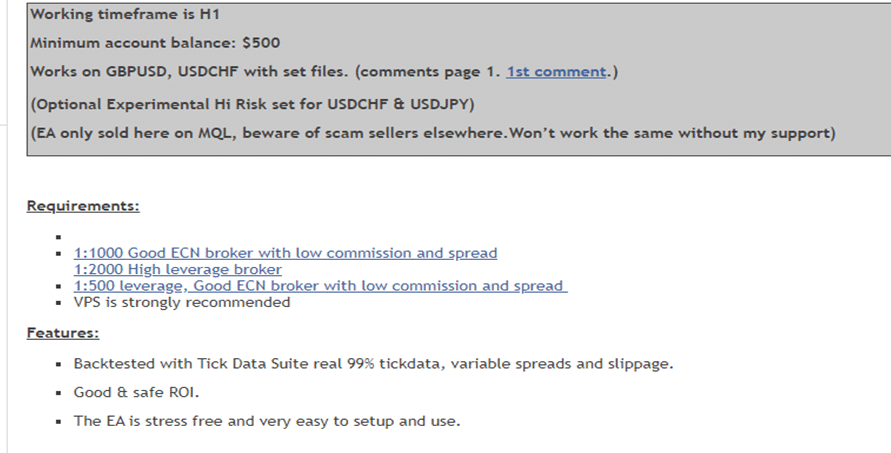

According to the developer, the system is easy to use. Indicators like EMA and RSI are used along with volatility filters with high optimization. While Lee does not mention the exact strategy used or explain what it is, he does state that the system does not use the Martingale strategy.

He recommends using the system on two pairs in a single account for stronger performance and better returns. The system uses the H1 timeframe and the minimum account balance needed is $500.

Medusa X Strategy Tests

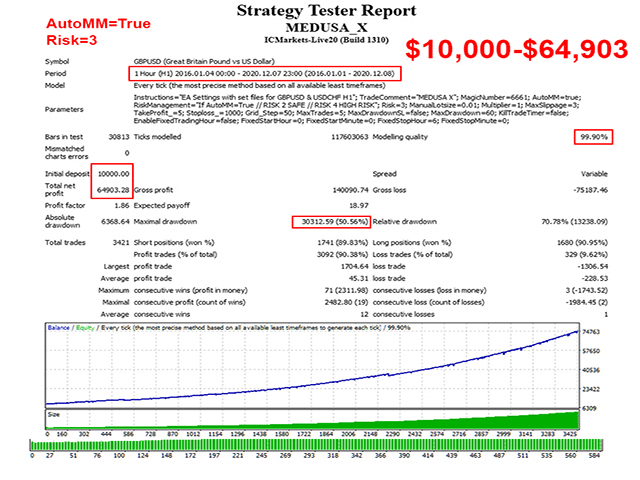

Lee provides backtest reports for the GBPUSD pair and the USDCHF pair trading with an initial deposit of $10000 on the H1 timeframe. Here is a screenshot of the backtest:

Done from 2016 up to 2020, the backtesting reveals a total profit of 64903.28 for a deposit of $10000. The modeling quality is 99.9%, which is ideal for knowing about the spread, slippage, etc. A maximal drawdown of 50.56% is shown which denotes a high-risk strategy. While the strategy tester report reveals safe ROI, the high drawdown is a downside that can wreak havoc with the capital.

Real Account Trading Results

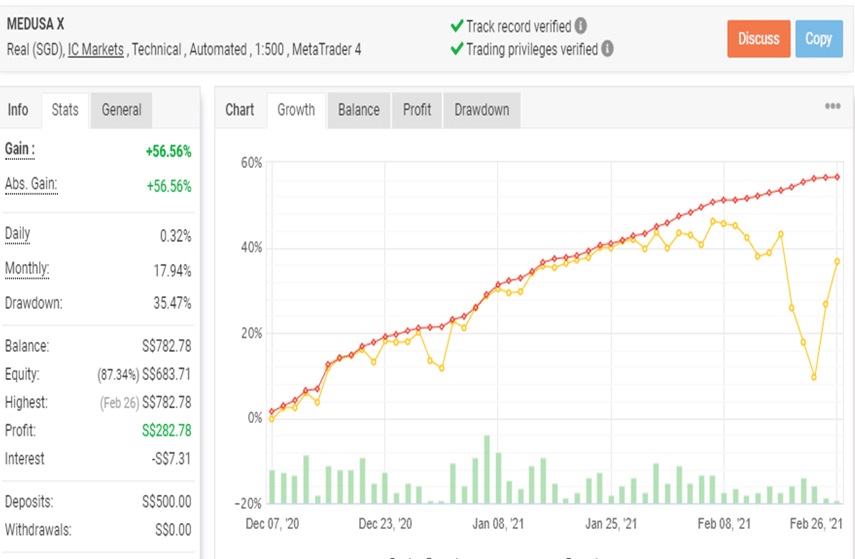

While the MQL5 site does not post verified trading results, we found a real SGD account of the system verified on the Myfxbook site but with the trading closed in February. Here is a screenshot of the results:

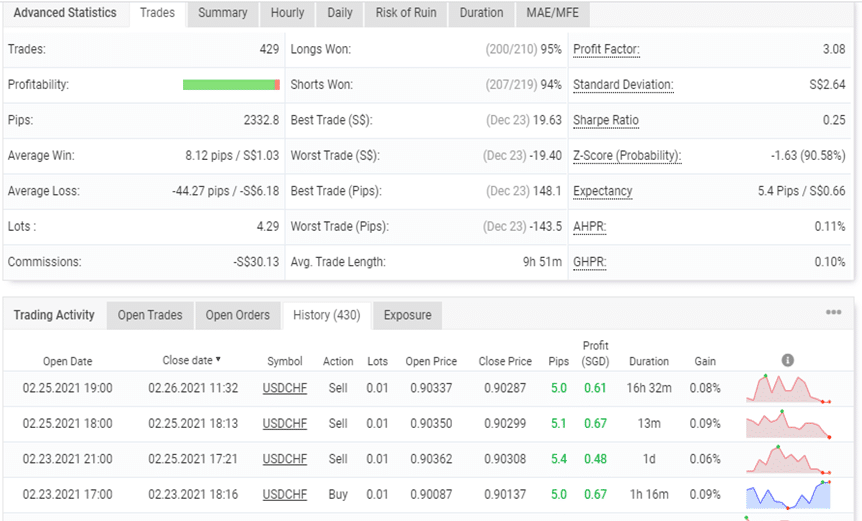

From the trading stats of this MetaTrader 4 compatible system using 1:500 leverage, we could see the total and absolute profit values are similar at 56.6%. A daily profit of 0.32% and a monthly profit of 17.94% are seen. The drawdown is 35.47% for the account started with a deposit of 500 SGD. The trading started on December 07, 2020, and ended on February 26, 2021.

During this span, a total of 429 trades have been executed with a profit factor of 3.08. A look at the trading history reveals lot sizes are 0.01. The profits not being that high and the huge drawdown may have been the factors that had forced the account to end. Comparing the backtesting and the real account results we could see the drawdown and profit factor values differ.

Pricing

Medusa X is available for $399 and rental options are also present. The single-month rental cost is $120 while it costs $250 for three months rental. A free demo is offered by the developer. We do not see any money-back assurance provided by the vendor.

Customer Reviews

We could not find user reviews for this expert advisor on reputed sites such as Forexpeacearmy, Trustpilot, myfxbook, etc. The absence of reviews prevents us from making a proper evaluation of the system’s performance and the support offered.

Wrapping up our review of the Medusa X Forex robot, we find that the system uses a high-risk strategy resulting in high drawdown values in both the backtest and the real trading account. The expensive price and lack of user reviews are other downsides of the system that the vendor and developer could address suitably.

Since the sample size is very small, we are unable to get a better perspective of the system and the closing of the account is another factor that raises our suspicion regarding the reliability of the system. With so many shortcomings we do not find this system a reliable one.

Leave a Reply