In the forex world, Martingale is a word everyone is familiar with, usually denoting a type of trading strategy employed by forex robots and expert advisors. The Martingale strategy is actually a negative progression system, which requires a trader to increase his/her position following a loss. In other words, it refers to the doubling of a trader’s trading size when he/she loses a position. One of the classic and most encountered scenarios involving Martingale is to trade an outcome with a 50% probability of it occurring, which usually has a zero expectation.

Why Traders are Attracted to Martingale?

Despite the various pitfalls and the degree of risk involved in a Martingale forex strategy, people still seem to use Martingale driven Expert Advisors for profit generations.

There are quite a number of reasons for this.

- Martingale Strategies follow the principle of cost-averaging which involves doubling the trade size after a loss until the trader experiences a profit. The phenomenon of doubling entices many traders to take part, who always hope to exit a certain position with a profit.

- Martingale strategies under certain conditions can give a predictable outcome when it comes to profit generation. The possibility of a “Sure bet” on eventual wins can be an enticing factor for traders.

- As Martingale strategies do not rely on any predictive ability, mathematical probabilities over time are used instead. This allows novice traders to take advantage, as no advanced forex trading skills or underlying knowledge is required.

- Since currency pairs tend to trade in trade in ranges, price levels tend to be revisited from time to time, creating multiple entries and exit possibilities similar to grid trading.

Dangers and Risks Associated with The Martingale System

We all know that risk management is the backbone of any successful trading strategy. The Martingale System, on the other hand, can risk losing all the money in a trader’s portfolio because of the risk involved. This is because the Martingale strategy is only applicable in circumstances where the chance of winning and losing are equal.

There are multiple risks that an investor can experience if they trade forex using a Martingale strategy. Forex price movements usually consolidate first and then trend and are said to trend only 30% of the time. If a trader is caught on the wrong side of a bet at any given point, the Martingale strategy may generate an insurmountable degree of risk.

Another reason happens to be the amount of leverage that most brokers offer. Under the Martingale system, small movements in any currency pair can result in substantial losses. This is why most brokers offer a leverage of 400:1. However, a leverage of even 50:1 can be harmful to traders and generate irrecoverable losses.

The third risk is the very nature of Martingale as it applies to forex markets. Financial markets are not linear like in the case of roulettes in casinos. Unlike roulettes which have three possible outcomes, the outcome of transactions is not linear in nature. Currency pairs can go up or down in price levels without stopping at any one place for several hours.

Looking at the Martingale Strategy from a Theoretical Standpoint

A Martingale strategy has a high possibility of working, if we look at it from a theoretical or methodical standpoint. This is because of the assumption that no long term sequence of trades will experience a loss. In the real world however, a trader would require unlimited capital as he/she may face a long string of losses before winning a single trade. The required drawdown generated would be very high.

In the case of too many consecutive losing trades, the strategy would not work. The trade sequence thus has to be closed at a loss and the cycle has to start again. The trader has a chance of survival only if their initial position size is kept small in comparison to the account equity.

When using a Martingale system during a sequence of losing trades, the risk exposure increases exponentially as well. Thus, if a trader exits a losing trade sequence prematurely, the losses incurred are huge. However, the profit from a martingale forex trade increases linearly. It can be calculated as half of the average profit per trade multiplied by the number of trades.

When Martingale Strategies work

There are certain situations where the Martingale strategy works with forex pairs.

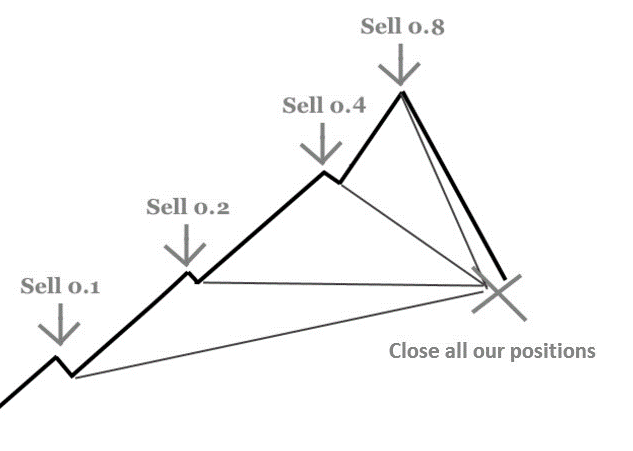

- When Currency prices are trading in a range: Traders who follow trends use a strategy that involves doubling the amount of winning trades to cut losses quickly. This is known as reverse martingale. However, normal martingale strategies tend to fail during tending markets, with the main opportunities coming from range trading instead.

- Enhancing Yield: Martingale Strategies can be used occasionally to enhance yield. It is used by many traders with positive carry forex trades, on currency pairs which have large interest rate differentials between them. This is because positive credits accumulate during the open trades.

Final Thoughts

The Martingale Strategy is known for being a risky strategy to follow. Unless losses are carefully managed, a Martingale strategy may drain an account all its money during a period of harsh drawdown. Thus, even though it offers some benefits, the risks associated with Martingale are overwhelmingly negative.

Leave a Reply