Market Crusher Pro is an expert advisor that trades on Forex, commodities, indices, and cryptocurrencies. It is a combination of four EAs that include many strategies. This FX EA is a fully automated system that works 24/7 helping you find accurate entry points.

Detailed Forex robot review

Scott Fredeman is the developer of this FX EA. He is from the United States and has more than 5 years of experience in developing FX EAs. He has created 11 products and 9 signals. For contact, he provides a website address and the direct messaging option on the MQL5 site. He also provides video tutorials for understanding the working of the trading tool.

As per the author, the main features of this FX robot that make it stand apart from its competitors are:

- The EA can work in automated trading mode and in the manual format simultaneously.

- There are settings present for changing the number of pairs, the timeframe, and the number of trades for each pair.

- It works on 28 symbols to identify the symbols with the strongest trend in a few seconds.

- The FX robot has sophisticated auto trading characteristics to identify the market condition accurately.

- It is easy to use and can work on any timeframe.

- MA, trend, and a bull/bear timeframe indicators/filters are present.

- ADX and Bollinger Bands filters are present.

- The SL deduction feature minimizes SL x pips every x minutes.

- TP, SL, and Equity TP or Loss can be enabled.

- A grid setup is present which can be used or disabled if you do not want it.

- The author recommends the use of MT5 brokers such as Vantage, IC Markets, Tickmill, Fusion Markets, and Pepperstone.

- Use of the default settings for the auto trading setup is recommended for the best results.

Market Crusher Pro strategy tests

As per the author, the strategies used by the FX robot include auto hands-free trading, semi-auto trading, day trading, night scalping, day scalping, trade correlation gaps between 2 symbols, trading the strongest trending symbol, and reversal trading. No backtests are present to analyze the approach used by the FX robot. The backtests are based on historical data and hence cannot predict the future performance of the system. However, traders prefer to backtest the system before using real money. The reason is that the strategy test helps to understand the approach and its effectiveness.

Live account trading results

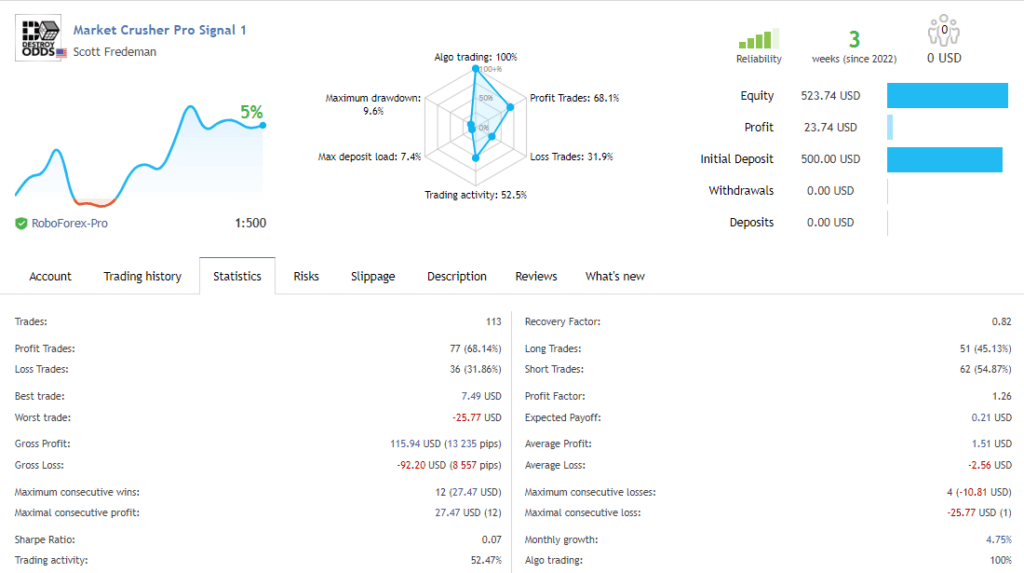

A live signal is present for the FX EA on the MQL5 site. Here is a screenshot of the trading stats:

From the results, we can see that the account is newly opened starting on May 19, 2022, showing 4.75% growth and a profit of $23.74 for an initial deposit of $500. A total of 113 trades were executed with a profitability of 68% and a profit factor of 1.26. The drawdown is 9.6%. From the results, we can see the profits are not high but the low drawdown indicates a low-risk approach. However, the growth curve shows many upward and downward dips indicating poor money management. Further, the sample size is too small for us to consider for evaluation.

Pricing

You can buy this MT5 tool for $399. The author provides rental options also that cost $149 for a three-month rental and $299 for a one-year rental. A free demo is present. However, the author does not provide further info on the features available with the package. When compared with the price of competitor systems, we find the FX EA is expensive. Moreover, there is no money-back guarantee present for the product which makes us suspicious of the reliability of the system.

Customer reviews

Customer reviews for the FX EA are present on the MQL5 site. There are 6 reviews with a rating of 5/5. However, we could not find user testimonials on reputed third-party portals such as Forexpeacearmy, Trustpilot, etc. that support the positive feedback present here. Since the MQL5 site is promoting the product, there is a high chance of the reviews being manipulated.

Leave a Reply