In the Forex market, margin trading refers to the process of making a deposit with a broker, in order to open and maintain positions, in one or more currencies. Margin is considered as a portion of the customer’s account balance, set aside for order trade. It is not a cost or a fee. Requirements for the amount of the margin can vary, depending on the brokerage firm chosen.

To understand margin trading, we first have to take a look at Margin accounts. A margin account is a special account which involves the trader, borrowing to increase the size of a position. It is usually an attempt to improve returns for trading. A trader can use the margin to allow him/her to leverage borrowed money, which they can use to control a larger position in the market. This would be more than what they would be able to control if they use their own capital.

In Forex, margin can increase both potential returns, as well as the risk. The amount of margin is usually calculated as a percentage of the size of the forex positions, which vary from broker to broker. A one percent margin is not unusual in forex markets. This indicates that traders can trade $100000 worth of currency at just $1000.

Mistakes that can Occur while Margin Trading

As mentioned, margin trading gives the trader the ability to enter into positions, which are larger than their account balance. Thus, this allows traders to open much bigger trades in the market. However, it can lead to mistakes, as the margin is often a misunderstood concept.

For instance, when price moves but in a direction against the trader, it can put a trader in a complicated position especially when they’re betting big in the hopes of being a winner. The traders’ trade automatically gets closed on the trading platform, ending up with a huge loss. This happens when the broker sends the trader a margin call and the trader experiences a “stop out”.

Margin Trading in Forex

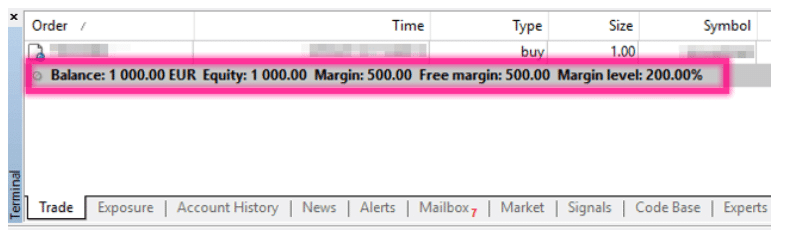

To understand how margin trading works, we first have to take a look at the jargon associated with it. We start with the various numbers one can see when they login to their trading platform. These” metrics” are shown in the example below in the MetaTrader 4 platform.

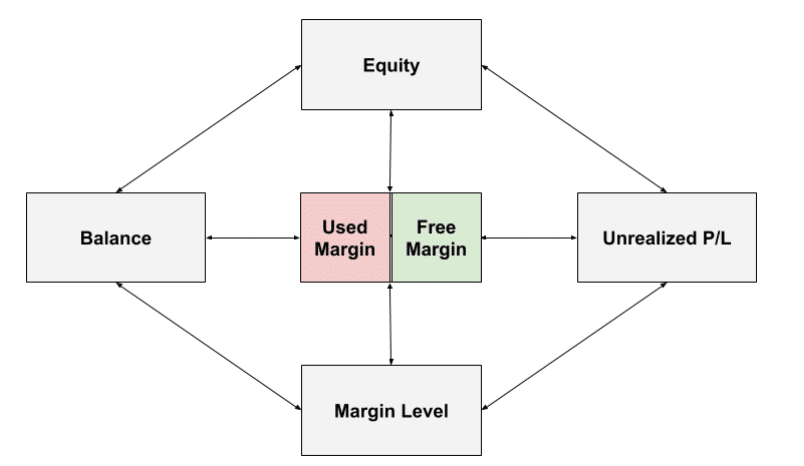

A change in of the above metrics can cause a change in another. To better understand the relationship between these metrics, a diagram is provided below.

A Trader needs to understand the relationships between the above metrics before even executing a single trade on a live account.

A margin Account consists of different metrics, such as Balance, Used Margin, Free Margin, Unrealised P/L, Equity and Margin level. These metrics may have slightly different names, depending on the trading platform the trader is on. We will now discuss each in brief below.

- Balance: Balance refers to the starting balance of a trader’s account. It mainly consists of the trader’s risk capital. The trader’s account balance is not affected when opening a new position until the same position is closed.

Thus the balance can change because of the following reasons.

- When the trader closes the position

- When the trader adds more funds to the account

- When a position is kept overnight, and the trader is required to pay or receive a swap or rollover fee.

- Unrealised and floating P/L: Unrealised P/L refers to the profit and loss held in the trader’s current open trading positions or their currently active trades. This indicates the amount of profit or loss one would receive if the trader’s open positions were to be closed immediately. Unrealised P/L are also known as floating P/L, as the value constantly changes since the trader’s positions are still open. If a trader currently has an unrealised profit, it can easily become an unrealised loss, of the price moves against him/her.

- Used Margin: To understand the concept of used margin, we have to take a look at the concept of “required margin”. When a trader opens more than one position simultaneously, each specific position would have its own required margin. Adding up all of the required margins for all the open positions would give us the “used margin”.

- Free Margin: Free Margin is calculated as the difference between the Equity and the used margin of a trader. It refers to the equity which is not tied up in margin for any current open positions in a trader’s account. It is also known as “usable margin” in some platforms.

Free Margin can refer to two things, namely

- The amount that existing positions can move against the trader before he/she receives a margin call or stop out.

- The amount which is available to traders to open new positions.

- Equity: Equity, or account equity refers to the current value of a trader’s trading account. It is calculated as the sum of the trader’s account balance and all the floating profits or losses associated with the trader’s open positions. Equities tend to fall or rise according to how much the current trades rise of fall in value.

- Margin Level: Margin level refers to the percentage value based on equity versus the Used margin. It allows traders to know how much of their funds are available for new trades. The higher the margin level, the more the trader has a free margin for trading. Consequently, the lower the margin level, the less free margin is available for trading. Trading platforms usually automatically calculate and display the trader’s margin level, which is calculated as (Equity/Used Margin) * 100%.

Conclusion

Margin Trading in forex has a lot of advantages, allowing traders to trade massive volumes of currency, with a considerably small amount invested. The correct implementation of margin trading can result in traders achieving a high level of success in the forex market. However, failure to grasp the concepts and details of margin trading can have dire consequences. Trades can get automatically closed if the trader does not suspect what’s happening.

Leave a Reply