Forex attracts the most number of traders at all times, as the entry level is not high, nor are there any barriers set for beginners. Unlike the stock market, it is pretty easy to get started in the $6 trillion marketplaces and start betting on currency pair’s price fluctuations.

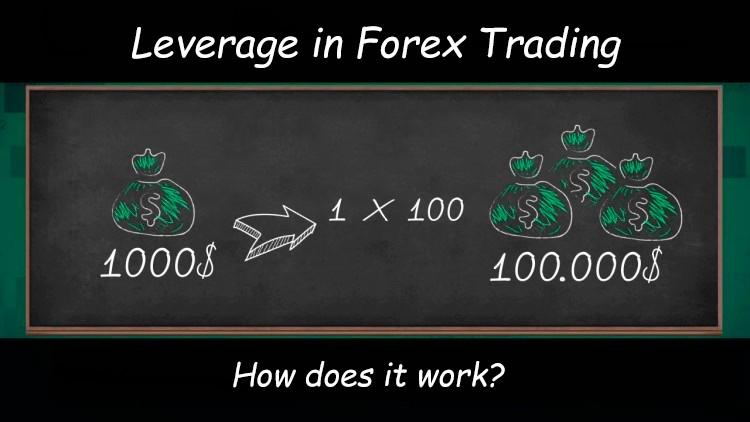

The ease of access stems from the fact that one only needs a small amount of capital to start trading. With as little as $50, it is possible to place trades worth thousands of dollars. Leverage is the arsenal that makes this possible.

What is leverage?

Leverage is a phenomenon that allows people to invest a small amount of capital into trading accounts, which is conversely magnified with borrowed money from a broker, resulting in a much bigger trading pool. In its purest form, it uses borrowed capital to bolster purchasing power in the marketplace.

Consider a trader who invests $200 in their brokerage account. Upon deploying leverage of 100:1, the trader can now purchase securities worth $20,000. This is partly because the 100:1 leverage magnifies the invested $200 capital to $20,000 ($200 x100).

While in most cases, one would be able to place trades worth $200, with leverage, the purchasing power is increased to $20,000. This magnification has always enticed people of all walks of life to invest a little amount and try their luck in the marketplace.

Different types of leverage

Brokers offer different sets of leverage amounts based on laid-out rules and regulations. The amounts vary as follows:

20:1: It is one of the lowest magnifying powers on offer among most brokers. With this amount, it means that for every $1 invested in an account, one gets an additional $20. Likewise, if you invest $100 in the account, you can buy items worth $2,000 at any given time.

100:1: The most common amount which sees people get an additional $100 for every $1 invested. In this case, $500 in invested capital accords one the right to purchase securities worth $50,000.

400:1: One of the highest leverage amounts. In this case, for every $1 invested, one gets an additional $400 in the account. By simply investing $300 in an account, one can trade items worth $120,000.

Its role in trading

Leverage takes trading to another level by essentially enticing traders with the least amount of capital to try their luck in the marketplace, conversely strengthening liquidity levels. An increase in traders translates to increased liquidity and volatility known to enhance price fluctuations crucial to trading.

Given that people only have to invest a small amount of money in trading is one of the reasons why forex is more popular compared to the stock market? Likewise, liquidity is always high, making it possible to enter and exit positions with ease and profit from the slightest price fluctuations.

Unlike in the stock market, moves of up to 10% can occur in the $6 trillion marketplaces over a short period. With such high moves, it becomes pretty easy to generate significant returns over a short period. However, while a market can move 10% in favor, being on the wrong side of the trade will always result in an exponential accumulation of losses.

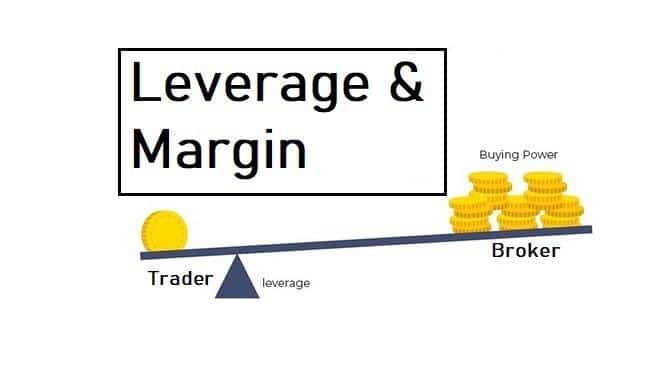

What is margin?

Margin and leverage go hand in hand. However, the two differ a great deal. Assume you invest $1,000 in a trading account and take advantage of the 100:1 leverage on offer. In this case, you can trade items worth $100,000.

The $1,000 deposited in the trading account is the account margin, which is the amount of money you have to give your broker to access the $100,000 to buy and sell.

Brokers pool together the amount deposited by traders, in this case, margin, to create a super margin deposit. It is this amount that the brokers use to place trades within the interbank network, thus allowing people to trade various currency pairs.

What is the best leverage?

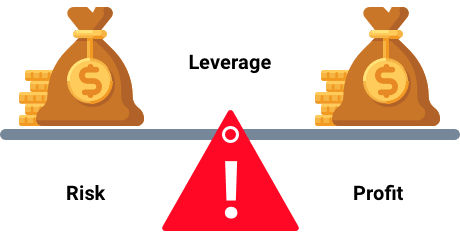

Leverage is a double-edged sword that any trader serious about protecting their invested capital should always take into consideration. While leverage increases the possibility of trading large amounts, conversely increasing the prospects of accumulating profits over a short period, the risk of losing everything is usually high.

The same way the leverage used magnifies profits is also the same way it magnifies losses when on the wrong side of a trade. Likewise, leverage is a double-edged sword. As it magnifies profits, so does it magnify losses.

For this reason, professional and experienced traders use very low leverage, of less than 20:1. The thing with low leverage is that it helps protect capital during market downturns or make mistakes. Besides, it ensures consistent profits.

In this case, leverage of 10:1 and 20:1 are considered ideal for risk management in the highly competitive marketplace.

Risk of higher leverage

One of the biggest risks of using higher leverage is that it increases risk exposure significantly. The same rate it increases profits is usually the same rate at which losses accumulate. Therefore, the higher the amount of leverage applied on the initial capital, the higher the risk of losing invested capital on things going south.

Bottom line

Leverage is a vital trading accessory that allows traders to deposit a small amount of money in their brokerage account to purchase items worth more than the invested capital. It is simply a loan offered by a broker that increases one’s purchasing power.

The borrowed amount can magnify one’s profits, given the ability to trade in large positional sizes. However, leverage also increases the potential of losses accumulating faster as they are magnified with the same proportion as profits.

The use of leverage requires always following the proven risk management strategies to generate significant profits while protecting invested capital. The use of stop losses should always come into play as part of any risk management play in the highly competitive marketplace.

Leave a Reply