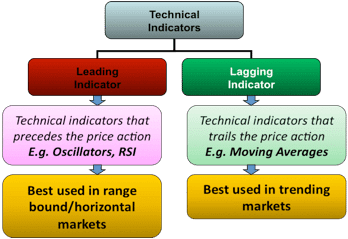

Indicators are at the heart of technical analysis in the capital markets. The best forex indicators are broadly classified into two, leading and lagging. Technical traders among other forex trading instruments rely on these indicators to make informed decisions when it comes to entry and exit points in the market.

Leading Indicators

Leading indicators are special types of forex trading instruments that provide trading signals before a new trend or reversal occurs in the market. These types of indicators allow traders and forex expert advisors to profit by predicting where the price would advance.

In essence, leading indicators lead price and give signals before a change in price happens. The indicators work by essentially identifying overbought and oversold conditions in chart patterns. When it comes to technical analysis, oscillators are typically leading indicators.

Some of the best leading indicators when it comes to forex analysis include the Stochastic and Relative Strength Index. The two indicators come with readings of between 0 and 100.

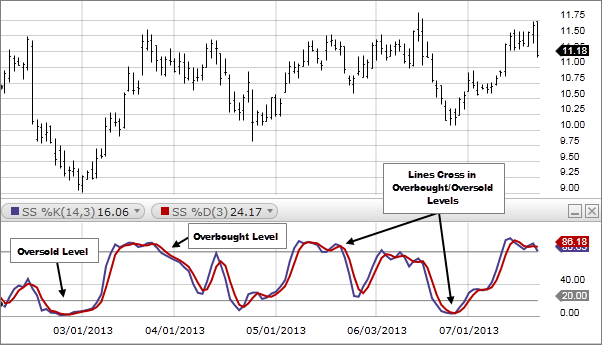

The stochastic indicator is one of the most used leading indicators by FX Expert advisors and traders as it tends to respond to price changes quickly.

The indicator signals overbought conditions when the price is above the 80 band level and oversold conditions when the price is below the 20 band level. Conversely, when the indicator is above 50, price is considered to be trending upwards. Likewise, when the indicator’s reading is below 20 levels, price is assumed to be trending lower.

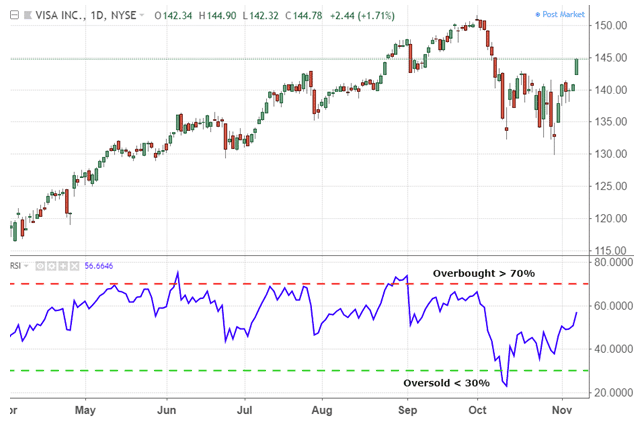

The Relative Strength Index is another momentum leading indicator that works the same way as the stochastic indicator. The indicator signals overbought market conditions when its reading is above 70 and oversold conditions when the price is below 30.

Likewise, a security would be considered bullish when the RSI reading rises above the 50 market level and bearish when the price is below the 50 level and pointing lower.

Leading indicators are ideal forex trading instruments as they signal trend reversals or trend formation before they happen. Likewise, they are ideal for high-speed trading strategies such as scalping, news trading, and swing trading in some cases.

However, they do also come with their fair share of drawbacks key among them being the possibility of providing false signals.

As an important forex trading secret, leading indicators should never be used in isolation. Leading indicators should be used in combination with other tools such as candlestick patterns, support and resistance levels, as well as lagging indicators.

Lagging indicators

As the name implies, lagging indicators tend to lag the market. The indicators are slow to respond to price changes in the market. Likewise, traders may witness price moves before the indicators signal the same

Lagging indicators are ideal trading instruments when it comes to trend trading as they tend to provide reliable signals instead of false breakouts. While the indicators put traders fairly late in the trade, they are more reliable for traders focused on long term trends in the market.

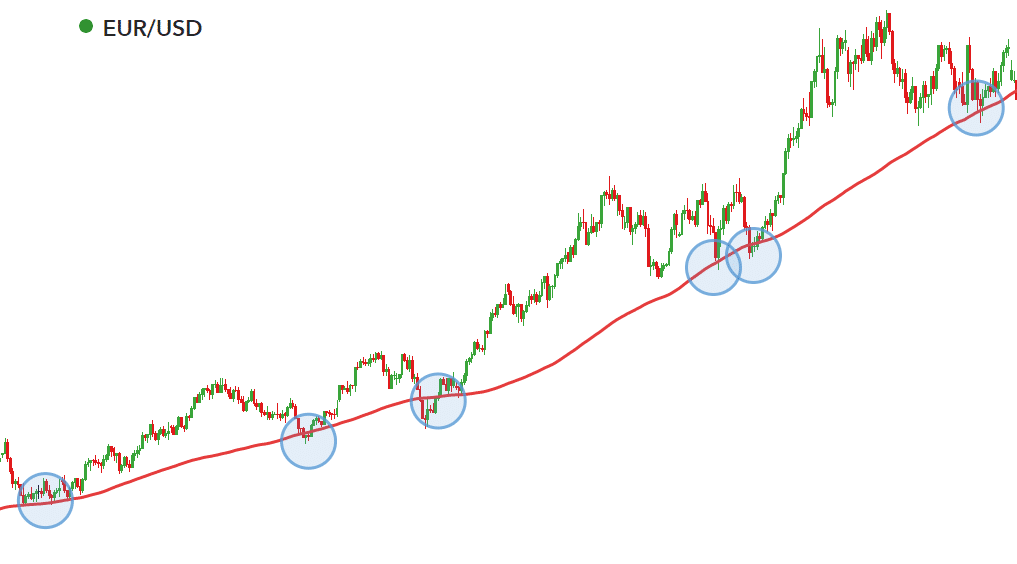

Moving averages, simple exponential and weighted are some of the best lagging indicators used in technical analysis in the market. Parabolic SAR and Moving Average Convergence Divergence are the other special types of lagging indicators.

The 200-day moving average is a commonly used lagging indicator. It is considered a more reliable indicator when it comes to trend trading as well as positional trading.

Whenever the price of an asset is above the 200-day trading moving average, it is considered to be trending upwards. In this case, traders, as well as other automated trading tools, would look to enter buy positions on price pulling close to the moving average

Likewise, traders, as well as algorithmic FX trading systems, would look to enter sell positions whenever the price is below the 200 day moving average.

Leading vs. Lagging Indicators

The type of indicators that one gets to use depends a great deal on the type of strategy deployed in the market. While leading indicators tend to predict market movements quite early into the game, they are ideal for scalping as well as swing trading. Lagging indicators, on the other hand, lag the market. However, they are ideal for confirming trends, thus reliable for positional as well as trend trading.

In addition, both leading and lagging indicators come with a fair share of advantages and drawbacks. While leading indicators can signal trends as well as reversals quite early, they are also prone to providing false signals that can lead to losses.

While lagging indicators are far slower to react to price changes, they tend to provide reliable trends in the market. However, their slow reaction can result in traders losing out on profitable trading opportunities in the market.

Bottom Line

Leading and lagging indicators are important money-making hacks when it comes to technical analysis in the forex market. Both are ideal for different trading strategies. However, relying solely on either could be detrimental in forex trading.

Leave a Reply